Enlarge image

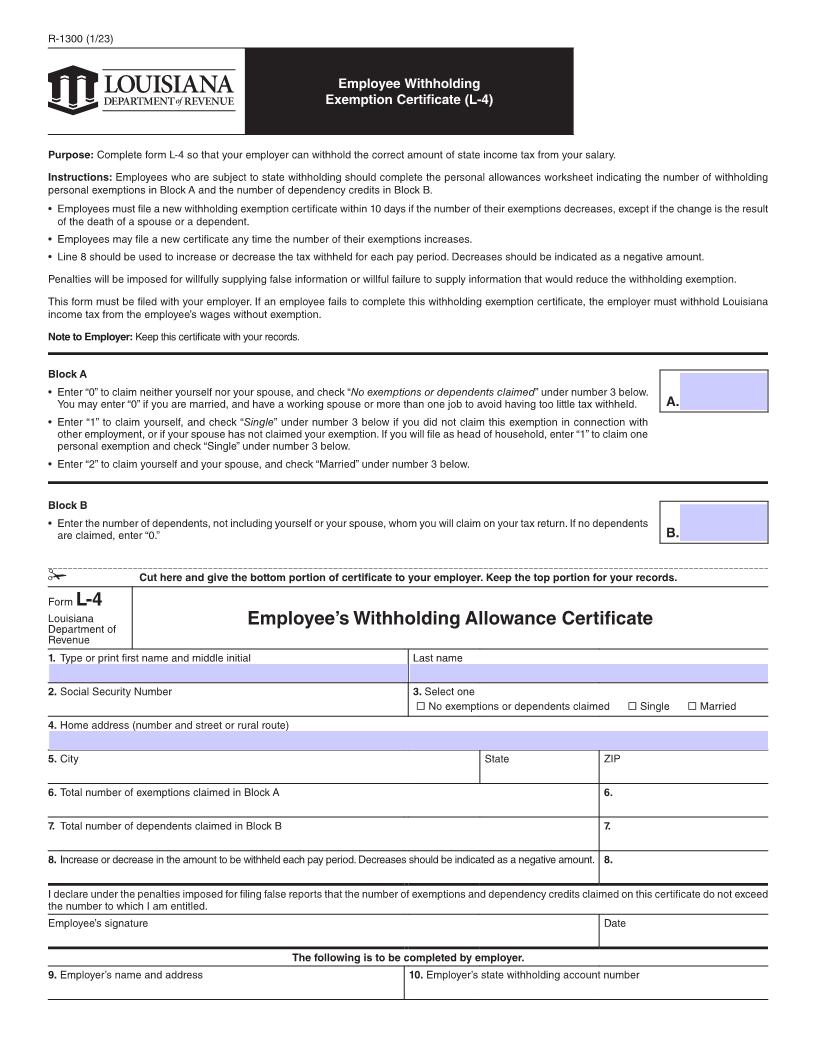

R-1300 (1/23) Employee Withholding Exemption Certificate (L-4) Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary. Instructions: Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding personal exemptions in Block A and the number of dependency credits in Block B. • Employees must file a new withholding exemption certificate within 10 days if the number of their exemptions decreases, except if the change is the result of the death of a spouse or a dependent. • Employees may file a new certificate any time the number of their exemptions increases. • Line 8 should be used to increase or decrease the tax withheld for each pay period. Decreases should be indicated as a negative amount. Penalties will be imposed for willfully supplying false information or willful failure to supply information that would reduce the withholding exemption. This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold Louisiana income tax from the employee’s wages without exemption. Note to Employer: Keep this certificate with your records. Block A • Enter “0” to claim neither yourself nor your spouse, and check “No exemptions or dependents claimed” under number 3 below. You may enter “0” if you are married, and have a working spouse or more than one job to avoid having too little tax withheld. A. • Enter “1” to claim yourself, and check “Single” under number 3 below if you did not claim this exemption in connection with other employment, or if your spouse has not claimed your exemption. If you will file as head of household, enter “1” to claim one personal exemption and check “Single” under number 3 below. • Enter “2” to claim yourself and your spouse, and check “Married” under number 3 below. Block B • Enter the number of dependents, not including yourself or your spouse, whom you will claim on your tax return. If no dependents are claimed, enter “0.” B. Cut here and give the bottom portion of certificate to your employer. Keep the top portion for your records. Form L-4 Louisiana Employee’s Withholding Allowance Certificate Department of Revenue 1. Type or print first name and middle initial Last name 2. Social Security Number 3. Select one No exemptions or dependents claimed Single Married 4. Home address (number and street or rural route) 5. City State ZIP 6. Total number of exemptions claimed in Block A 6. 7. Total number of dependents claimed in Block B 7. 8. Increase or decrease in the amount to be withheld each pay period. Decreases should be indicated as a negative amount. 8. I declare under the penalties imposed for filing false reports that the number of exemptions and dependency credits claimed on this certificate do not exceed the number to which I am entitled. Employee’s signature Date The following is to be completed by employer. 9. Employer’s name and address 10. Employer’s state withholding account number