Enlarge image

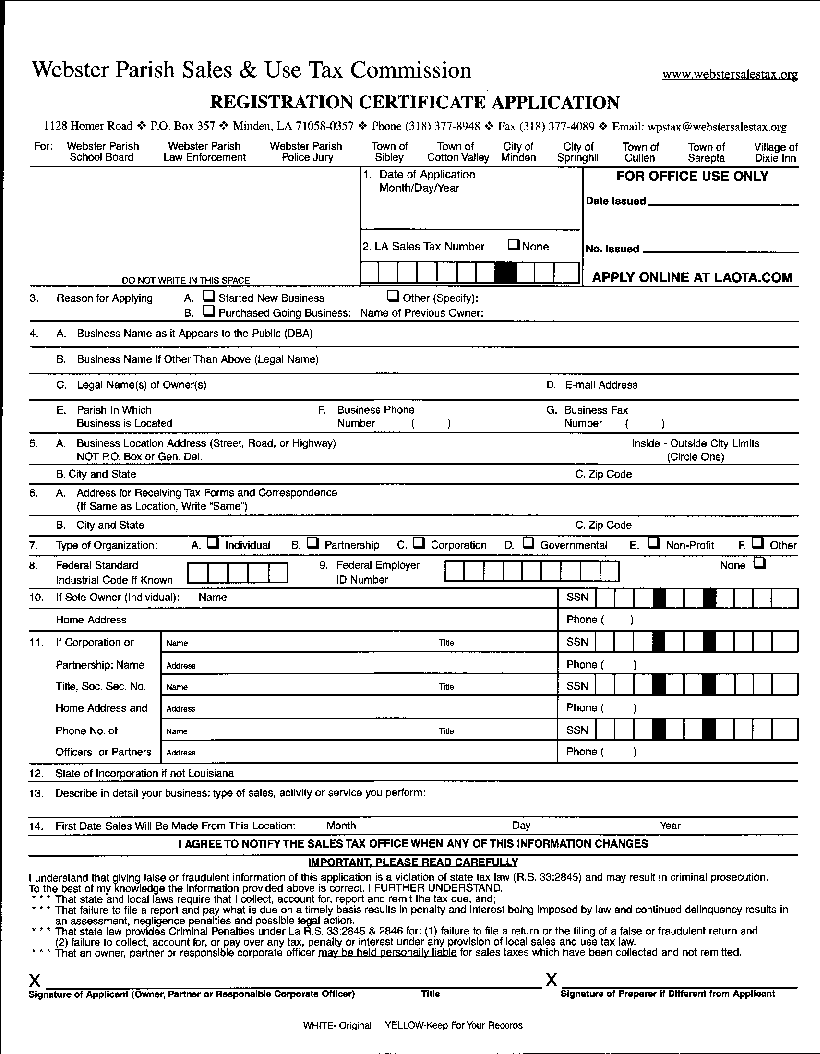

Webster Parish Sales Use Tax Commission wwwwebsiersalestaXOre REGISTRATION CERTIFICATE APPLICATION 1128 HomerRoad 3 OP Box357 MiudenLA035771058 d Phone 318 8948377 3 Fax 318 4089377 4 Email ersalestaxocgwpstanCwebs For Webster Parish Webster Parish Webster Parish Town of Town of City of City of Town of Town of Village of School Board Law Enforcement Police Jury Sibley Cotton Valley Minden Springhill Cullen Sarepta Dixie Inn 1 Date of Application FOR OFFICE USE ONLY YearDayMonth Date Issued 2 LA Sales Tau Number None No Issued DO NO7 WRITE IN THIS SPACE APPLY ONLINE AT LAOTACOM 3 Reason for Applying A Started New Business Other Specify B Purchased Going Business Name of Previous Owner 4 A Business Name as it Appears to the Public D8A B Business Name if Other Than Above Legal Name C Legal Names of Owners D Email Address E Parish In Which F Business Phone G Business Fax Business is Located Number Number 5 A Business Location Address Steet Road or Highway Inside Outside City LimNs NOT PO Box or Gen Del Circle One 8 ityC dna teaSt CZip Code 6 A Address for Receiving Tar Forms and Corcespondence If Same as Location Write Same B Cily and State C Zip Code 7 Type of Organization A Individual B Partnership C Corporation D Governmental E NonProfit F Other 8 Federal Standard 9 Federal Employer None Industrial Code if Known ID Number 10 If Sole Owner Individual Name SSN Home Address Phone 11 If Corporation or Name nne SSN Partnership Name nderess Phone Title Soa Sec No Name rne SSN Home Address and ndarass Phone PhOnO NOOf Name rne SSN Officers or Partners naas Phone 12 State of Incorporation if not Louisiana 13 Describe in detail your business type of sales activity or service you perform 14 First Date Sales Will Be Made From This Location Mont Day Year I AGREETO NOTIFYTHE SALESTAX OFFICE WHEN ANY OFTHIS INFORMATION CHANGES IMPORTANT PLEASE READ CAREPULLY I understand that giving false or fraudulent information of this application is a violation of state tax law RS 332845 and may resutt in criminal prosecution To the best of my knowledge the intormation provided above is correct I FURTHER UNDERSTAND That state and local laws require that I collect account for report and remit the tau due and That failure to file a report and pay what is due on a timely basis resulis in penalry and interest being imposed by law and continued delinquency results in an assessment negligence penalties and possible legal aclion That state law provides Criminal Penalties under La RS 332845 2846 tor 1 failure to file a return or the filing of a false or fraudulent return and 2 failure to collect account for or pay over any tau penalty or interest under any provision of local sales and use tax law Thatan owner partner or responsible corporate officer mavbe held sonalpyliable for sales cesta which have been collected andnot remitted X X Signehre of Applicant Owner Pertner or Responsible Corporate Oflicer 71t1e Signature of Preparer H DNfarent from Applicant OriginalWHI7E KeepForYourRewrtlsVELLOW