Enlarge image

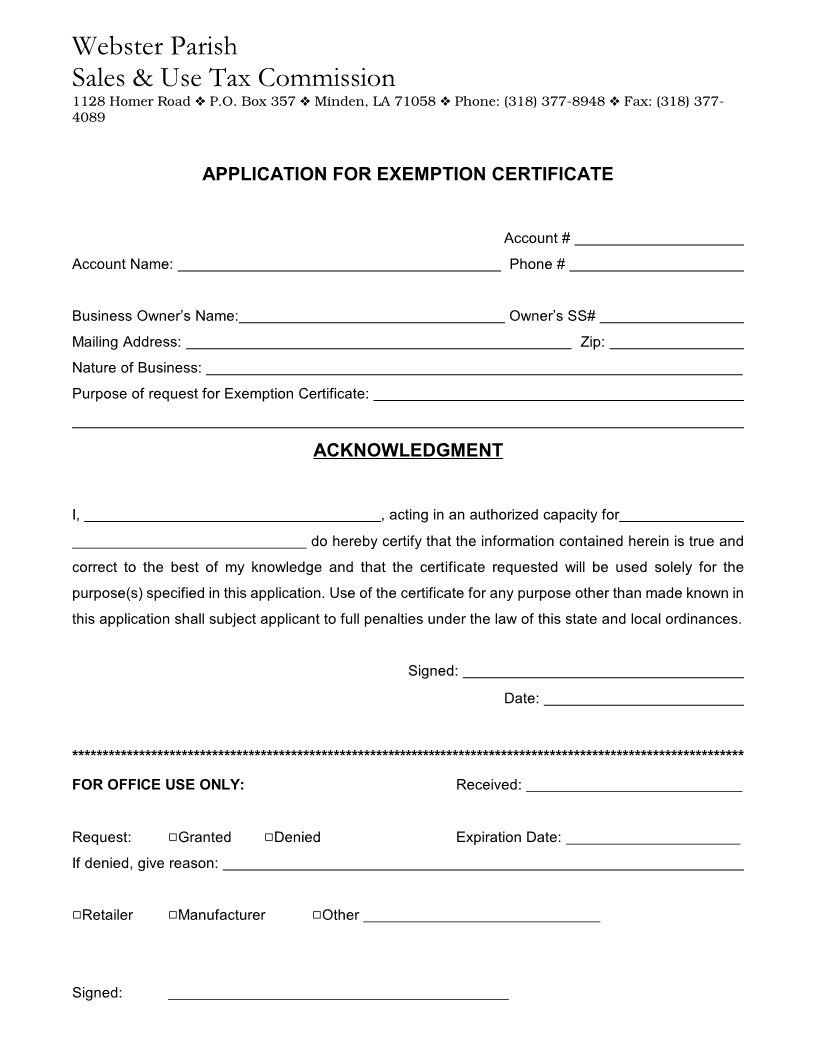

Webster Parish

Sales & Use Tax Commission

1128 Homer Road ˜ P.O. Box 357 ˜ Minden, LA 71058 ˜ Phone: (318) 377-8948 ˜ Fax: (318) 377-

4089

APPLICATION FOR EXEMPTION CERTIFICATE

Account #

Account Name: Phone #

Business Owner’s Name: Owner’s SS#

Mailing Address: Zip:

Nature of Business:

Purpose of request for Exemption Certificate:

ACKNOWLEDGMENT

I, , acting in an authorized capacity for

do hereby certify that the information contained herein is true and

correct to the best of my knowledge and that the certificate requested will be used solely for the

purpose(s) specified in this application. Use of the certificate for any purpose other than made known in

this application shall subject applicant to full penalties under the law of this state and local ordinances.

Signed:

Date:

***************************************************************************************************************

FOR OFFICE USE ONLY: Received:

Request: 9Granted 9Denied Expiration Date:

If denied, give reason:

9Retailer 9Manufacturer 9Other

Signed: