Enlarge image

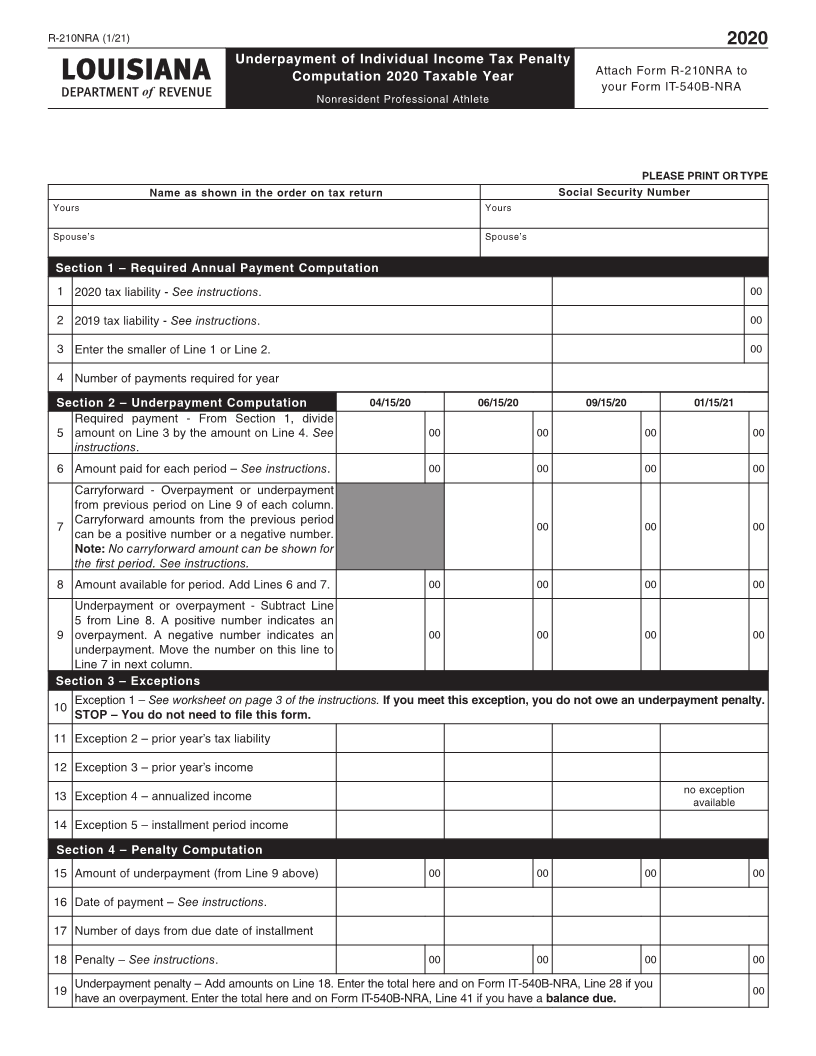

R-210NRA (1/21) 2020 Underpayment of Individual Income Tax Penalty Computation 2020 Taxable Year Attach Form R-210NRA to your Form IT-540B-NRA Nonresident Professional Athlete PLEASE PRINT OR TYPE Name as shown in the order on tax return Social Security Number Yours Yours Spouse’s Spouse’s Section 1 – Required Annual Payment Computation 1 2020 tax liability - See instructions. 00 2 2019 tax liability - See instructions. 00 3 Enter the smaller of Line 1 or Line 2. 00 4 Number of payments required for year Section 2 – Underpayment Computation 04/15/20 06/15/20 09/15/20 01/15/21 Required payment - From Section 1, divide 5 amount on Line 3 by the amount on Line 4. See 00 00 00 00 instructions. 6 Amount paid for each period – See instructions. 00 00 00 00 Carryforward - Overpayment or underpayment from previous period on Line 9 of each column. Carryforward amounts from the previous period 7 00 00 00 can be a positive number or a negative number. Note: No carryforward amount can be shown for the first period. See instructions. 8 Amount available for period. Add Lines 6 and 7. 00 00 00 00 Underpayment or overpayment - Subtract Line 5 from Line 8. A positive number indicates an 9 overpayment. A negative number indicates an 00 00 00 00 underpayment. Move the number on this line to Line 7 in next column. Section 3 – Exceptions Exception 1 – See worksheet on page 3 of the instructions. If you meet this exception, you do not owe an underpayment penalty. 10 STOP – You do not need to file this form. 11 Exception 2 – prior year’s tax liability 12 Exception 3 – prior year’s income no exception 13 Exception 4 – annualized income available 14 Exception 5 – installment period income Section 4 – Penalty Computation 15 Amount of underpayment (from Line 9 above) 00 00 00 00 16 Date of payment – See instructions. 17 Number of days from due date of installment 18 Penalty – See instructions. 00 00 00 00 Underpayment penalty – Add amounts on Line 18. Enter the total here and on Form IT-540B-NRA, Line 28 if you 19 00 have an overpayment. Enter the total here and on Form IT-540B-NRA, Line 41 if you have a balance due.