- 3 -

Enlarge image

|

R-540CNRi (7/15)

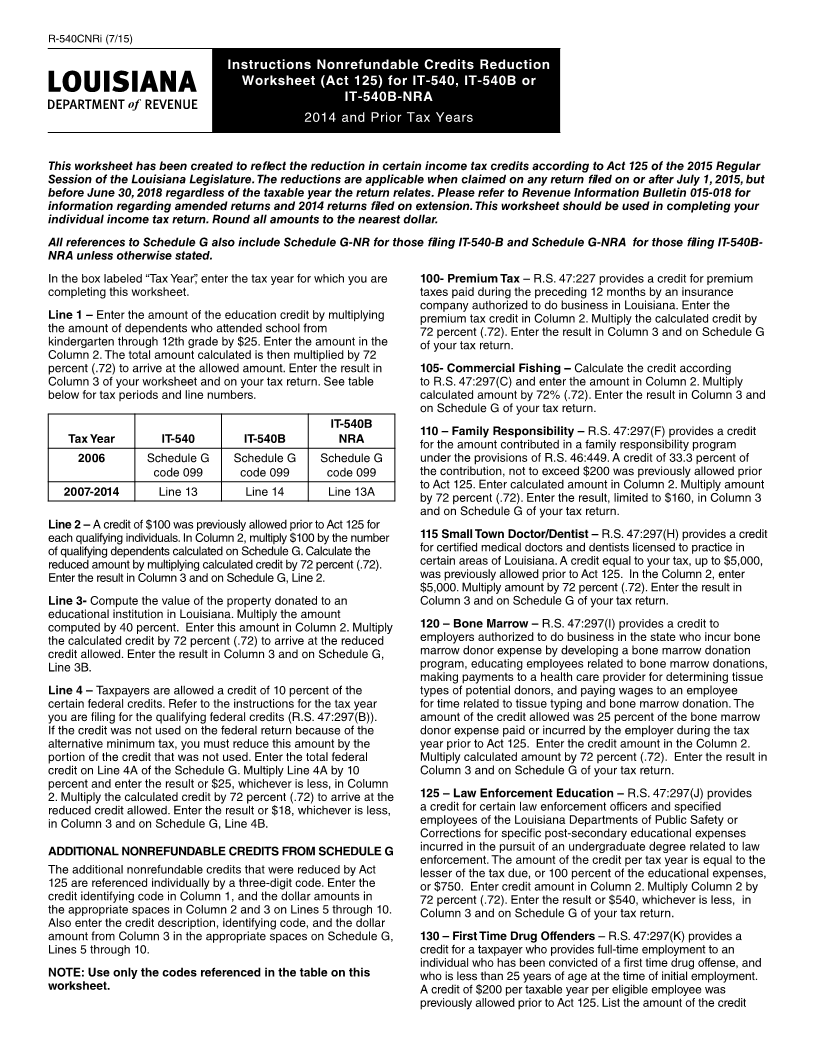

in the Column 2. Multiply Column 2 by 72 percent (.72). Enter the credit per eligible employee for hiring a previously unemployed

result in Column 3 and on Schedule G of your tax return. person who participates in the Family Independence Work

Program in a newly created full-time job. Enter calculated credit

135 – Bulletproof Vest – R.S. 47:297(L) provides a credit for amount in Column 2. Multiply amount by 72 percent (.72). Enter

the purchase of a bulletproof vest for certain law enforcement the result in Column 3 and on Schedule G of your tax return.

personnel. The credit is limited to $100 prior to Act 125. Enter

$100 in Column 2. Multiply Column 2 by 72 percent (.72). Enter 210 – Recycling Credit – R.S. 47:6005 provides a credit for

the result in Column 3 and on Schedule G of your tax return. the purchase of certain equipment or service contracts related

to recycling. The credit must be certified by the Louisiana

140 – Nonviolent Offenders – R.S. 47:297(O) provides a credit Department of Environmental Quality and a copy of the

for a taxpayer who provides full-time employment to an individual certification must be attached to the return. Enter credit amount

who has been convicted of a first-time nonviolent offense, has in Column 2. Multiply amount by 72 percent (.72). Enter the result

completed a court-ordered program certified by the employee’s in Column 3 and on Schedule G of your tax return.

probation officer, and has worked 180 days. The credit is equal to

$200 per qualifying employee prior to Act 125. In Column 2, enter 212 – Basic Skills Training – R.S. 47:6009 provides a credit

credit amount. Multiply Column 2 by 72 percent (.72). Enter the for employers who pay for training to bring employees’ reading,

result in Column 3 and on Schedule G of your tax return. writing, or mathematical skills to at least the 12th grade level.

The credit is limited to $250 per participating employee, not to

145 – Owner of Newly Constructed Accessible Home – R.S. exceed $30,000 for the tax year. Enter credit amount in Column 2.

47:297(P) provides a credit for a taxpayer who owns a newly Multiply amount by 72 percent (.72). Enter the result in Column 3

constructed one or two-family dwelling on which the homestead and on Schedule G of your tax return.

exemption is claimed. The dwelling must include certain

accessible and barrier free design elements. Prior to Act 125, the 224 – New Jobs Credit – R.S. 47:34 and R.S. 47:287.749 provide

credit is for the lesser of $1,000 or tax, and is taken in the taxable a credit to employers who establish or expand a business in the

year that the construction of the dwelling is completed. Enter state. Prior to Act 125, the credit is limited to 50% of tax. Calculate

calculated credit amount in Column 2. Multiply Column 2 by 72 credit based on revised statue and enter amount in Column 2.

percent (.72). Enter the result in Column 3 and on Schedule G of Multiply amount by 72 percent (.72). Enter the result in Column 3

your tax return. and on Schedule G of your tax return.

150 – Qualified Playgrounds – R.S. 47:6008 provides a credit 226 – Refund by Utilities – R.S. 47:287.664 provides a credit for

for donations to assist qualified playgrounds. Prior to Act 125, the 100 percent of certain court ordered refunds made by utilities to

credit is for the lesser of $1,000 or one-half of the value of the its customers. Enter credit amount in Column 2. Multiply amount

cash, equipment, goods, or services donated. Enter calculated by 72 percent (.72). Enter the result in Column 3 and on Schedule

credit amount in Column 2. Multiply Column 2 by 72 percent (.72). G of your tax return.

Enter the result in 3 and on Schedule G of your tax return.

228 – Eligible Re-entrants – R.S. 47:287.748 provides a credit

155 – Debt Issuance – R.S. 47:6017 provides a credit for the to a taxpayer who employs an eligible re-entrant in Louisiana.

filing fee paid to the Louisiana State Bond Commission, which The credit shall be one hundred fifty dollars per eligible re-entrant

is incurred by an economic development corporation in the employed, but shall not exceed 50 percent of income tax. Enter

preparation and issuance of bonds. Enter credit amount in credit amount in Column 2. Multiply amount by 72 percent (.72).

Column 2. Multiply amount by 72 percent (.72). Enter the result in Enter the result in Column 3 and on Schedule G of your tax

Column 3 and on Schedule G of your tax return. return.

175 – Donations of Materials, Equipment, Advisors, 230 – Neighborhood Assistance – R.S. 47:35 and R.S.

Instructors – R.S. 47:6012 provides a credit for employers within 47:287.753 provide a credit for an entity engaged in the activities

the state for donations of the newest technology available in of providing neighborhood assistance, job training, and education

materials, equipment, or instructors to public training providers, for individuals, community services, or crime prevention in

secondary and postsecondary vocational-technical schools, Louisiana. Prior to Act 125, the credit is for up to 70 percent of the

community colleges, or apprenticeship programs registered with amount contributed for investment in programs approved by the

the Louisiana Workforce Commission to assist in the development Commissioner of Administration, and the credit shall not exceed

of training programs designed to meet industry needs. The credit $250,000 annually. Enter credit amount in Column 2. The credit

is for 50 percent of the value of the donated materials, equipment, is now limited to 50 percent of amount contributed and limited to

or services rendered by the instructor. When taken with other $180,000 annually. Enter reduced calculated amount in Column 3

applicable credits, this credit cannot exceed 20 percent of the and on Schedule G of your tax return.

employer’s tax liability for any taxable year. Enter calculated credit

amount in Column 2. Multiply amount by 72 percent (.72). Enter 232 – Cane River Heritage – R.S. 47:6026 provides a credit for

the result in Column 3 and on Schedule G of your tax return. a heritage-based cottage industry located or to be located in the

Cane River Heritage Area Development Zone. The taxpayer must

199 – Other – Reserved for future credits. enter into a contract with the Louisiana Department of Culture,

Recreation, and Tourism. Enter credit amount in Column 2.

200 – Atchafalaya Trace – R.S. 25:1226.4 provides a credit to Multiply Column 2 by 72 percent (.72). Enter the result in Column

certain heritage-based cottage industries that have entered into 3 and on Schedule G of your tax return.

a contract with the State Board of Commerce and Industry. Enter

credit amount in Column 2. Multiply amount by 80 percent (.80). 258 – LA Community Development Financial Institution

Enter the result in Column 3 and on Schedule G of your tax return. (LCDFI )– R.S. 51:3085 et seq. provides a credit for certain

investments in an LCDFI to encourage the expansion of

202 – Organ Donation – R.S. 47:297(N) provides a credit equal businesses in economically distressed areas. Prior to Act 125,

to certain expenses incurred by an individual or spouse for a the credit shall be calculated at 75 percent of investment. Enter

living organ donation, up to $10,000. Enter calculated credit calculated credit amount in Column 2. Under Act 125 , the credit

amount in Column 2. Multiply amount by 72 percent (.72). Enter shall be calculated at 54 percent of investment. Enter calculated

the result in Column 3 and on Schedule G of your tax return. credit in Column 3 and on Schedule G of your tax return.

208 – Previously Unemployed – R.S. 47:6004 provides a $750 299 – Other – reserved for future credits

|