- 75 -

Enlarge image

|

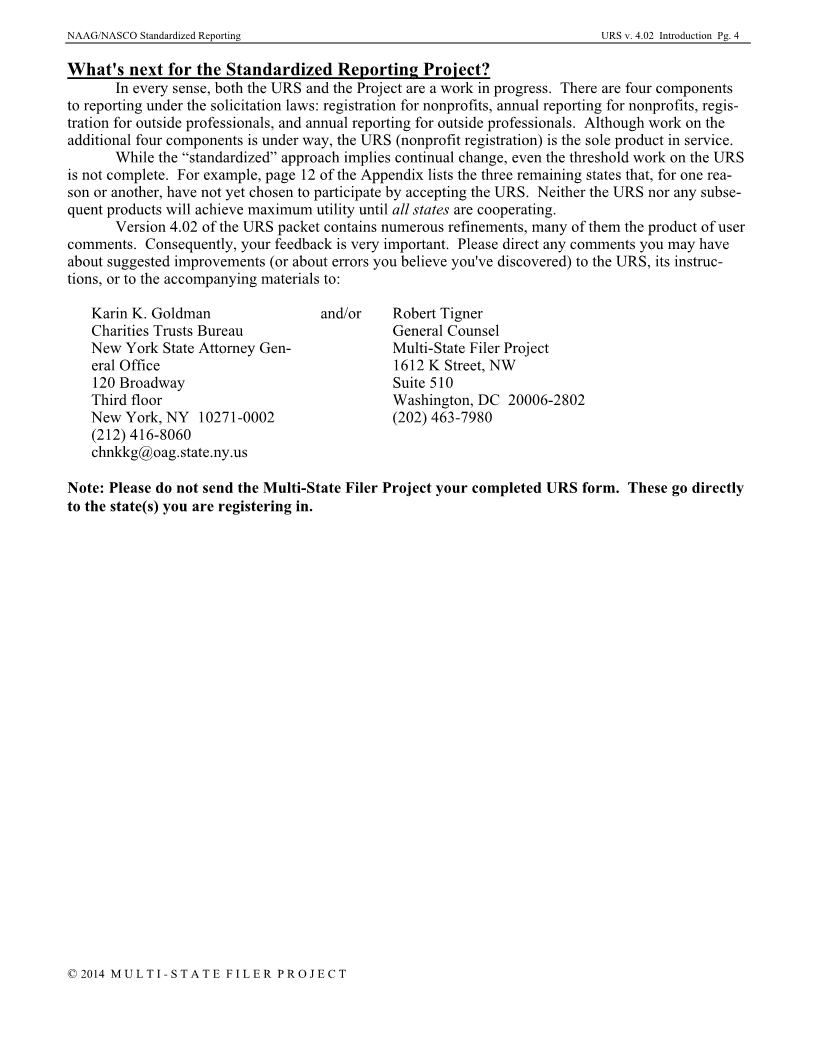

NAAG/NASCO Standardized Reporting URS v. 4.0 2Appendix Pg 7

Check payable to: "NYS Department of Law." soliciting contributions for any person specified by name at the time

Period covered: Indefinite. of the solicitation if all the contributions received are transferred

Renewal Due date: No renewal of registration but financial reports within a reasonable time after receipt to the person named or that

are due annually within four and a half months of Fiscal Year end. person’s parent, guardian or conservator with no restrictions on their

Required signatures: Two, President and director or chief fiscal expenditure and with no deduction; religious organizations;

officer. institutions of higher learning; a private or public elementary or

Notarized signature required: No. secondary school; any candidate for national, state, or local elective

Fundraiser contracts: No (these are filed by the fundraiser). office or political party or other committee required to file

Certificate/Articles of Incorporation: Yes. information with the federal election committee, a state election

Bylaws: Yes. commission, or an equivalent office or agency.

IRS Form 990: Yes. Fees: $25 initial. $10 renewal.

IRS Determination Letter: Yes. (Must also submit copy of IRS Form Check payable to: "Secretary of State."

1023 or 1024). Period covered: One Year.

Resident/Registered Agent required: No (Secretary of State may be Renewal Due date: September 1.

designated). Required signatures: One. An authorized officer of the charitable

Audit: Yes, if over $250,000 in revenues (CPA review if between organization.

100,000-$250,000). Notarized signature required: Yes.

State forms additional to URS: None. Fundraiser contracts: Yes.

Mailing address: Dept. of Law, Charities Bureau, 120 Broadway 3 rd Certificate/Articles of Incorporation: Yes.

fl., New York, NY 10271 Bylaws: No.

Info. telephone & contact: 212-416-8401, Karin K. Goldman, Asst. IRS Form 990: Yes.

Attorney General IRS Determination Letter: Yes.

Web: www.charitiesnys.gov Resident/Registered Agent required: Yes (see below for required

form).

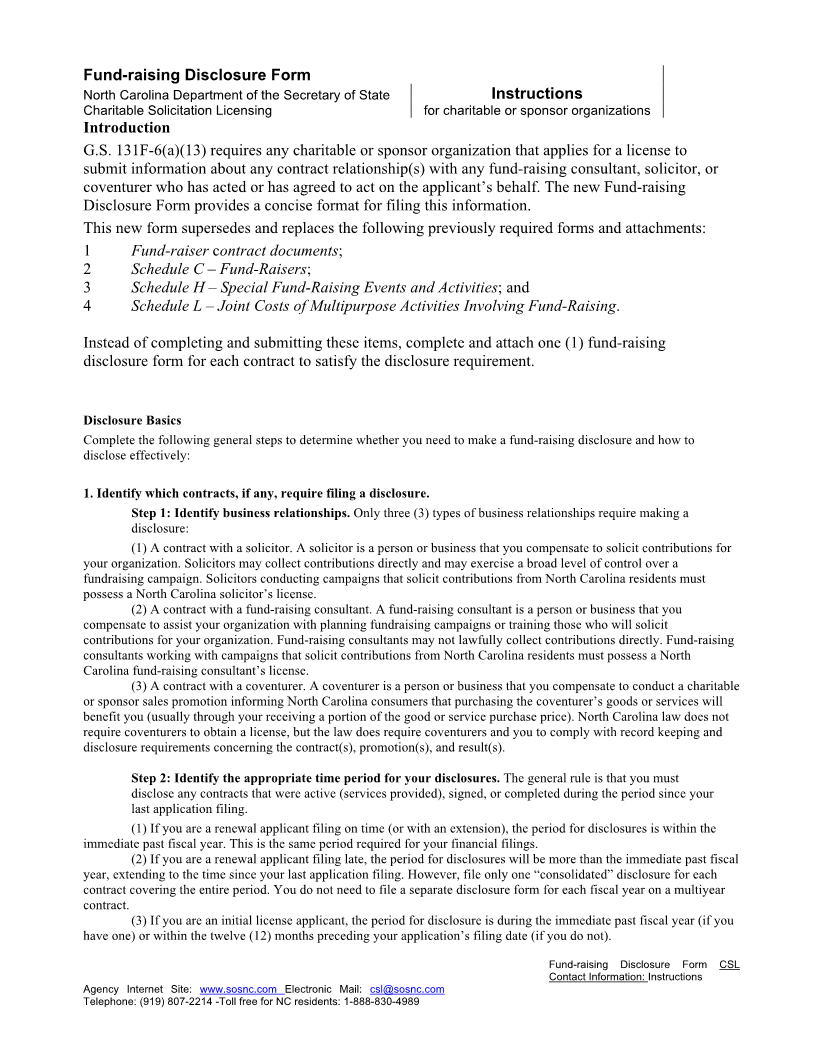

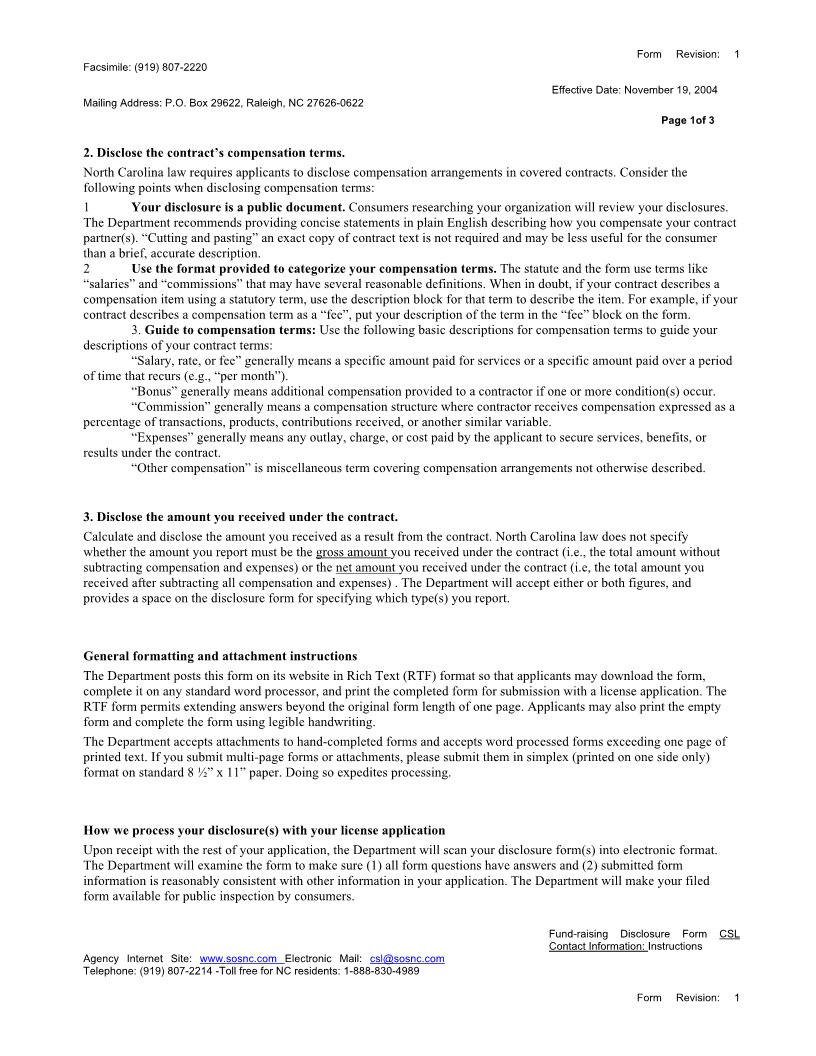

North Carolina Audit: No.

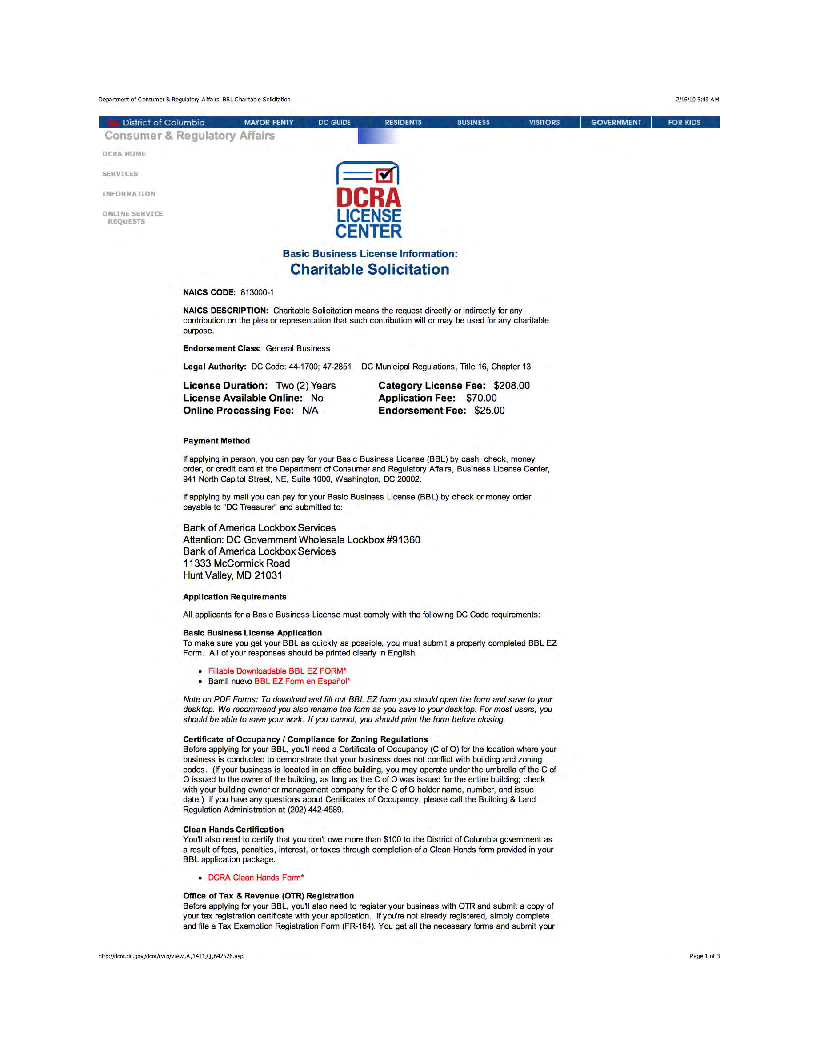

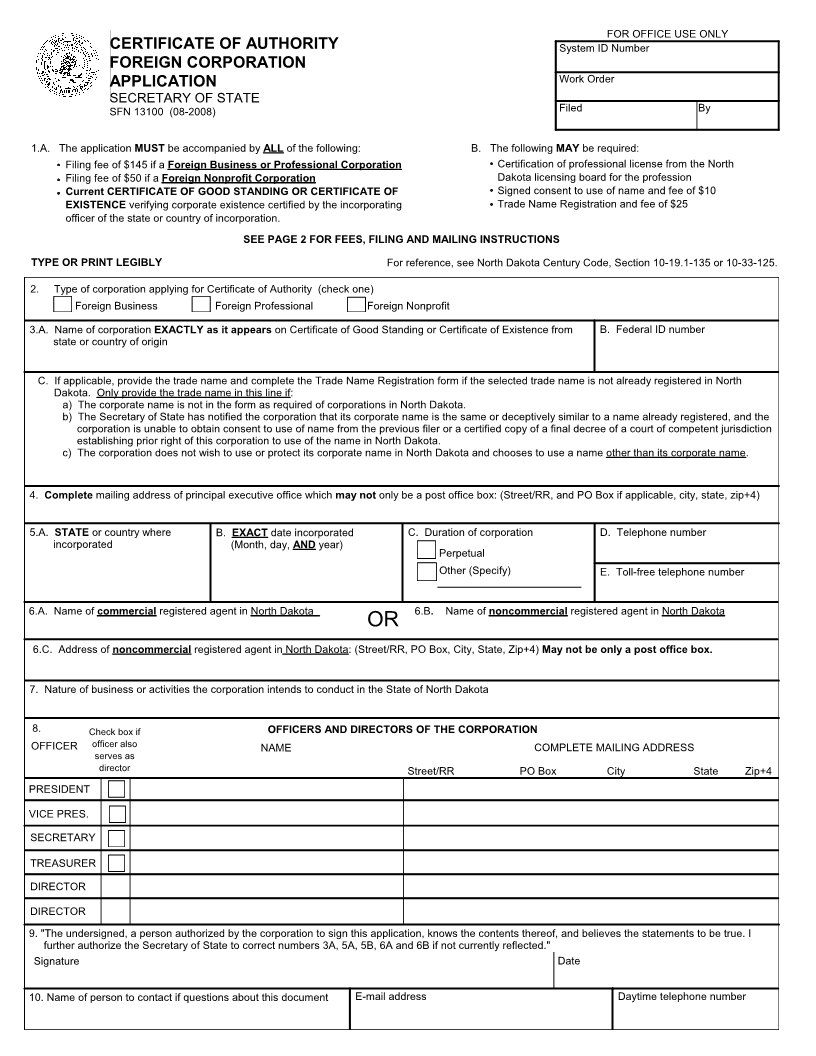

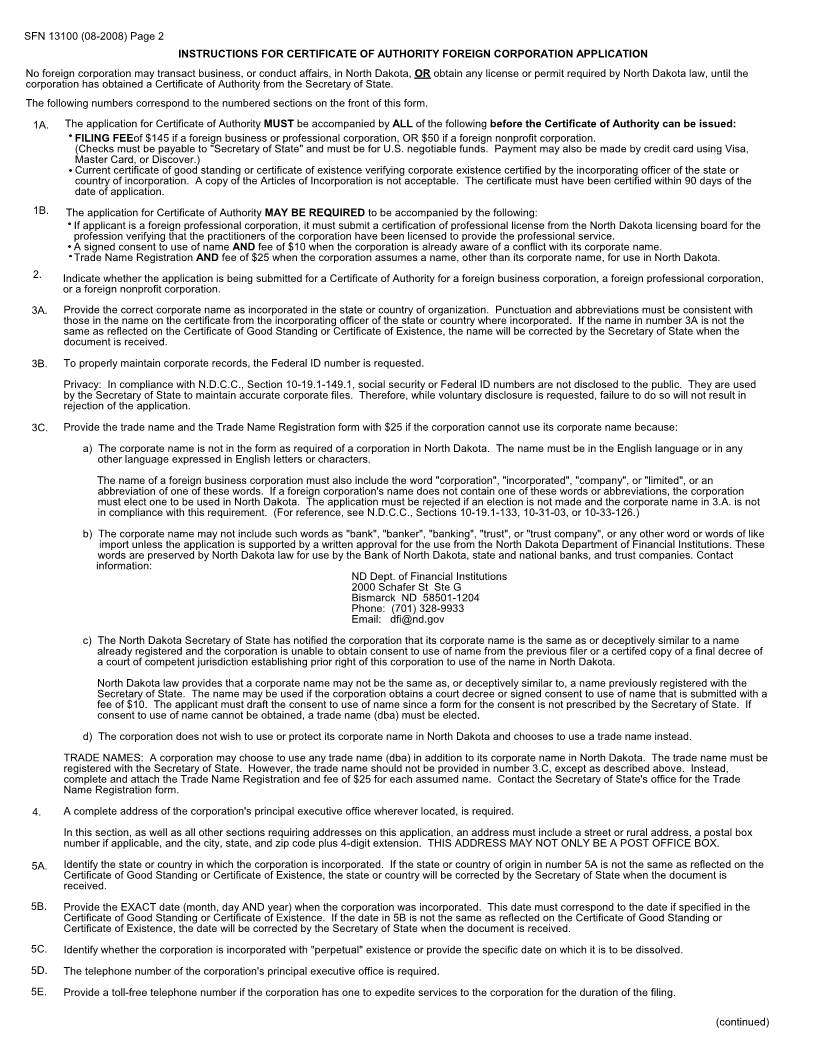

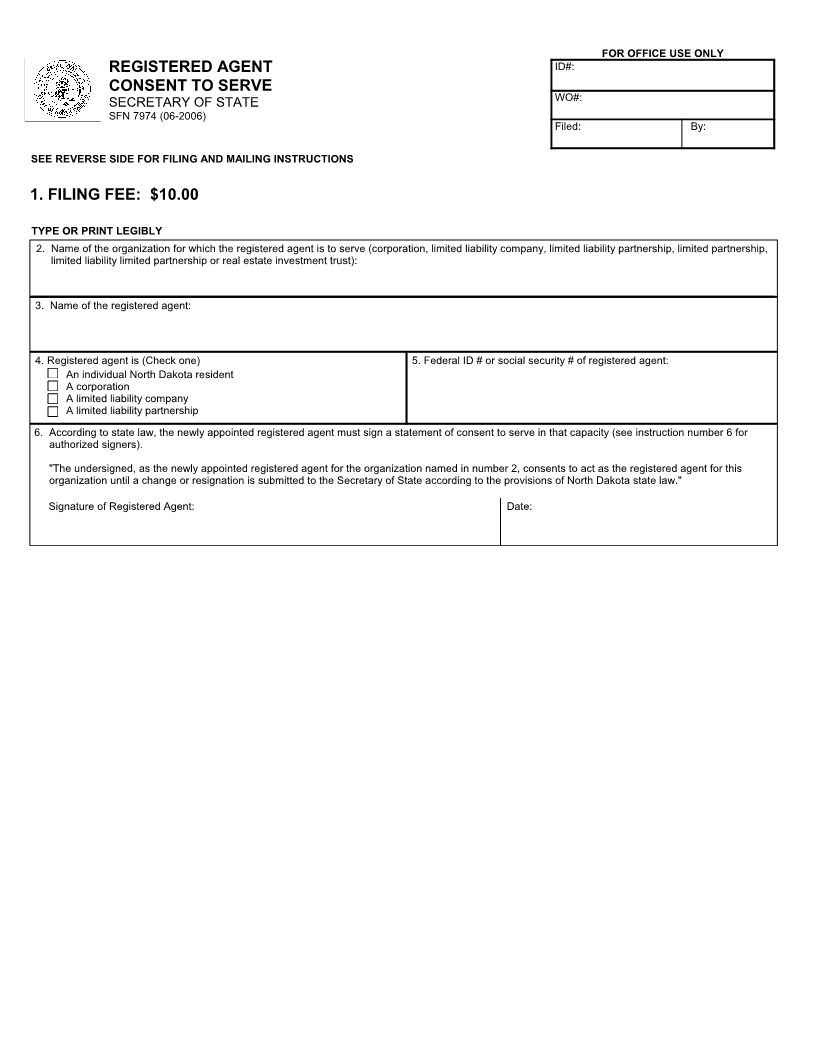

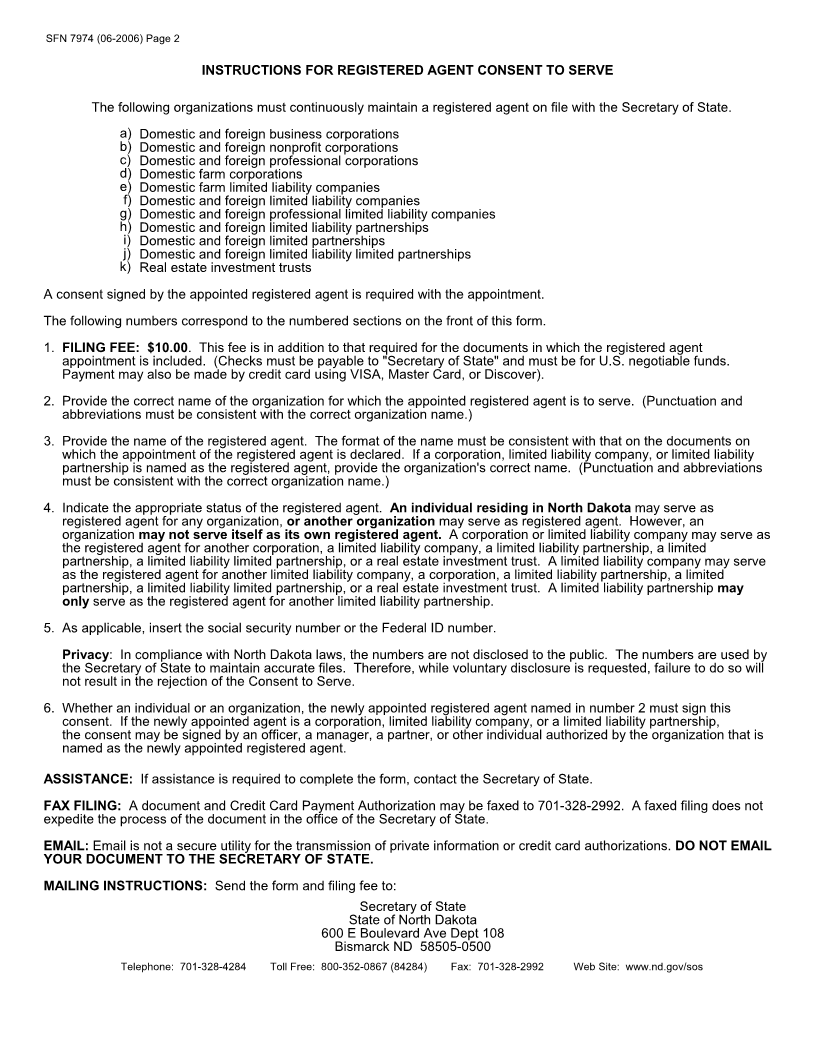

Governing law: Chapter 131 F. State forms additional to URS: Two. “Certificate of Authority “ (SFN

Exemptions: Qualifying religious institutions, government agencies, 13100), with an additional $50 fee and “Registered Agent” (SFN

persons or organizations receiving less than $25,000 in contributions 7974), with an additional $10 fee.

in a calendar year that do not compensate any officer, trustee, Mailing address: Sec. of State, State of North Dakota, 600 E.

organizer, incorporator, fund-raiser or solicitor, educational Boulevard. Ave., Dept. 108 Bismarck, ND 58505-0500

institutions and foundations, hospitals and hospital foundations, Info. telephone & contact: 701-328-3665 or 800-352-0867 ext.83665

noncommercial broadcast stations, qualified community trusts; Web:www.nd.gov/sos/nonprofit/charitableorg/index.html

volunteer fire departments, rescue squads, emergency medical

services; YMCAs or YWCAs; nonprofit continuing care facilities, Ohio

and certain tax exempt nonprofit fire or emergency medical service Governing law: OHIO REV CODE Chapt. 1716

organizations involved in the sale of goods or services that do not ask Exemptions: (A) Any religious agencies and organizations, and

for donations. charities, agencies, and organizations operated, supervised, or

Fees: $0 if contributions received for last fiscal year total less than controlled by a religious organization; (B) Any charitable

$5,000. $50 if between $5,000 and $100,000. $100 if between organization that meets all of the following requirements: (1) It has

$100,001 and $200,000. $200 if $200,001 or more. been in continuous existence in this state for a period of at least two

Check payable to: “North Carolina Department of Sec. of State.” years; (2) It has received from the IRS a determination letter that is

Period covered: One Year. currently in effect, stating that the charitable organization is exempt

Renewal Due date: Within four months and fifteen days after Fiscal from federal income taxation under subsection 501(a) and described

Year end. in subsection 501(c)(3) of the IRS; (3) It has registered with the

Required signatures: One. Treasurer or Chief Fiscal Officer. attorney general as a charitable trust pursuant to section 109.26 of the

Notarized signature required: Yes. Revised Code; (4) It has filed an annual report with and paid the

Fundraiser contracts: No, but see below for certain Fundraising required fee to the attorney general pursuant to section 109.31 of the

disclosures required. Revised Code. (C) Any educational institution, when solicitation of

Certificate/Articles of Incorporation: No. contributions is confined to alumni, faculty, trustees, or the student

Bylaws: No. membership and their families; (D) Every person other than an

IRS Form 990: Yes (No, if filing NC Annual Financial Report individual, when solicitation of contributions for a charitable purpose

Form). or on behalf of a charitable organization is confined to its existing

IRS Determination Letter: Yes, for initial filing only. membership, present or former employees, or present or former

Resident/Registered Agent required: No. trustees; (E) Any public primary or secondary school, when

Audit: No. solicitation of contributions is confined to alumni, faculty, or the

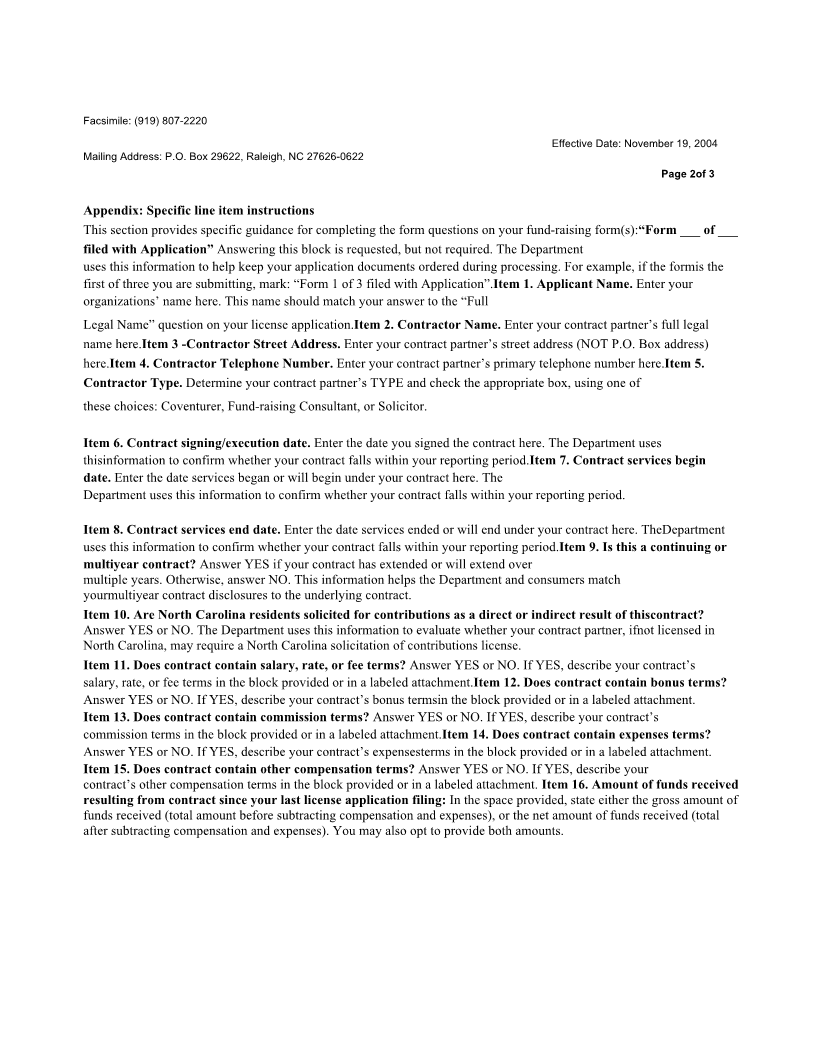

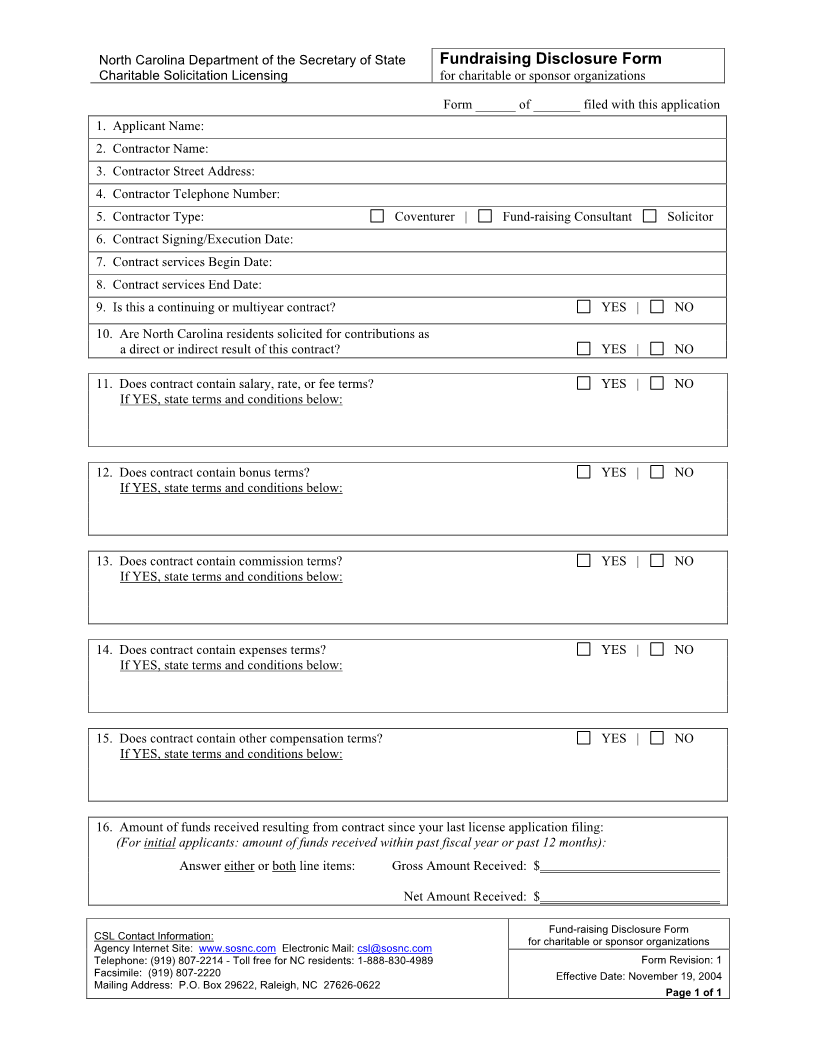

State forms additional to the URS: One, “Fundraising Disclosure general population of the local school district; (F) Any booster club

Form.” This form is required if charity has a contractual relationship that is organized and operated in conjunction with and for the benefit

with any fundraising consultant, solicitor, or coventurer. of students of public primary or secondary schools; (G) Any

Mailing address: NC Dept. of Secretary of State, Charitable charitable organization that does not receive gross revenue, excluding

Solicitation Licensing, P.O. Box 29622, Raleigh, NC 27626-0622. grants or awards from the government or an organization in excess of

Info. telephone & contact: 919-807-2214. Angelia Boone-Hicks, $25,000 during its immediately preceding fiscal year, if the

Licensing and Filing Supervisor. organization does not compensate any person primarily to solicit

E-mail: csl@sos.nc.com contributions.

Web: www.secretary.state.nc.us/csl Fees: $0-$4999.99: $0; $5000-$24,999.99: $50; $25,000-$49,999.99:

$100; $50,000+: $200

North Dakota Check payable to: “Treasurer of the State of Ohio.”

Governing law: No.Dak. Century Code, Chapter 50-22. Period covered: One year.

Exemptions: An organization using volunteer fundraisers and Renewal Due date: Within 4 !months of Fiscal Year end.

soliciting funds for a political subdivision, government entity, or for a Required signatures: One. Treasurer or Chief Fiscal Officer.

civic or community project in which the contributions received are Notarized signature Required: Yes.

used solely for the project; a charitable organization or person Fundraiser contracts: No.

|