Enlarge image

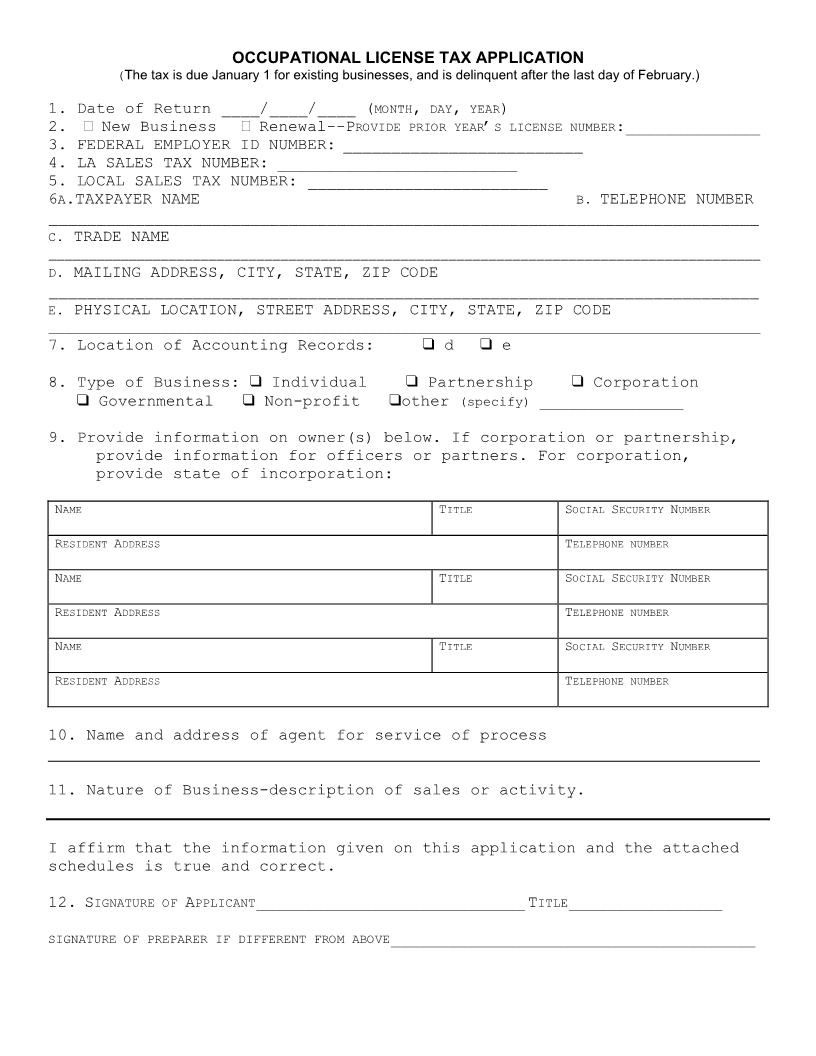

OCCUPATIONAL LICENSE TAX APPLICATION

(The tax is due January 1 for existing businesses, and is delinquent after the last day of February.)

1. Date of Return ____/____/____ (MONTH ,DAY ,YEAR)

2. New Business Renewal--PROVIDE PRIOR YEAR’S LICENSE NUMBER:______________

3. FEDERAL EMPLOYER ID NUMBER: _________________________

4. LA SALES TAX NUMBER: _________________________

5. LOCAL SALES TAX NUMBER: _________________________

6A.TAXPAYER NAME B.TELEPHONE NUMBER

__________________________________________________________________________

C. TRADE NAME

_________________________________________________________________________________________

D. MAILING ADDRESS, CITY, STATE, ZIP CODE

__________________________________________________________________________

E. PHYSICAL LOCATION, STREET ADDRESS, CITY, STATE, ZIP CODE

_________________________________________________________________________________________

7. Location of Accounting Records: “ d “ e

8. Type of Business: “ Individual “ Partnership “Corporation

“ Governmental “ Non-profit “ other (specify)_______________

9. Provide information on owner(s) below. If corporation or partnership,

provide information for officers or partners. For corporation,

provide state of incorporation:

NAME TITLE SOCIAL SECURITY NUMBER

RESIDENT ADDRESS TELEPHONE NUMBER

NAME TITLE SOCIAL SECURITY NUMBER

RESIDENT ADDRESS TELEPHONE NUMBER

NAME TITLE SOCIAL SECURITY NUMBER

RESIDENT ADDRESS TELEPHONE NUMBER

10. Name and address of agent for service of process

________________________________________________________________________________

11. Nature of Business-description of sales or activity.

I affirm that the information given on this application and the attached

schedules is true and correct.

12. SIGNATURE OF APPLICANT____________________________ TITLE________________

SIGNATURE OF PREPARER IF DIFFERENT FROM ABOVE______________________________________