Enlarge image

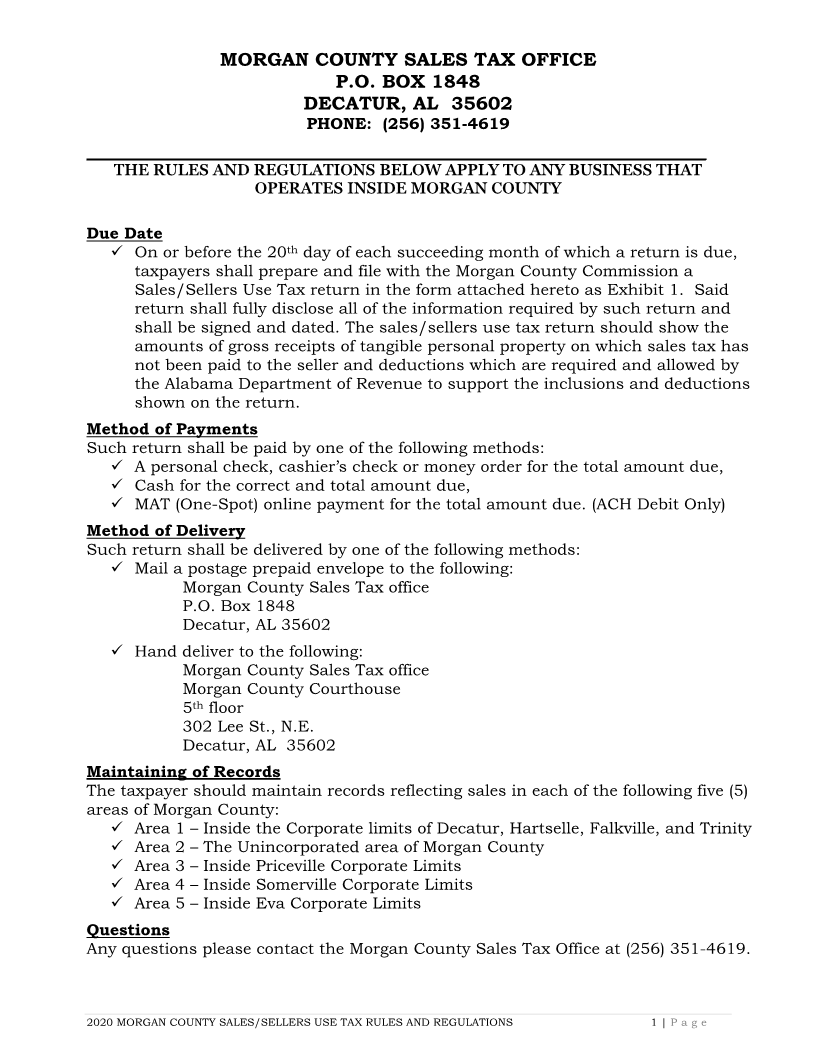

MORGAN COUNTY SALES TAX OFFICE

P.O. BOX 1848

DECATUR, AL 35602

PHONE: (256) 351-4619

_____________________________________________________________________________________________

THE RULES AND REGULATIONS BELOW APPLY TO ANY BUSINESS THAT

OPERATES INSIDE MORGAN COUNTY

Due Date

✓ On or before the 20 thday of each succeeding month of which a return is due,

taxpayers shall prepare and file with the Morgan County Commission a

Sales/Sellers Use Tax return in the form attached hereto as Exhibit 1. Said

return shall fully disclose all of the information required by such return and

shall be signed and dated. The sales/sellers use tax return should show the

amounts of gross receipts of tangible personal property on which sales tax has

not been paid to the seller and deductions which are required and allowed by

the Alabama Department of Revenue to support the inclusions and deductions

shown on the return.

Method of Payments

Such return shall be paid by one of the following methods:

✓ A personal check, cashier’s check or money order for the total amount due,

✓ Cash for the correct and total amount due,

✓ MAT (One-Spot) online payment for the total amount due. (ACH Debit Only)

Method of Delivery

Such return shall be delivered by one of the following methods:

✓ Mail a postage prepaid envelope to the following:

Morgan County Sales Tax office

P.O. Box 1848

Decatur, AL 35602

✓ Hand deliver to the following:

Morgan County Sales Tax office

Morgan County Courthouse

5 thfloor

302 Lee St., N.E.

Decatur, AL 35602

Maintaining of Records

The taxpayer should maintain records reflecting sales in each of the following five (5)

areas of Morgan County:

✓ Area 1 –Inside the Corporate limits of Decatur, Hartselle, Falkville, and Trinity

✓ Area 2 –The Unincorporated area of Morgan County

✓ Area 3 –Inside Priceville Corporate Limits

✓ Area 4 –Inside Somerville Corporate Limits

✓ Area 5 –Inside Eva Corporate Limits

Questions

Any questions please contact the Morgan County Sales Tax Office at (256) 351-4619.

2020 MORGAN COUNTY SALES/SELLERS USE TAX RULES AND REGULATIONS 1 | P a g e