Enlarge image

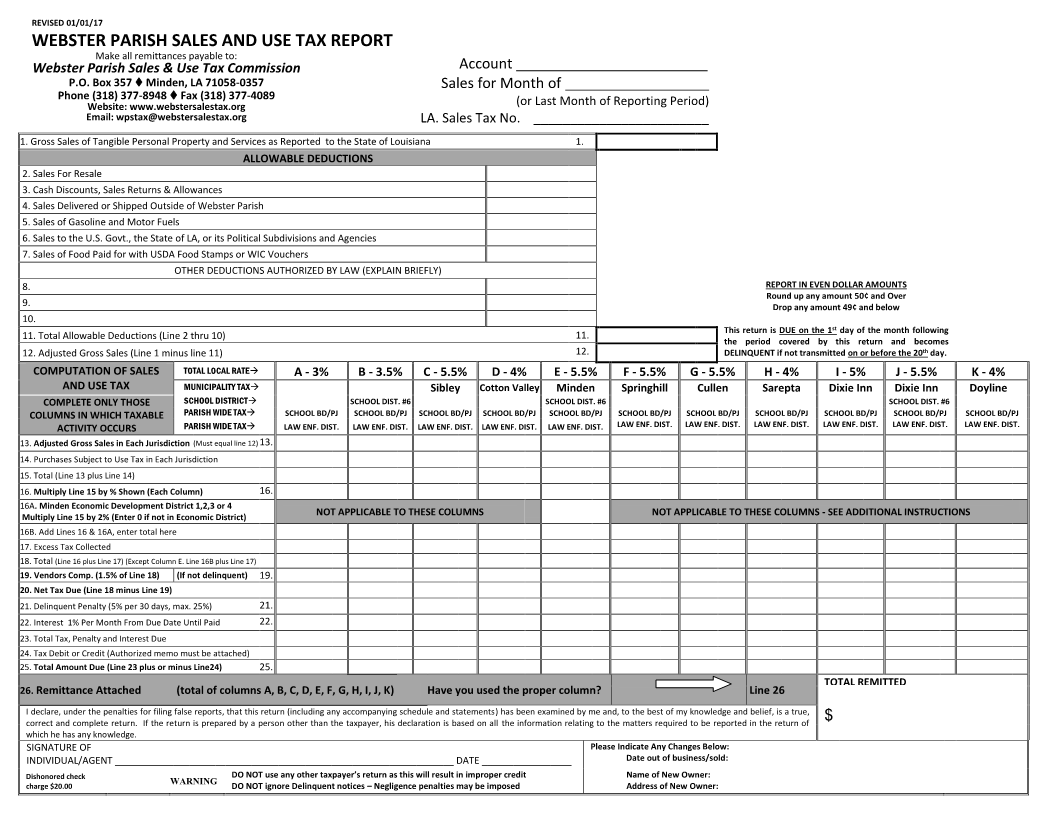

REVISED 01/01/17

WEBSTER PARISH SALES AND USE TAX REPORT

Webster Parish Sales & Use Tax Commission Account

P.O. Box 357 ♦ Minden, LA 71058-0357 Sales for Month of

Phone (318) 377-8948 ♦ Fax (318) 377-4089 (or Last Month of Reporting Period)

Website: www.webstersalestax.org

Email: wpstax@webstersalestax.org LA. Sales Tax No. ________________________

Make all remittances payable to:

1. Gross SalesEmail:of Tangiblewpstax@webstersalestax.orgPersonal Property and Services as Reported to the State of Louisiana 1.

ALLOWABLE DEDUCTIONS

2. Sales For Resale

3. Cash Discounts, Sales Returns & Allowances

4. Sales Delivered or Shipped Outside of Webster Parish

5. Sales of Gasoline and Motor Fuels

6. Sales to the U.S. Govt., the State of LA, or its Political Subdivisions and Agencies

7. Sales of Food Paid for with USDA Food Stamps or WIC Vouchers

OTHER DEDUCTIONS AUTHORIZED BY LAW (EXPLAIN BRIEFLY)

8. REPORT IN EVEN DOLLAR AMOUNTS

Round up any amount 50¢ and Over

9. Drop any amount 49¢ and below

10.

This return is DUE on the 1 daystof the month following

11. Total Allowable Deductions (Line 2 thru 10) 11. the period covered by this return and becomes

12. Adjusted Gross Sales (Line 1 minus line 11) 12. DELINQUENT if not transmitted on or before the 20 thday.

COMPUTATION OF SALES TOTAL LOCAL RATE

A - 3% B - 3.5% C - 5.5% D - 4% E - 5.5% F - 5.5% G - 5.5% H - 4% I - 5% J - 5.5% K - 4%

AND USE TAX MUNICIPALITY TAX Sibley Cotton Valley Minden Springhill Cullen Sarepta Dixie Inn Dixie Inn Doyline

COMPLETE ONLY THOSE SCHOOL DISTRICT SCHOOL DIST. #6 SCHOOL DIST. #6 SCHOOL DIST. #6

COLUMNS IN WHICH TAXABLE PARISH WIDE TAX SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ SCHOOL BD/PJ

ACTIVITY OCCURS PARISH WIDE TAX LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST. LAW ENF. DIST.

13. Adjusted Gross Sales in Each Jurisdiction (Must equal line 12) 13.

14. Purchases Subject to Use Tax in Each Jurisdiction

15. Total (Line 13 plus Line 14)

16. Multiply Line 15 by % Shown (Each Column) 16.

16A. Minden Economic Development District 1,2,3 or 4 NOT APPLICABLE TO THESE COLUMNS NOT APPLICABLE TO THESE COLUMNS - SEE ADDITIONAL INSTRUCTIONS

Multiply Line 15 by 2% (Enter 0 if not in Economic District)

16B. Add Lines 16 & 16A, enter total here

17. Excess Tax Collected

18. Total (Line 16 plus Line 17) (Except Column E. Line 16B plus Line 17)

19. Vendors Comp. (1.5% of Line 18) (If not delinquent) 19.

20. Net Tax Due (Line 18 minus Line 19)

21. Delinquent Penalty (5% per 30 days, max. 25%) 21.

22. Interest 1% Per Month From Due Date Until Paid 22.

23. Total Tax, Penalty and Interest Due

24. Tax Debit or Credit (Authorized memo must be attached)

25. Total Amount Due (Line 23 plus or minus Line24) 25.

TOTAL REMITTED

26. Remittance Attached (total of columns A, B, C, D, E, F, G, H, I, J, K) Have you used the proper column? Line 26

I declare, under the penalties for filing false reports, that this return (including any accompanying schedule and statements) has been examined by me and, to the best of my knowledge and belief, is a true,

correct and complete return. If the return is prepared by a person other than the taxpayer, his declaration is based on all the information relating to the matters required to be reported in the return of $

which he has any knowledge.

SIGNATURE OF Please Indicate Any Changes Below:

INDIVIDUAL/AGENT ___________________ ___________________________________________ DATE _ _______________ Date out of business/sold:

Dishonored check WARNING DO NOT use any other taxpayer’s return as this will result in improper credit Name of New Owner:

charge $20.00 DO NOT ignore Delinquent notices – Negligence penalties may be imposed Address of New Owner: