Enlarge image

R-6981 (2/21)

Louisiana Statement of Owner’s Share Attach this form to your

of Entity Level Tax Items IT-540 or IT-540B

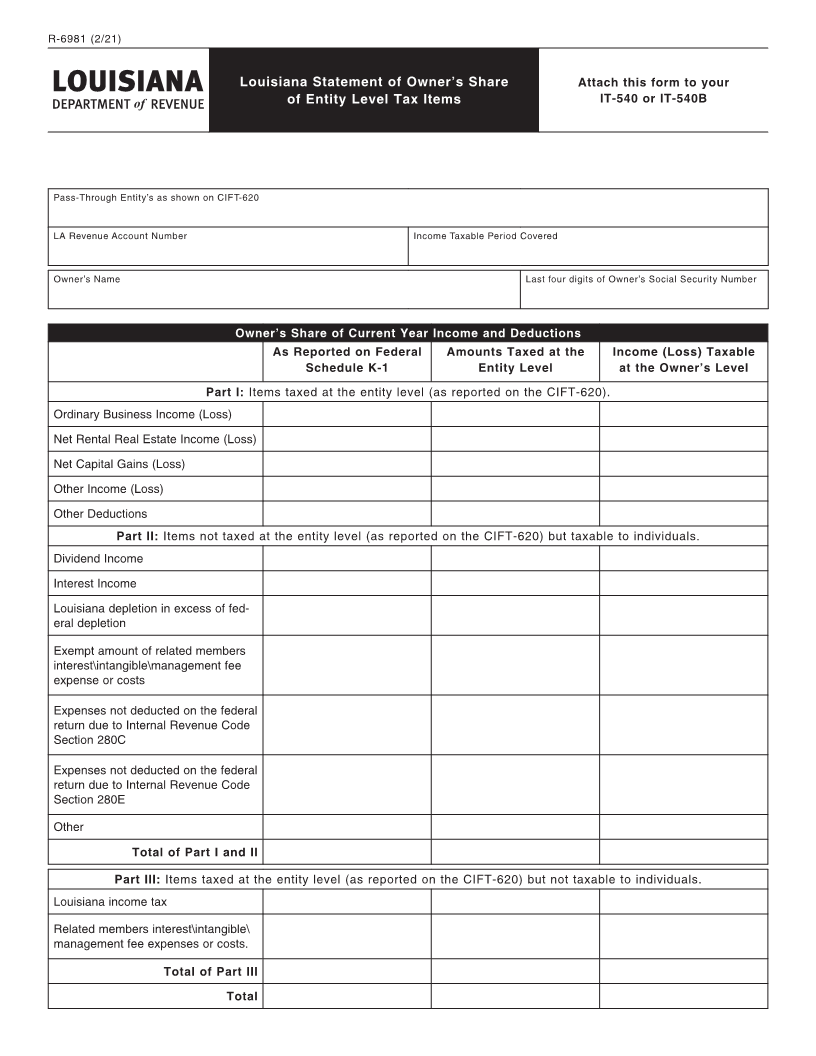

Pass-Through Entity’s as shown on CIFT-620

LA Revenue Account Number Income Taxable Period Covered

Owner’s Name Last four digits of Owner’s Social Security Number

Owner’s Share of Current Year Income and Deductions

As Reported on Federal Amounts Taxed at the Income (Loss) Taxable

Schedule K-1 Entity Level at the Owner’s Level

Part I: Items taxed at the entity level (as reported on the CIFT-620).

Ordinary Business Income (Loss)

Net Rental Real Estate Income (Loss)

Net Capital Gains (Loss)

Other Income (Loss)

Other Deductions

Part II: Items not taxed at the entity level (as reported on the CIFT-620) but taxable to individuals.

Dividend Income

Interest Income

Louisiana depletion in excess of fed-

eral depletion

Exempt amount of related members

interest\intangible\management fee

expense or costs

Expenses not deducted on the federal

return due to Internal Revenue Code

Section 280C

Expenses not deducted on the federal

return due to Internal Revenue Code

Section 280E

Other

Total of Part I and II

Part III: Items taxed at the entity level (as reported on the CIFT-620) but not taxable to individuals.

Louisiana income tax

Related members interest\intangible\

management fee expenses or costs.

Total of Part III

Total