- 2 -

Enlarge image

|

R-540CRWi (7/15--revised 07/01/16)

Instructions to Refundable Credits Reduction

Worksheet Form R-540CRW for use with Forms

IT-540, IT-540B and IT-540B NRA

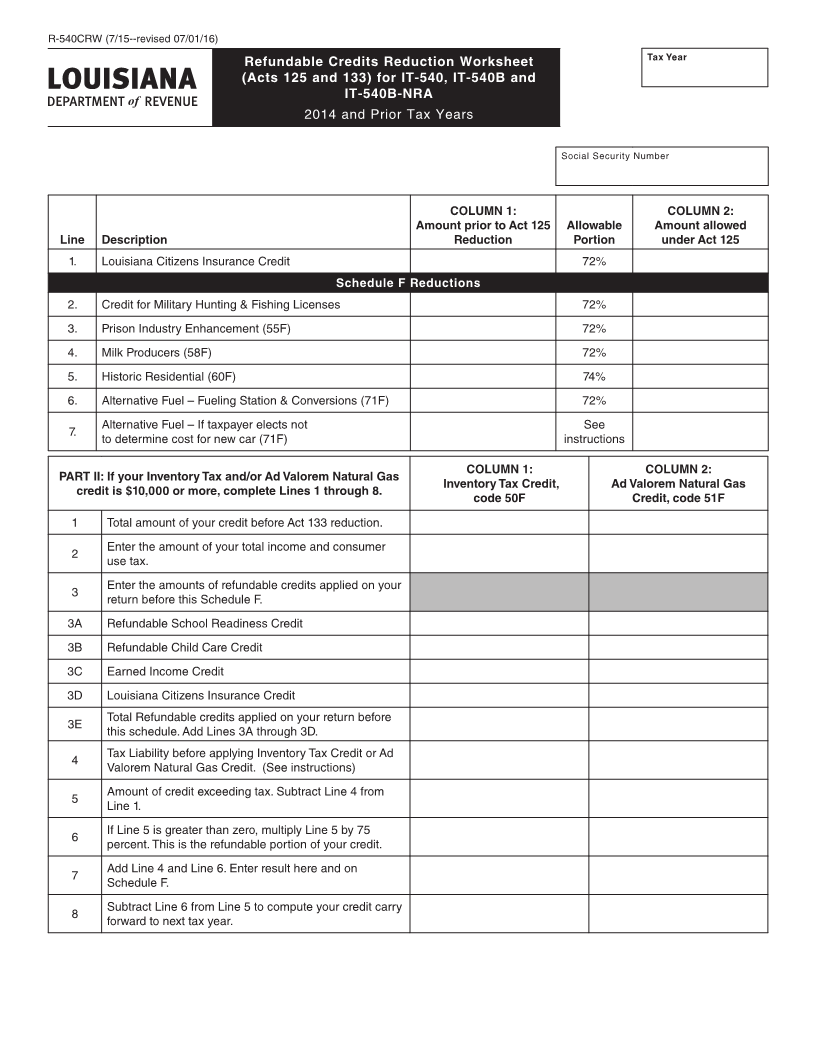

This worksheet has been created to reflect the reduction in certain income tax credits according to Act 125 and Act 133 of the

2015 Regular Session of the Louisiana Legislature. The reductions are applicable when claimed on any return filed on or after

July 1, 2015, but before June 30, 2018 regardless of the taxable year the return relates. Please refer to Revenue Information

Bulletins 15-019 and 15-021 for information regarding amended returns and returns on extension. This worksheet should be

used in completing your individual income tax return. Round all amounts to the nearest dollar.

This form should be used only if you are amending a 2014 or prior tax year that was filed on or after July 1, 2015 but before

July 1, 2016 and the credit was claimed on that return.

If you are claiming the credit for the first time, you must use Form R-10610 (7/16) regardless of the tax year.

All references to Schedule F also include Schedule F-NR for those filing IT-540-B and Schedule F-NRA for those filing IT-540B-

NRA unless otherwise stated.

In the box labeled “Tax Year”, enter the tax year for which you are Line 4 – Milk Producers (58F) - R.S. 47:6032 allows a

completing this worksheet. refundable credit for a resident taxpayer engaged in the business

of producing milk for sale. Prior to Act 125, the cap amount

Line 1 – Enter the amount of the Louisiana Citizens Property for the credit was $30,000. Enter the amount of the credit as

Insurance assessment that was included in your homeowner’s figured based on Revenue Information Bulletin 08-014 in Column

insurance premium in Column 1. Multiply the credit by 72 percent 1. Multiply the amount by 72 percent (.72). The reduced cap is

(.72). Enter the result in Column 2 and on your return. Below are $21,600. Enter the results in Column 2 and on Schedule F under

the tax return types and line numbers to enter the credit on the additional refundable credits with the identifying three-digit code.

tax return.

Line 5 – Historic Residential (60F) - R.S. 47:297.6 allows a

Tax Year Form IT-540 Form IT-540B IT-540B NRA refundable credit for the amount of eligible costs and expenses

Schedule F Schedule F incurred during the rehabilitation of an owner-occupied residential

2006 Line 15A or owner-occupied mixed use structure located in a National

line 9 line 9

Register Historic District, a cultural district, a local historic

2007 Line 21 Line 21 Line 15A district, a Main Street District, or a downtown development

2008-2014 Line 22 Line 22 Line 15A district. Prior to the Act 125, the tax credit is limited to one credit

per rehabilitated structure and cannot exceed $18,500 per

Line 2 – Military Hunting and Fishing Licenses – R.S. 47:297.9 structure. Enter credit amount in Column 1. If the credit is for the

allows a credit for 100 percent of the amount paid by an active rehabilitation of an owner-occupied residential structure, the credit

or reserve servicemember, the spouse of an active or reserve shall be eighteen and one-half of one percent of the eligible costs

servicemember, or the dependent of such servicemember for and expenses of a rehabilitation for which an application for credit

obtaining a Louisiana noncommercial hunting and fishing license has been filed for the first time after July 1, 2011. If the credit is

was allowed. Calculate the original credit and enter the amount in for the rehabilitation of a vacant and blighted owner- occupied

Column 1. Multiply the credit by 72 percent (.72). Enter the result residential structure that is at least fifty years old, the credit is 36

in Column 2 and on Schedule F, Line 1. percent of the eligible costs and expenses of a rehabilitation for

Lines 3 through 7: The additional refundable credits that were which an application for credit has been filed for the first time after

reduced by Act 125 are referenced individually by a three- July 1, 2011. Calculate the reduced credit and enter amount in

digit code. Enter the dollar amounts in the appropriate spaces Column 2 and on Schedule F under additional refundable credits

in Column1 and 2 on Lines 3 through 7. Also enter the credit with the identifying three-digit code.

description, identifying code, and the dollar amount from Column Line 6 – Alternative Fuel (71F) - Fueling Station & Conversions

2 in the appropriate spaces on Schedule F. R.S. 47:6035 allows a refundable credit for the purchase of, or

NOTE: Use only the codes referenced in the table on this conversion of a vehicle designed to run on an alternative fuel.

worksheet. Prior to Act 125, the credit is equal to 50 percent of the cost of the

qualified clean-burning motor vehicle fuel property that has been

Line 3 – Prison Industry Enhancement (55F) - R.S. 47:6018 purchased and installed. If the taxpayer is unable to determine the

allows a refundable credit for the state sales and use tax paid exact cost attributable to the qualified clean-burning motor vehicle,

by a taxpayer on purchases of specialty apparel items from a please skip and go to Line 7. Calculate the credit and enter amount

private sector Prison Industry Enhancement (PIE) contractor. The in Column 1. Under Act 125, the credit is equal to 36 percent of the

amount of the credit shall be equal to the state sales and use cost of the qualified clean-burning motor vehicle fuel property that

tax paid by the purchaser on each case or other unit of apparel has been purchased and installed. Calculate the reduced credit

during the purchaser’s tax year as reflected on the books and and enter amount in Column 2 and on Schedule F under additional

records of the purchaser during his tax year. Enter the PIE credit refundable credits with the identifying three-digit code.

in Column 1. Multiply by 72 percent (.72). Enter the results in

Column 2 and on Schedule F under additional refundable credits Line 7 – Conversion of Vehicle to Alternative Fuel (71F) - Prior

with the identifying three-digit code. to Act 125, if the taxpayer is unable to determine the exact cost

attributable to the qualified clean-burning motor vehicle, a credit

|