Enlarge image

PRSRT STD

U.S. POSTAGE PAID

Port Allen, LA

Post Office Box 86 Permit NO. 11

Port Allen, Louisiana 70767

Telephone (225) 336-2408 • Fax (225) 334-0543

ADDRESS SERVICE REQUESTED

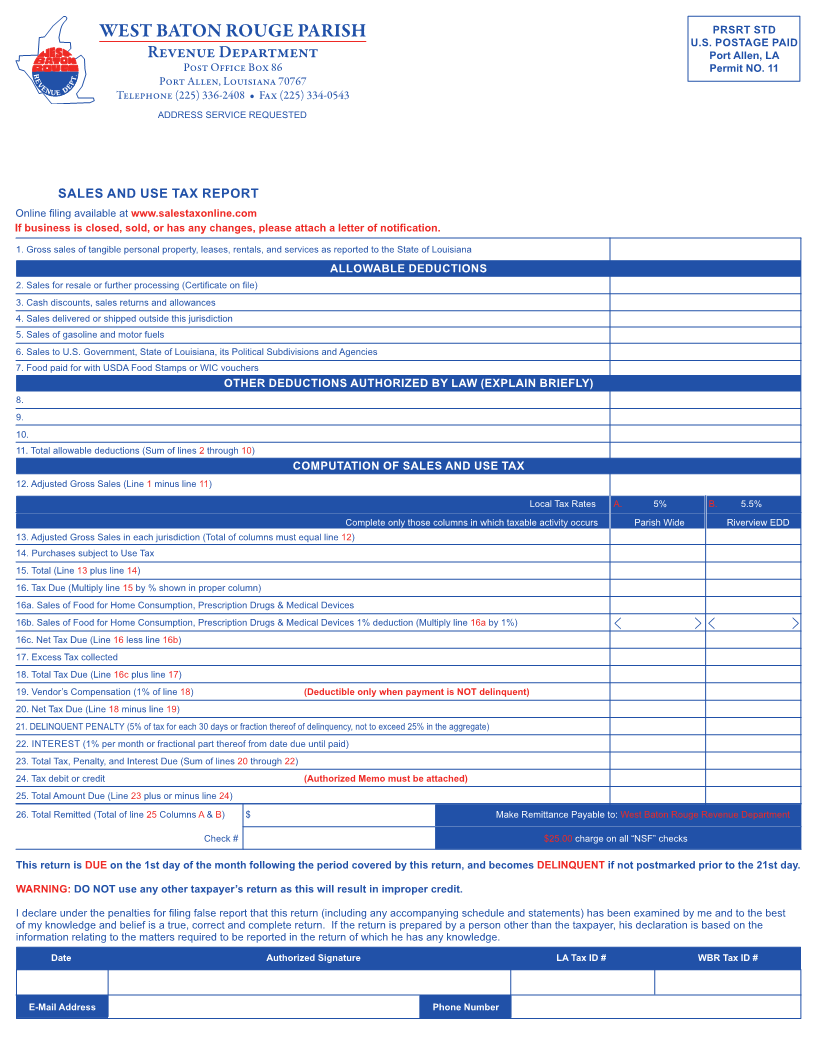

SALES AND USE TAX REPORT

Online filing available at www.salestaxonline.com

If business is closed, sold, or has any changes, please attach a letter of notification.

1. Gross sales of tangible personal property, leases, rentals, and services as reported to the State of Louisiana

ALLOWABLE DEDUCTIONS

2. Sales for resale or further processing (Certificate on file)

3. Cash discounts, sales returns and allowances

4. Sales delivered or shipped outside this jurisdiction

5. Sales of gasoline and motor fuels

6. Sales to U.S. Government, State of Louisiana, its Political Subdivisions and Agencies

7. Food paid for with USDA Food Stamps or WIC vouchers

OTHER DEDUCTIONS AUTHORIZED BY LAW (EXPLAIN BRIEFLY)

8.

9.

10.

11. Total allowable deductions (Sum of lines 2through 10)

COMPUTATION OF SALES AND USE TAX

12. Adjusted Gross Sales (Line 1minus line 11)

Local Tax Rates A. 5% 5.5%B.

Complete only those columns in which taxable activity occurs Parish Wide Riverview EDD

13. Adjusted Gross Sales in each jurisdiction (Total of columns must equal line 12)

14. Purchases subject to Use Tax

15. Total (Line 13 plus line 14)

16. Tax Due (Multiply line 15 by % shown in proper column)

16a. Sales of Food for Home Consumption, Prescription Drugs & Medical Devices

16b. Sales of Food for Home Consumption, Prescription Drugs & Medical Devices 1% deduction (Multiply line 16a by 1%)

16c. Net Tax Due (Line 16 less line 16b)

17. Excess Tax collected

18. Total Tax Due (Line 16c plus line 17)

19. Vendor’s Compensation (1% of line18 ) (Deductible only when payment is NOT delinquent)

20. Net Tax Due (Line 18 minus line 19)

21. DELINQUENT PENALTY (5% of tax for each 30 days or fraction thereof of delinquency, not to exceed 25% in the aggregate)

22. INTEREST (1% per month or fractional part thereof from date due until paid)

23. Total Tax, Penalty, and Interest Due (Sum of lines 20 through 22)

24. Tax debit or credit (Authorized Memo must be attached)

25. Total Amount Due (Line 23 plus or minus line 24)

26. Total Remitted (Total of line25 Columns A& ) B $ Make Remittance Payable to: West Baton Rouge Revenue Department

Check # $25.00 charge on all “NSF” checks

This return is DUE on the 1st day of the month following the period covered by this return, and becomes DELINQUENT if not postmarked prior to the 21st day.

WARNING: DO NOT use any other taxpayer’s return as this will result in improper credit.

I declare under the penalties for filing false report that this return (including any accompanying schedule and statements) has been examined by me and to the best

of my knowledge and belief is a true, correct and complete return. If the return is prepared by a person other than the taxpayer, his declaration is based on the

information relating to the matters required to be reported in the return of which he has any knowledge.

Date Authorized Signature LA Tax ID # WBR Tax ID #

E-Mail Address Phone Number