Enlarge image

CIFT-620ESi (2021) 2021

Declaration of Estimated Tax for

Corporations General Information

lat ap.r e venue.louisiana.go v

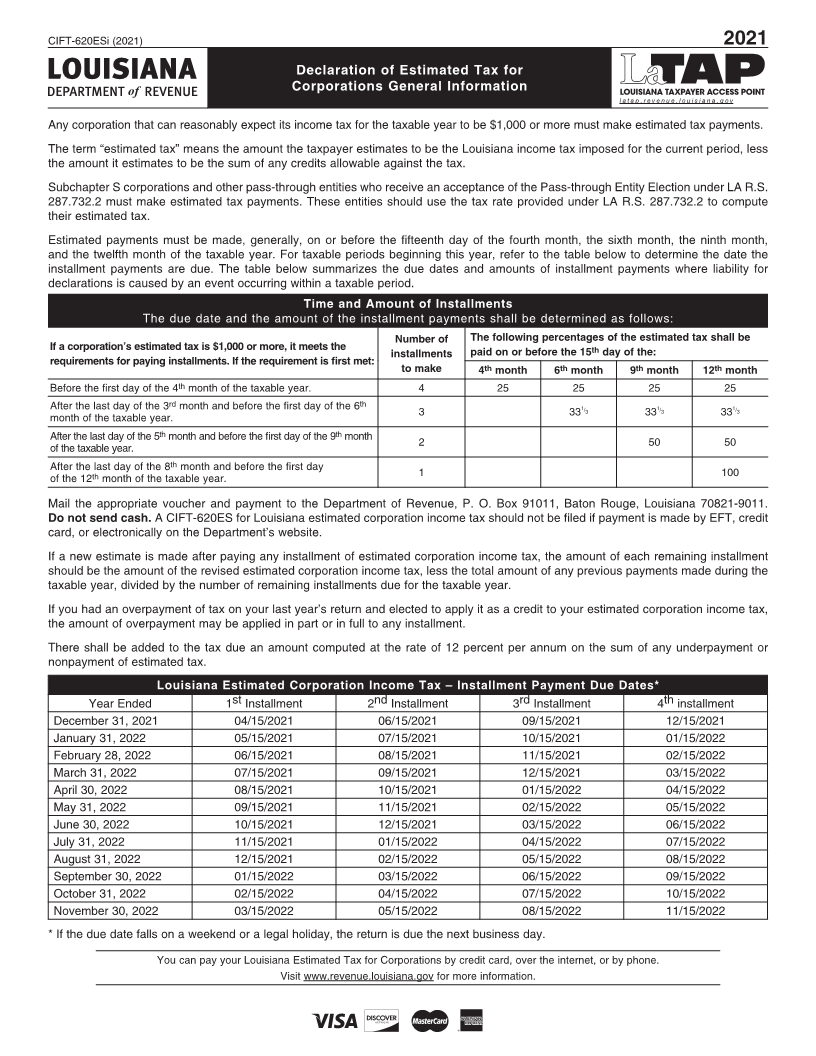

Any corporation that can reasonably expect its income tax for the taxable year to be $1,000 or more must make estimated tax payments.

The term “estimated tax” means the amount the taxpayer estimates to be the Louisiana income tax imposed for the current period, less

the amount it estimates to be the sum of any credits allowable against the tax.

Subchapter S corporations and other pass-through entities who receive an acceptance of the Pass-through Entity Election under LA R.S.

287.732.2 must make estimated tax payments. These entities should use the tax rate provided under LA R.S. 287.732.2 to compute

their estimated tax.

Estimated payments must be made, generally, on or before the fifteenth day of the fourth month, the sixth month, the ninth month,

and the twelfth month of the taxable year. For taxable periods beginning this year, refer to the table below to determine the date the

installment payments are due. The table below summarizes the due dates and amounts of installment payments where liability for

declarations is caused by an event occurring within a taxable period.

Time and Amount of Installments

The due date and the amount of the installment payments shall be determined as follows:

Number of The following percentages of the estimated tax shall be

If a corporation’s estimated tax is $1,000 or more, it meets the paid on or before the 15 thday of the:

installments

requirements for paying installments. If the requirement is first met: th 6 thmonth 9 thmonth 12 thmonth

to make 4 month

Before the first day of the 4 thmonth of the taxable year. 4 25 25 25 25

After the last day of the 3 rdmonth and before the first day of the 6 th 1 / 3 331 / 3 331 / 3

month of the taxable year. 3 33

After the last day of theth5 month and before the first day of theth9 month

of the taxable year. 2 50 50

After the last day of the 8 thmonth and before the first day

of the 12 thmonth of the taxable year. 1 100

Mail the appropriate voucher and payment to the Department of Revenue, P. O. Box 91011, Baton Rouge, Louisiana 70821-9011.

Do not send cash. A CIFT-620ES for Louisiana estimated corporation income tax should not be filed if payment is made by EFT, credit

card, or electronically on the Department’s website.

If a new estimate is made after paying any installment of estimated corporation income tax, the amount of each remaining installment

should be the amount of the revised estimated corporation income tax, less the total amount of any previous payments made during the

taxable year, divided by the number of remaining installments due for the taxable year.

If you had an overpayment of tax on your last year’s return and elected to apply it as a credit to your estimated corporation income tax,

the amount of overpayment may be applied in part or in full to any installment.

There shall be added to the tax due an amount computed at the rate of 12 percent per annum on the sum of any underpayment or

nonpayment of estimated tax.

Louisiana Estimated Corporation Income Tax – Installment Payment Due Dates*

Year Ended 1 stInstallment 2nd Installment 3 rdInstallment 4 thinstallment

December 31, 2021 04/15/2021 06/15/2021 09/15/2021 12/15/2021

January 31, 2022 05/15/2021 07/15/2021 10/15/2021 01/15/2022

February 28, 2022 06/15/2021 08/15/2021 11/15/2021 02/15/2022

March 31, 2022 07/15/2021 09/15/2021 12/15/2021 03/15/2022

April 30, 2022 08/15/2021 10/15/2021 01/15/2022 04/15/2022

May 31, 2022 09/15/2021 11/15/2021 02/15/2022 05/15/2022

June 30, 2022 10/15/2021 12/15/2021 03/15/2022 06/15/2022

July 31, 2022 11/15/2021 01/15/2022 04/15/2022 07/15/2022

August 31, 2022 12/15/2021 02/15/2022 05/15/2022 08/15/2022

September 30, 2022 01/15/2022 03/15/2022 06/15/2022 09/15/2022

October 31, 2022 02/15/2022 04/15/2022 07/15/2022 10/15/2022

November 30, 2022 03/15/2022 05/15/2022 08/15/2022 11/15/2022

* If the due date falls on a weekend or a legal holiday, the return is due the next business day.

You can pay your Louisiana Estimated Tax for Corporations by credit card, over the internet, or by phone.

Visit www.revenue.louisiana.gov for more information.