Enlarge image

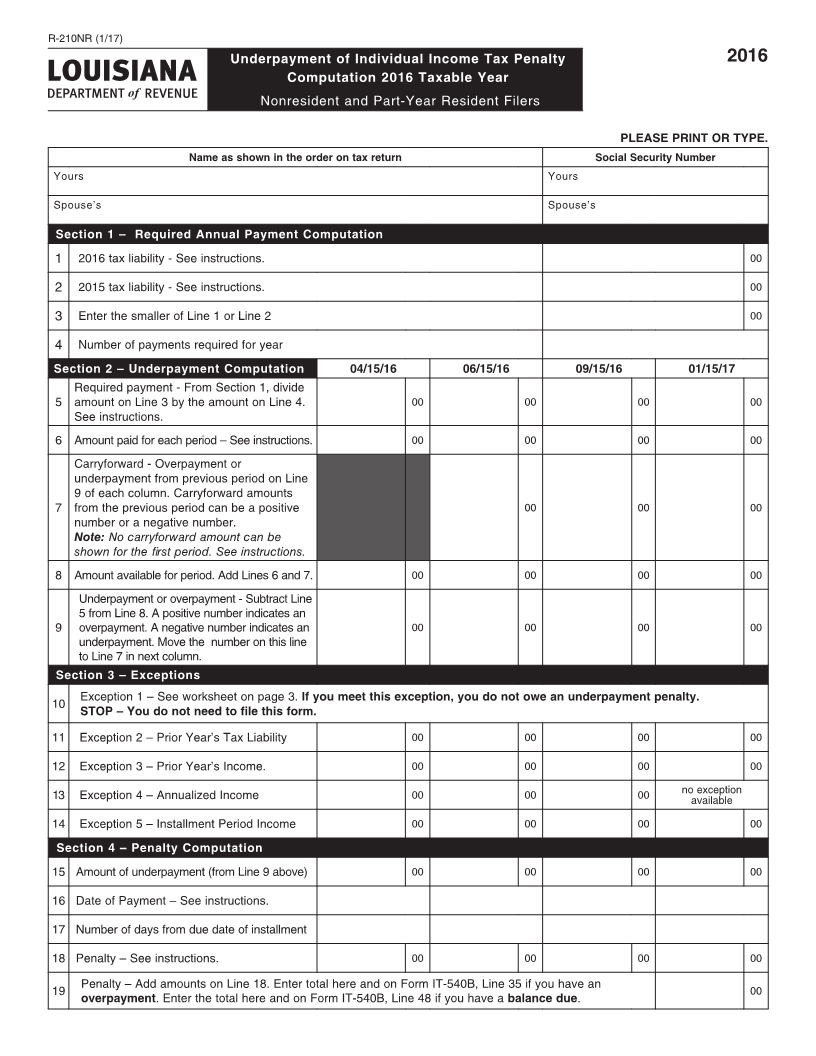

R-210NR (1/17)

Underpayment of Individual Income Tax Penalty 2016

Computation 2016 Taxable Year

Nonresident and Part-Year Resident Filers

PLEASE PRINT OR TYPE.

Name as shown in the order on tax return Social Security Number

Yours Yours

Spouse’s Spouse’s

Section 1 – Required Annual Payment Computation

1 2016 tax liability - See instructions. 00

2 2015 tax liability - See instructions. 00

3 Enter the smaller of Line 1 or Line 2 00

4 Number of payments required for year

Section 2 – Underpayment Computation 04/15/16 06/15/16 09/15/16 01/15/17

Required payment - From Section 1, divide

5 amount on Line 3 by the amount on Line 4. 00 00 00 00

See instructions.

6 Amount paid for each period – See instructions. 00 00 00 00

Carryforward - Overpayment or

underpayment from previous period on Line

9 of each column. Carryforward amounts

7 from the previous period can be a positive 00 00 00

number or a negative number.

Note: No carryforward amount can be

shown for the first period. See instructions.

8 Amount available for period. Add Lines 6 and 7. 00 00 00 00

Underpayment or overpayment - Subtract Line

5 from Line 8. A positive number indicates an

9 overpayment. A negative number indicates an 00 00 00 00

underpayment. Move the number on this line

to Line 7 in next column.

Section 3 – Exceptions 04/15/08 06/16/08 09/15/08 01/15/09

Exception 1 – See worksheet on page 3. If you meet this exception, you do not owe an underpayment penalty.

10

STOP – You do not need to file this form.

11 Exception 2 – Prior Year’s Tax Liability 00 00 00 00

12 Exception 3 – Prior Year’s Income. 00 00 00 00

13 Exception 4 – Annualized Income 00 00 00 no exception

available

14 Exception 5 – Installment Period Income 00 00 00 00

Section 4 – Penalty Computation

15 Amount of underpayment (from Line 9 above) 00 00 00 00

16 Date of Payment – See instructions.

17 Number of days from due date of installment

18 Penalty – See instructions. 00 00 00 00

Penalty – Add amounts on Line 18. Enter total here and on Form IT-540B, Line 35 if you have an

19 00

overpayment. Enter the total here and on Form IT-540B, Line 48 if you have a balance due.