Enlarge image

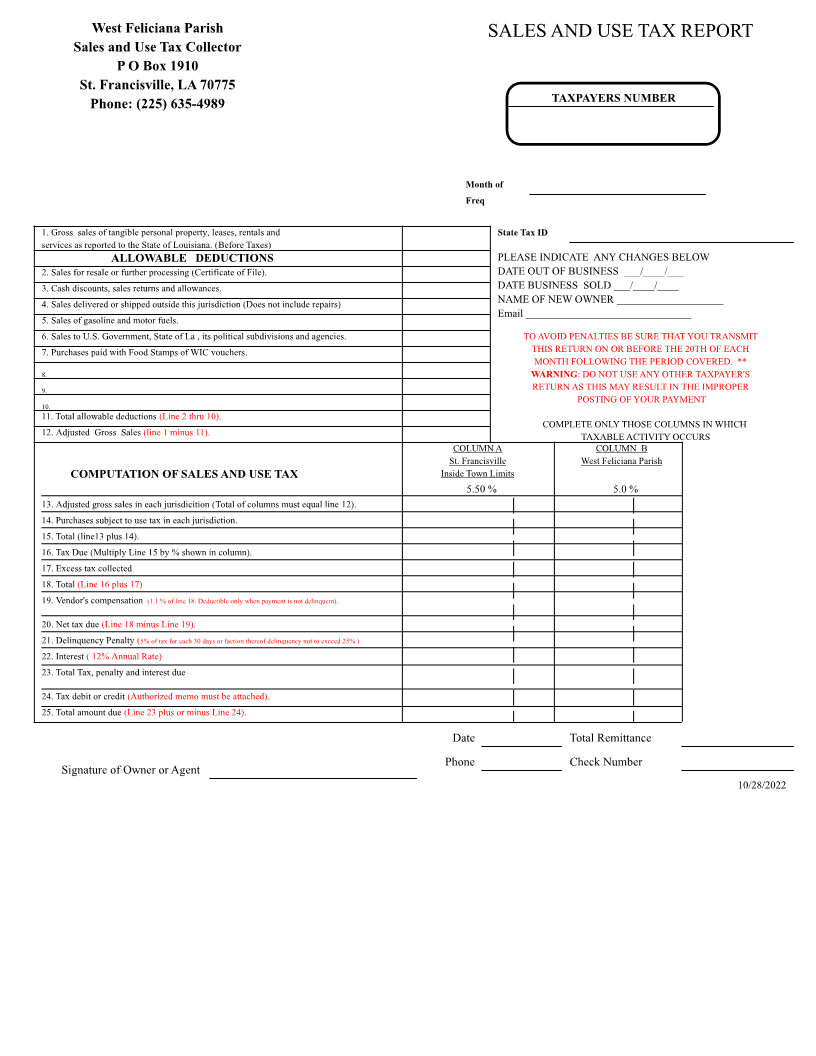

West Feliciana Parish SALES AND USE TAX REPORT

Sales and Use Tax Collector

P O Box 1910

St. Francisville, LA 70775

TAXPAYERS NUMBER

Phone: (225) 635-4989

Month of

Freq

1. Gross sales of tangible personal property, leases, rentals and State Tax ID

services as reported to the State of Louisiana. (Before Taxes)

ALLOWABLE DEDUCTIONS PLEASE INDICATE ANY CHANGES BELOW

2. Sales for resale or further processing (Certificate of File). DATE OUT OF BUSINESS ___/____/___

3. Cash discounts, sales returns and allowances. DATE BUSINESS SOLD ___/____/____

4. Sales delivered or shipped outside this jurisdiction (Does not include repairs) NAME OF NEW OWNER ____________________

5. Sales of gasoline and motor fuels. Email _______________________________

6. Sales to U.S. Government, State of La , its political subdivisions and agencies. TO AVOID PENALTIES BE SURE THAT YOU TRANSMIT

7. Purchases paid with Food Stamps of WIC vouchers. THIS RETURN ON OR BEFORE THE 20TH OF EACH

MONTH FOLLOWING THE PERIOD COVERED. **

8. WARNING: DO NOT USE ANY OTHER TAXPAYER'S

9. RETURN AS THIS MAY RESULT IN THE IMPROPER

10. POSTING OF YOUR PAYMENT

11. Total allowable deductions (Line 2 thru 10).

COMPLETE ONLY THOSE COLUMNS IN WHICH

12. Adjusted Gross Sales (line 1 minus 11). TAXABLE ACTIVITY OCCURS

COLUMN A COLUMN B

St. Francisville West Feliciana Parish

COMPUTATION OF SALES AND USE TAX Inside Town Limits

5.50 % 5.0 %

13. Adjusted gross sales in each jurisdicition (Total of columns must equal line 12).

14. Purchases subject to use tax in each jurisdiction.

15. Total (line13 plus 14).

16. Tax Due (Multiply Line 15 by % shown in column).

17. Excess tax collected

18. Total (Line 16 plus 17)

19. Vendor's compensation (1.1 % of line 18. Deductible only when payment is not delinquent).

20. Net tax due (Line 18 minus Line 19).

21. Delinquency Penalty (5% of tax for each 30 days or faction thereof delinquency not to exceed 25% )

22. Interest ( 12% Annual Rate)

23. Total Tax, penalty and interest due

24. Tax debit or credit (Authorized memo must be attached).

25. Total amount due (Line 23 plus or minus Line 24).

Date Total Remittance

Phone Check Number

Signature of Owner or Agent

10/28/2022