Enlarge image

R-19026 (6/21)

Louisiana Department of Revenue

Collection Division

Installment Request

P.O. Box 66658

for Individual Income Baton Rouge, LA 70896-6658

Telephone: (855) 307-3893

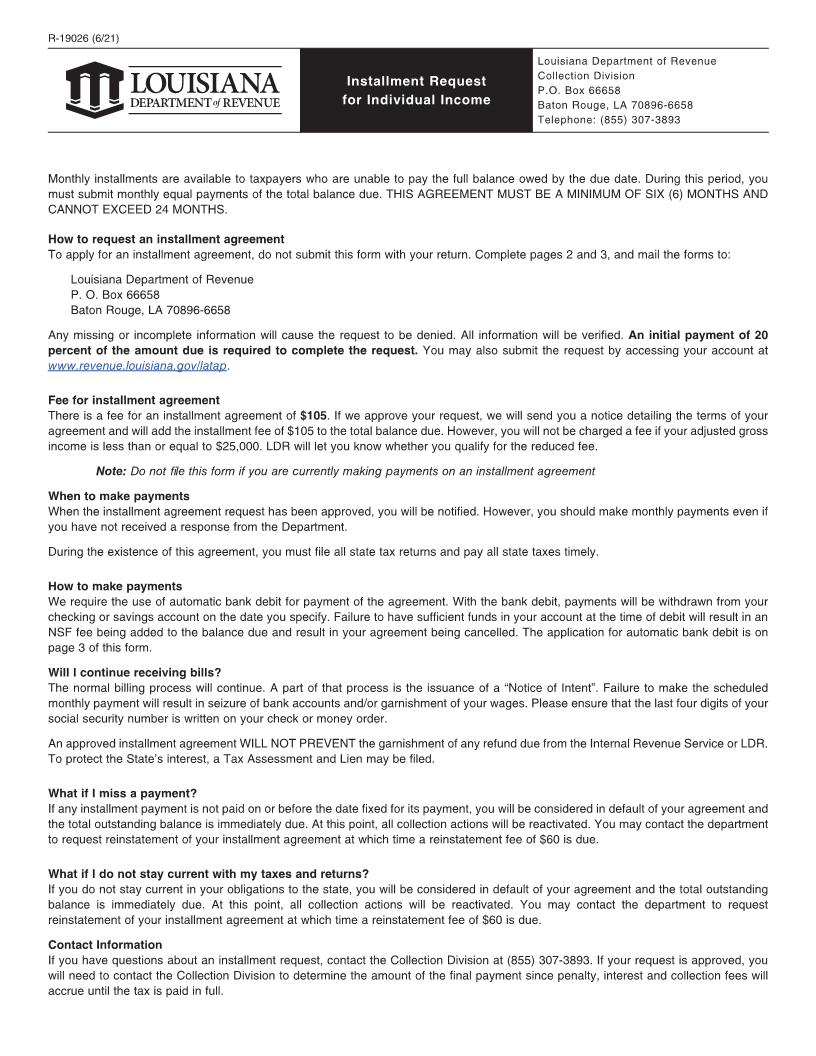

Monthly installments are available to taxpayers who are unable to pay the full balance owed by the due date. During this period, you

must submit monthly equal payments of the total balance due. THIS AGREEMENT MUST BE A MINIMUM OF SIX (6) MONTHS AND

CANNOT EXCEED 24 MONTHS.

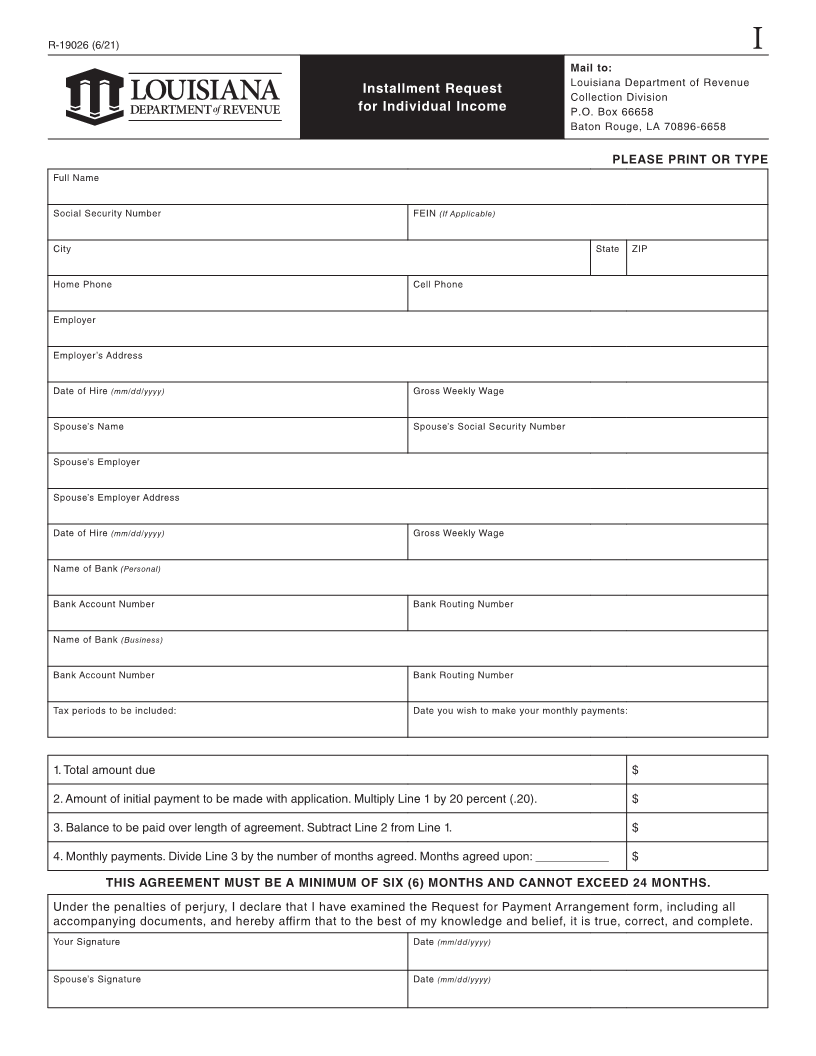

How to request an installment agreement

To apply for an installment agreement, do not submit this form with your return. Complete pages 2 and 3, and mail the forms to:

Louisiana Department of Revenue

P. O. Box 66658

Baton Rouge, LA 70896-6658

Any missing or incomplete information will cause the request to be denied. All information will be verified. An initial payment of 20

percent of the amount due is required to complete the request. You may also submit the request by accessing your account at

www.revenue.louisiana.gov/latap.

Fee for installment agreement

There is a fee for an installment agreement of $105. If we approve your request, we will send you a notice detailing the terms of your

agreement and will add the installment fee of $105 to the total balance due. However, you will not be charged a fee if your adjusted gross

income is less than or equal to $25,000. LDR will let you know whether you qualify for the reduced fee.

Note: Do not file this form if you are currently making payments on an installment agreement

When to make payments

When the installment agreement request has been approved, you will be notified. However, you should make monthly payments even if

you have not received a response from the Department.

During the existence of this agreement, you must file all state tax returns and pay all state taxes timely.

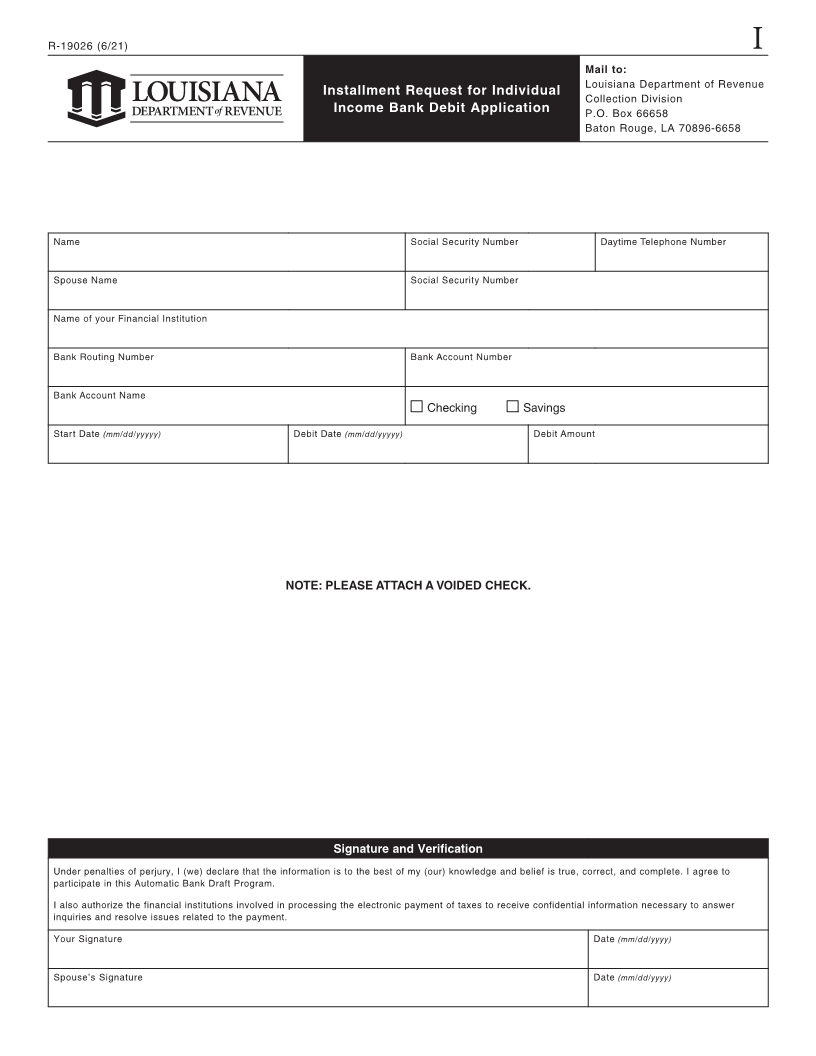

How to make payments

We require the use of automatic bank debit for payment of the agreement. With the bank debit, payments will be withdrawn from your

checking or savings account on the date you specify. Failure to have sufficient funds in your account at the time of debit will result in an

NSF fee being added to the balance due and result in your agreement being cancelled. The application for automatic bank debit is on

page 3 of this form.

Will I continue receiving bills?

The normal billing process will continue. A part of that process is the issuance of a “Notice of Intent”. Failure to make the scheduled

monthly payment will result in seizure of bank accounts and/or garnishment of your wages. Please ensure that the last four digits of your

social security number is written on your check or money order.

An approved installment agreement WILL NOT PREVENT the garnishment of any refund due from the Internal Revenue Service or LDR.

To protect the State’s interest, a Tax Assessment and Lien may be filed.

What if I miss a payment?

If any installment payment is not paid on or before the date fixed for its payment, you will be considered in default of your agreement and

the total outstanding balance is immediately due. At this point, all collection actions will be reactivated. You may contact the department

to request reinstatement of your installment agreement at which time a reinstatement fee of $60 is due.

What if I do not stay current with my taxes and returns?

If you do not stay current in your obligations to the state, you will be considered in default of your agreement and the total outstanding

balance is immediately due. At this point, all collection actions will be reactivated. You may contact the department to request

reinstatement of your installment agreement at which time a reinstatement fee of $60 is due.

Contact Information

If you have questions about an installment request, contact the Collection Division at (855) 307-3893. If your request is approved, you

will need to contact the Collection Division to determine the amount of the final payment since penalty, interest and collection fees will

accrue until the tax is paid in full.