Enlarge image

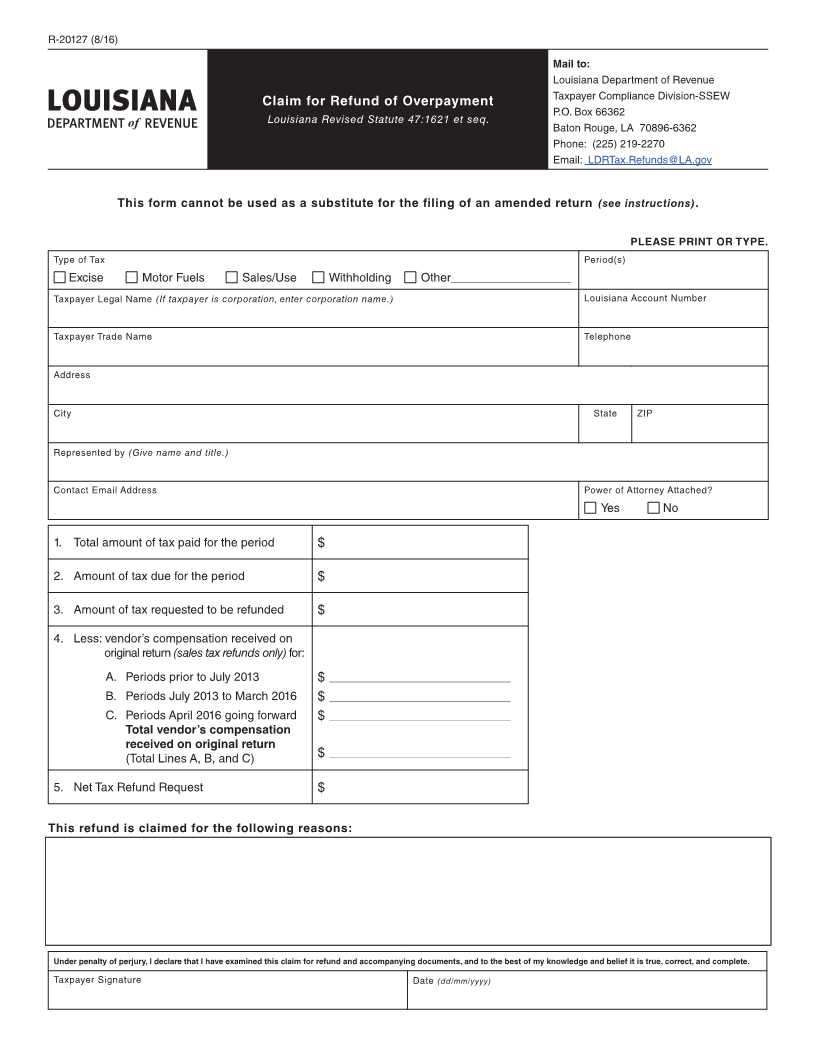

R-20127 (8/16)

Mail to:

Louisiana Department of Revenue

Claim for Refund of Overpayment Taxpayer Compliance Division-SSEW

P.O. Box 66362

Louisiana Revised Statute 47:1621 et seq.

Baton Rouge, LA 70896-6362

Phone: (225) 219-2270

Email: LDRTax.Refunds@LA.gov

This form cannot be used as a substitute for the filing of an amended return (see instructions).

PLEASE PRINT OR TYPE.

Type of Tax Period(s)

Excise Motor Fuels Sales/Use Withholding Other__________________

Taxpayer Legal Name (If taxpayer is corporation, enter corporation name.) Louisiana Account Number

Taxpayer Trade Name Telephone

Address

City State ZIP

Represented by (Give name and title.)

Contact Email Address Power of Attorney Attached?

Yes No

1. Total amount of tax paid for the period $

2. Amount of tax due for the period $

3. Amount of tax requested to be refunded $

4. Less: vendor’s compensation received on

original return (sales tax refunds only) for:

A. Periods prior to July 2013 $ _________________________________________________________________

B. Periods July 2013 to March 2016 $ _________________________________________________________________

C. Periods April 2016 going forward $ _________________________________________________________________

Total vendor’s compensation

received on original return

(Total Lines A, B, and C) $ _________________________________________________________________

5. Net Tax Refund Request $

This refund is claimed for the following reasons:

Under penalty of perjury, I declare that I have examined this claim for refund and accompanying documents, and to the best of my knowledge and belief it is true, correct, and complete.

Taxpayer Signature Date (dd/mm/yyyy)