Enlarge image

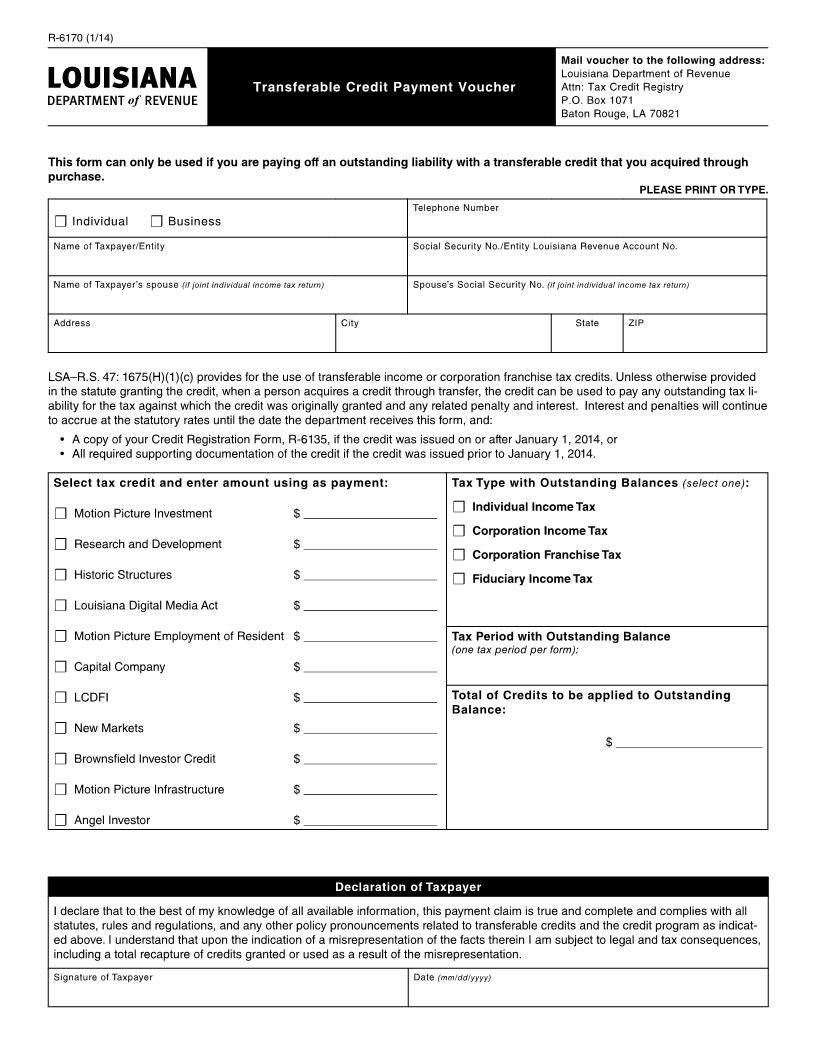

R-6170 (1/14)

Mail voucher to the following address:

Louisiana Department of Revenue

Transferable Credit Payment Voucher Attn: Tax Credit Registry

P.O. Box 1071

Baton Rouge, LA 70821

This form can only be used if you are paying off an outstanding liability with a transferable credit that you acquired through

purchase.

PLEASE PRINT OR TYPE.

Telephone Number

☐ Individual ☐ Business

Name of Taxpayer/Entity Social Security No./Entity Louisiana Revenue Account No.

Name of Taxpayer’s spouse (if joint individual income tax return) Spouse’s Social Security No. (if joint individual income tax return)

Address City State ZIP

LSA–R.S. 47: 1675(H)(1)(c) provides for the use of transferable income or corporation franchise tax credits. Unless otherwise provided

in the statute granting the credit, when a person acquires a credit through transfer, the credit can be used to pay any outstanding tax li-

ability for the tax against which the credit was originally granted and any related penalty and interest. Interest and penalties will continue

to accrue at the statutory rates until the date the department receives this form, and:

• A copy of your Credit Registration Form, R-6135, if the credit was issued on or after January 1, 2014, or

• All required supporting documentation of the credit if the credit was issued prior to January 1, 2014.

Select tax credit and enter amount using as payment: Tax Type with Outstanding Balances (select one):

☐ Motion Picture Investment $ ____________________ ☐ Individual Income Tax

☐ Corporation Income Tax

☐ Research and Development $ ____________________

☐ Corporation Franchise Tax

☐ Historic Structures $ ____________________ Fiduciary Income Tax

☐

☐ Louisiana Digital Media Act $ ____________________

☐ Motion Picture Employment of Resident $ ____________________ Tax Period with Outstanding Balance

(one tax period per form):

☐ Capital Company $ ____________________

☐ LCDFI $ ____________________ Total of Credits to be applied to Outstanding

Balance:

☐ New Markets $ ____________________

$ ______________________

☐ Brownsfield Investor Credit $ ____________________

☐ Motion Picture Infrastructure $ ____________________

☐ Angel Investor $ ____________________

Declaration of Taxpayer

I declare that to the best of my knowledge of all available information, this payment claim is true and complete and complies with all

statutes, rules and regulations, and any other policy pronouncements related to transferable credits and the credit program as indicat-

ed above. I understand that upon the indication of a misrepresentation of the facts therein I am subject to legal and tax consequences,

including a total recapture of credits granted or used as a result of the misrepresentation.

Signature of Taxpayer Date (mm/dd/yyyy)