Enlarge image

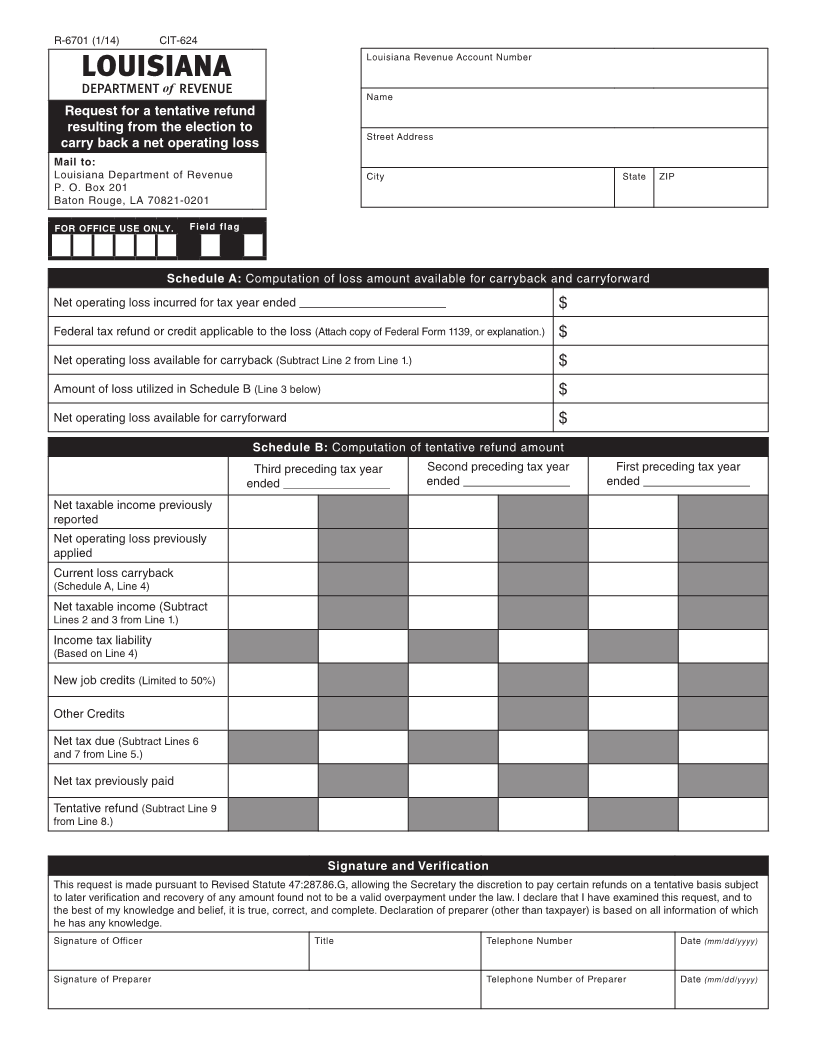

R-6701 (1/14) CIT-624

Louisiana Revenue Account Number

Name

Request for a tentative refund

resulting from the election to

Street Address

carry back a net operating loss

Mail to:

Louisiana Department of Revenue City State ZIP

P. O. Box 201

Baton Rouge, LA 70821-0201

FOR OFFICE USE ONLY. Field flag

Schedule A: Computation of loss amount available for carryback and carryforward

Net operating loss incurred for tax year ended ______________________ $

Federal tax refund or credit applicable to the loss (Attach copy of Federal Form 1139, or explanation.) $

Net operating loss available for carryback (Subtract Line 2 from Line 1.) $

Amount of loss utilized in Schedule B (Line 3 below) $

Net operating loss available for carryforward $

Schedule B: Computation of tentative refund amount

Third preceding tax year Second preceding tax year First preceding tax year

ended ________________ ended ________________ ended ________________

Net taxable income previously

reported

Net operating loss previously

applied

Current loss carryback

(Schedule A, Line 4)

Net taxable income (Subtract

Lines 2 and 3 from Line 1.)

Income tax liability

(Based on Line 4)

New job credits (Limited to 50%)

Other Credits

Net tax due (Subtract Lines 6

and 7 from Line 5.)

Net tax previously paid

Tentative refund (Subtract Line 9

from Line 8.)

Signature and Verification

This request is made pursuant to Revised Statute 47:287.86.G, allowing the Secretary the discretion to pay certain refunds on a tentative basis subject

to later verification and recovery of any amount found not to be a valid overpayment under the law. I declare that I have examined this request, and to

the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which

he has any knowledge.

Signature of Officer Title Telephone Number Date (mm/dd/yyyy)

Signature of Preparer Telephone Number of Preparer Date (mm/dd/yyyy)