Enlarge image

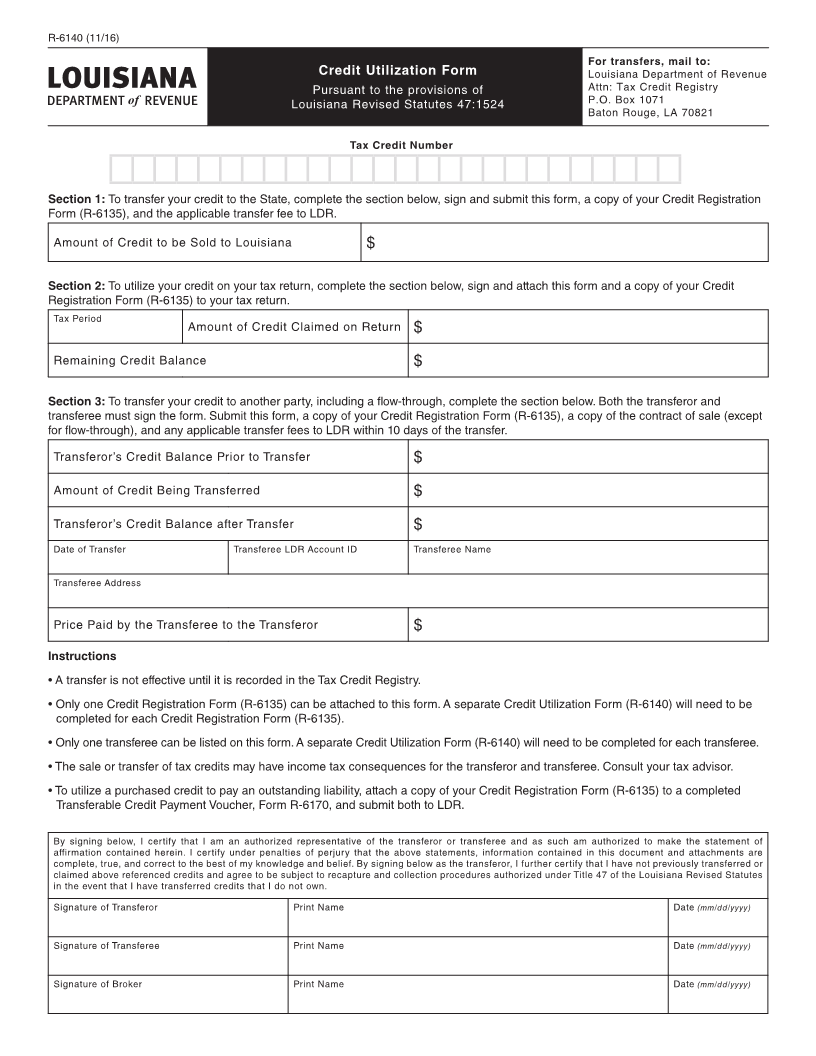

R-6140 (11/16)

For transfers, mail to:

Credit Utilization Form Louisiana Department of Revenue

Pursuant to the provisions of Attn: Tax Credit Registry

Louisiana Revised Statutes 47:1524 P.O. Box 1071

Baton Rouge, LA 70821

Tax Credit Number

Section 1: To transfer your credit to the State, complete the section below, sign and submit this form, a copy of your Credit Registration

Form (R-6135), and the applicable transfer fee to LDR.

Amount of Credit to be Sold to Louisiana $

Section 2: To utilize your credit on your tax return, complete the section below, sign and attach this form and a copy of your Credit

Registration Form (R-6135) to your tax return.

Tax Period

Amount of Credit Claimed on Return $

Remaining Credit Balance $

Section 3: To transfer your credit to another party, including a flow-through, complete the section below. Both the transferor and

transferee must sign the form. Submit this form, a copy of your Credit Registration Form (R-6135), a copy of the contract of sale (except

for flow-through), and any applicable transfer fees to LDR within 10 days of the transfer.

Transferor’s Credit Balance Prior to Transfer $

Amount of Credit Being Transferred $

Transferor’s Credit Balance after Transfer $

Date of Transfer Transferee LDR Account ID Transferee Name

Transferee Address

Price Paid by the Transferee to the Transferor $

Instructions

• A transfer is not effective until it is recorded in the Tax Credit Registry.

• Only one Credit Registration Form (R-6135) can be attached to this form. A separate Credit Utilization Form (R-6140) will need to be

completed for each Credit Registration Form (R-6135).

• Only one transferee can be listed on this form. A separate Credit Utilization Form (R-6140) will need to be completed for each transferee.

• The sale or transfer of tax credits may have income tax consequences for the transferor and transferee. Consult your tax advisor.

• To utilize a purchased credit to pay an outstanding liability, attach a copy of your Credit Registration Form (R-6135) to a completed

Transferable Credit Payment Voucher, Form R-6170, and submit both to LDR.

By signing below, I certify that I am an authorized representative of the transferor or transferee and as such am authorized to make the statement of

affirmation contained herein. I certify under penalties of perjury that the above statements, information contained in this document and attachments are

complete, true, and correct to the best of my knowledge and belief. By signing below as the transferor, I further certify that I have not previously transferred or

claimed above referenced credits and agree to be subject to recapture and collection procedures authorized under Title 47 of the Louisiana Revised Statutes

in the event that I have transferred credits that I do not own.

Signature of Transferor Print Name Date (mm/dd/yyyy)

Signature of Transferee Print Name Date (mm/dd/yyyy)

Signature of Broker Print Name Date (mm/dd/yyyy)