- 2 -

Enlarge image

|

R-620CRWi (7/15)

Instructions to Refundable Credits Reduction

Worksheet Form 620CRW for use with forms

CIFT-620, IT-541 and R-6922

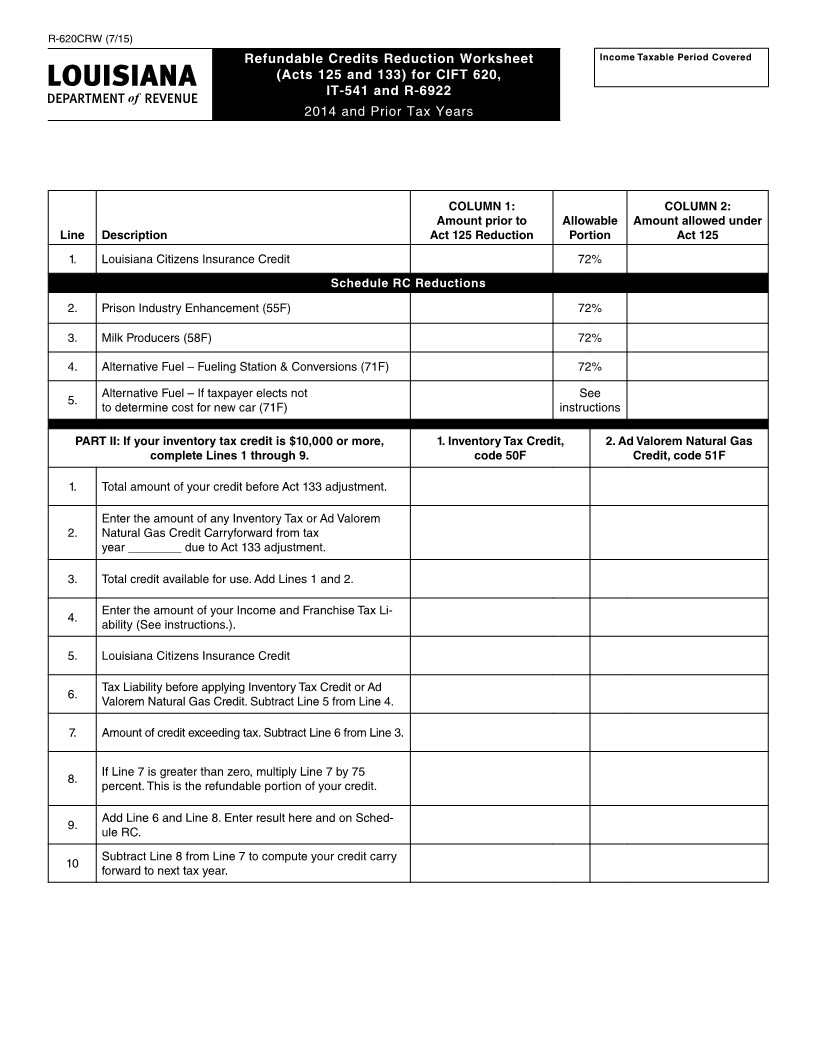

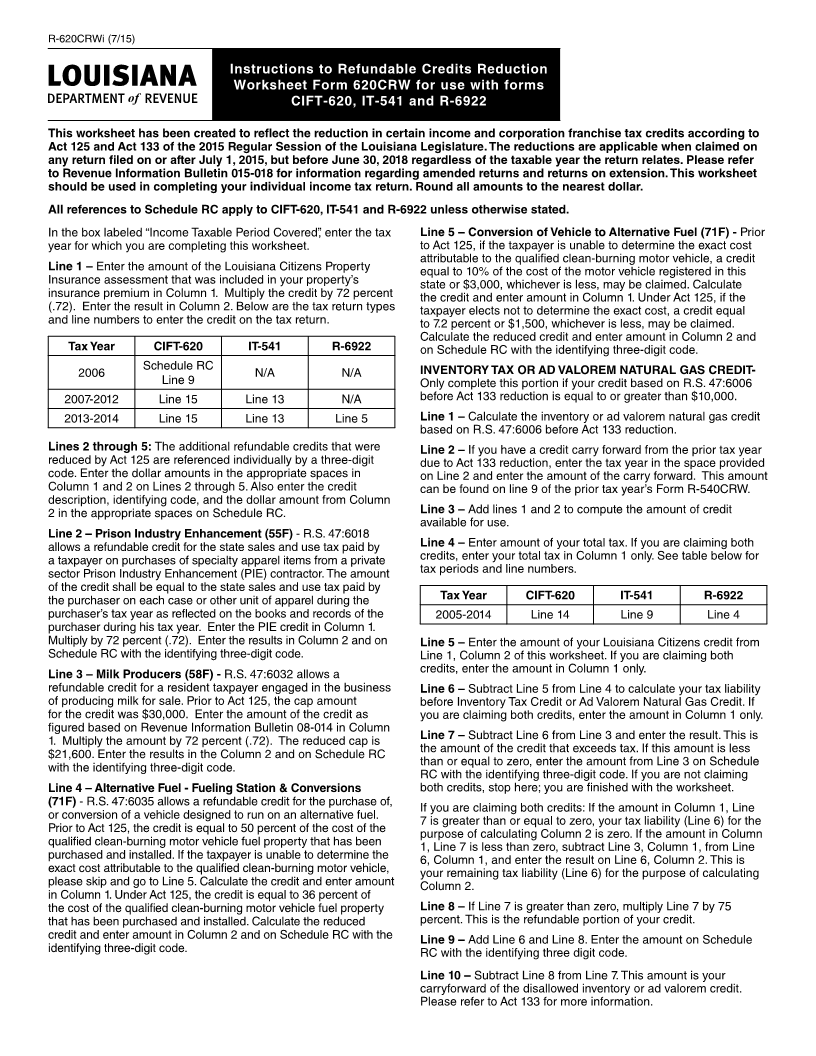

This worksheet has been created to reflect the reduction in certain income and corporation franchise tax credits according to

Act 125 and Act 133 of the 2015 Regular Session of the Louisiana Legislature. The reductions are applicable when claimed on

any return filed on or after July 1, 2015, but before June 30, 2018 regardless of the taxable year the return relates. Please refer

to Revenue Information Bulletin 015-018 for information regarding amended returns and returns on extension. This worksheet

should be used in completing your individual income tax return. Round all amounts to the nearest dollar.

All references to Schedule RC apply to CIFT-620, IT-541 and R-6922 unless otherwise stated.

In the box labeled “Income Taxable Period Covered”, enter the tax Line 5 – Conversion of Vehicle to Alternative Fuel (71F) - Prior

year for which you are completing this worksheet. to Act 125, if the taxpayer is unable to determine the exact cost

attributable to the qualified clean-burning motor vehicle, a credit

Line 1 – Enter the amount of the Louisiana Citizens Property equal to 10% of the cost of the motor vehicle registered in this

Insurance assessment that was included in your property’s state or $3,000, whichever is less, may be claimed. Calculate

insurance premium in Column 1. Multiply the credit by 72 percent the credit and enter amount in Column 1. Under Act 125, if the

(.72). Enter the result in Column 2. Below are the tax return types taxpayer elects not to determine the exact cost, a credit equal

and line numbers to enter the credit on the tax return. to 7.2 percent or $1,500, whichever is less, may be claimed.

Calculate the reduced credit and enter amount in Column 2 and

Tax Year CIFT-620 IT-541 R-6922 on Schedule RC with the identifying three-digit code.

Schedule RC

2006 N/A N/A InVEnToRY TAX oR AD VALoREm nATuRAL GAS CREDIT-

Line 9 Only complete this portion if your credit based on R.S. 47:6006

2007-2012 Line 15 Line 13 N/A before Act 133 reduction is equal to or greater than $10,000.

2013-2014 Line 15 Line 13 Line 5 Line 1 – Calculate the inventory or ad valorem natural gas credit

based on R.S. 47:6006 before Act 133 reduction.

Lines 2 through 5: The additional refundable credits that were Line 2 – If you have a credit carry forward from the prior tax year

reduced by Act 125 are referenced individually by a three-digit due to Act 133 reduction, enter the tax year in the space provided

code. Enter the dollar amounts in the appropriate spaces in on Line 2 and enter the amount of the carry forward. This amount

Column 1 and 2 on Lines 2 through 5. Also enter the credit can be found on line 9 of the prior tax year’s Form R-540CRW.

description, identifying code, and the dollar amount from Column

2 in the appropriate spaces on Schedule RC. Line 3 – Add lines 1 and 2 to compute the amount of credit

available for use.

Line 2 – Prison Industry Enhancement (55F) - R.S. 47:6018

allows a refundable credit for the state sales and use tax paid by Line 4 – Enter amount of your total tax. If you are claiming both

a taxpayer on purchases of specialty apparel items from a private credits, enter your total tax in Column 1 only. See table below for

sector Prison Industry Enhancement (PIE) contractor. The amount tax periods and line numbers.

of the credit shall be equal to the state sales and use tax paid by

the purchaser on each case or other unit of apparel during the Tax Year CIFT-620 IT-541 R-6922

purchaser’s tax year as reflected on the books and records of the 2005-2014 Line 14 Line 9 Line 4

purchaser during his tax year. Enter the PIE credit in Column 1.

Multiply by 72 percent (.72). Enter the results in Column 2 and on Line 5 – Enter the amount of your Louisiana Citizens credit from

Schedule RC with the identifying three-digit code. Line 1, Column 2 of this worksheet. If you are claiming both

Line 3 – milk Producers (58F) - R.S. 47:6032 allows a credits, enter the amount in Column 1 only.

refundable credit for a resident taxpayer engaged in the business Line 6 – Subtract Line 5 from Line 4 to calculate your tax liability

of producing milk for sale. Prior to Act 125, the cap amount before Inventory Tax Credit or Ad Valorem Natural Gas Credit. If

for the credit was $30,000. Enter the amount of the credit as you are claiming both credits, enter the amount in Column 1 only.

figured based on Revenue Information Bulletin 08-014 in Column

1. Multiply the amount by 72 percent (.72). The reduced cap is Line 7 – Subtract Line 6 from Line 3 and enter the result. This is

$21,600. Enter the results in the Column 2 and on Schedule RC the amount of the credit that exceeds tax. If this amount is less

with the identifying three-digit code. than or equal to zero, enter the amount from Line 3 on Schedule

RC with the identifying three-digit code. If you are not claiming

Line 4 – Alternative Fuel - Fueling Station & Conversions both credits, stop here; you are finished with the worksheet.

(71F) - R.S. 47:6035 allows a refundable credit for the purchase of, If you are claiming both credits: If the amount in Column 1, Line

or conversion of a vehicle designed to run on an alternative fuel. 7 is greater than or equal to zero, your tax liability (Line 6) for the

Prior to Act 125, the credit is equal to 50 percent of the cost of the purpose of calculating Column 2 is zero. If the amount in Column

qualified clean-burning motor vehicle fuel property that has been 1, Line 7 is less than zero, subtract Line 3, Column 1, from Line

purchased and installed. If the taxpayer is unable to determine the 6, Column 1, and enter the result on Line 6, Column 2. This is

exact cost attributable to the qualified clean-burning motor vehicle, your remaining tax liability (Line 6) for the purpose of calculating

please skip and go to Line 5. Calculate the credit and enter amount Column 2.

in Column 1. Under Act 125, the credit is equal to 36 percent of

the cost of the qualified clean-burning motor vehicle fuel property Line 8 – If Line 7 is greater than zero, multiply Line 7 by 75

that has been purchased and installed. Calculate the reduced percent. This is the refundable portion of your credit.

credit and enter amount in Column 2 and on Schedule RC with the Line 9 – Add Line 6 and Line 8. Enter the amount on Schedule

identifying three-digit code. RC with the identifying three digit code.

Line 10 – Subtract Line 8 from Line 7. This amount is your

carryforward of the disallowed inventory or ad valorem credit.

Please refer to Act 133 for more information.

|