Enlarge image

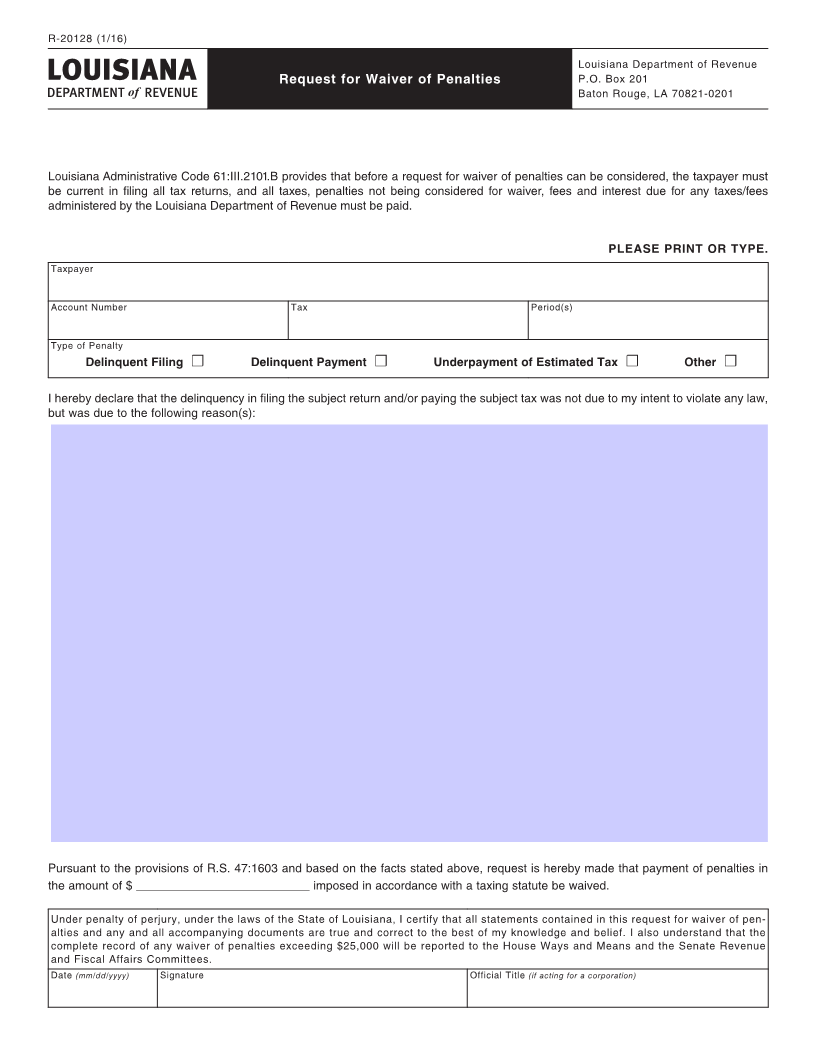

R-20128 (1/16)

Louisiana Department of Revenue

Request for Waiver of Penalties P.O. Box 201

Baton Rouge, LA 70821-0201

Louisiana Administrative Code 61:III.2101.B provides that before a request for waiver of penalties can be considered, the taxpayer must

be current in filing all tax returns, and all taxes, penalties not being considered for waiver, fees and interest due for any taxes/fees

administered by the Louisiana Department of Revenue must be paid.

PLEASE PRINT OR TYPE.

Taxpayer

Account Number Tax Period(s)

Type of Penalty

Delinquent Filing ☐ Delinquent Payment ☐ Underpayment of Estimated Tax ☐ Other ☐

I hereby declare that the delinquency in filing the subject return and/or paying the subject tax was not due to my intent to violate any law,

but was due to the following reason(s):

Pursuant to the provisions of R.S. 47:1603 and based on the facts stated above, request is hereby made that payment of penalties in

the amount of $ __________________________ imposed in accordance with a taxing statute be waived.

Under penalty of perjury, under the laws of the State of Louisiana, I certify that all statements contained in this request for waiver of pen-

alties and any and all accompanying documents are true and correct to the best of my knowledge and belief. I also understand that the

complete record of any waiver of penalties exceeding $25,000 will be reported to the House Ways and Means and the Senate Revenue

and Fiscal Affairs Committees.

Date (mm/dd/yyyy) Signature Official Title (if acting for a corporation)