Enlarge image

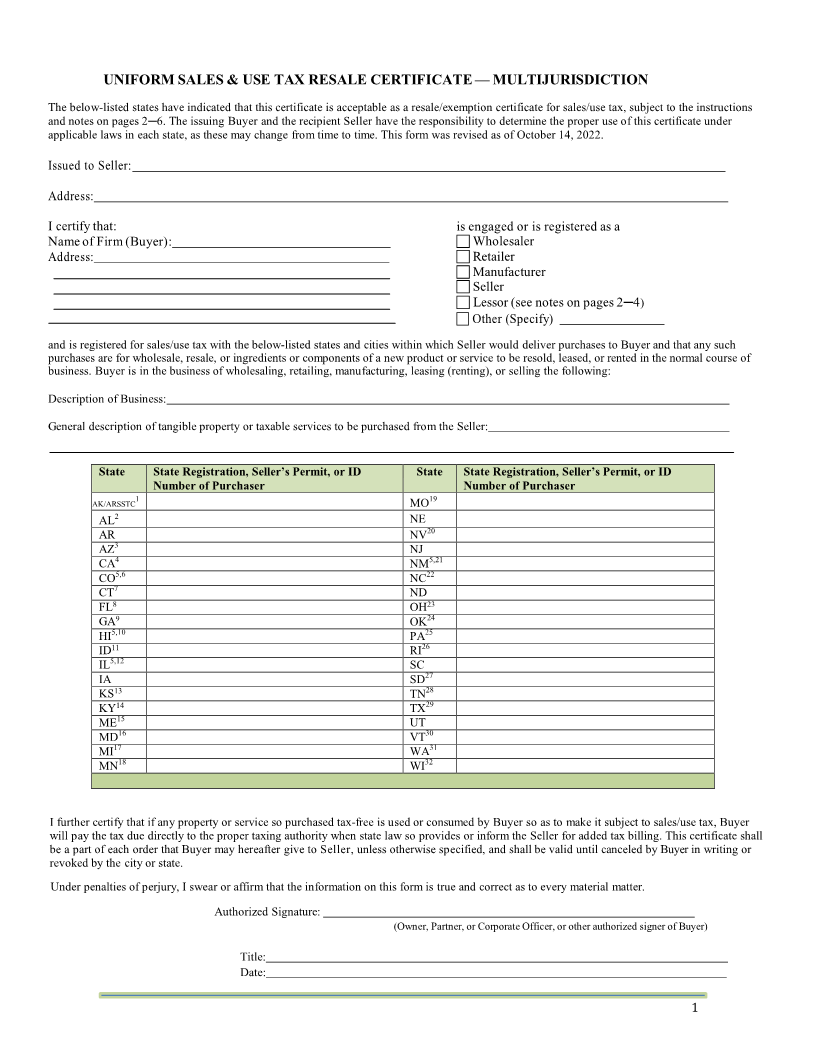

UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION

The below-listed states have indicated that this certificate is acceptable as a resale/exemption certificate for sales/use tax, subject to the instructions

and notes on pages 2─6. The issuing Buyer and the recipient Seller have the responsibility to determine the proper use of this certificate under

applicable laws in each state, as these may change from time to time. This form was revised as of October 14, 2022.

Issued to Seller:

Address:

I certify that: is engaged or is registered as a

Name of Firm (Buyer): Wholesaler

Address: Retailer

Manufacturer

Seller

Lessor (see notes on pages 2─4 )

Other (Specify)

and is registered for sales/use tax with the below-listed states and cities within which Seller would deliver purchases to Buyer and that any such

purchases are for wholesale, resale, or ingredients or components of a new product or service to be resold, leased, or rented in the normal course of

business. Buyer is in the business of wholesaling, retailing, manufacturing, leasing (renting), or selling the following:

Description of Business:

General description of tangible property or taxable services to be purchased from the Seller:

State State Registration, Seller’s Permit, or ID State State Registration, Seller’s Permit, or ID

Number of Purchaser Number of Purchaser

AK/ARSSTC1 MO 19

AL2 NE

AZ

CA

CO

CT

FL

GA

HI

ID

IL

IA SD

KS

KY

ME

MD

MI

MN

AR5,125,1011817713345,6914 15 1618 NJTNRISCTXWAOHNVNCWINDVTNMPAOKUT26253227302829222320245,2131

I further certify that if any property or service so purchased tax-free is used or consumed by Buyer so as to make it subject to sales/use tax, Buyer

will pay the tax due directly to the proper taxing authority when state law so provides or inform the Seller for added tax billing. This certificate shall

be a part of each order that Buyer may hereafter give to Seller, unless otherwise specified, and shall be valid until canceled by Buyer in writing or

revoked by the city or state.

Under penalties of perjury, I swear or affirm that the information on this form is true and correct as to every material matter.

Authorized Signature:

(Owner, Partner, or Corporate Officer, or other authorized signer of Buyer)

Title:

Date:

1