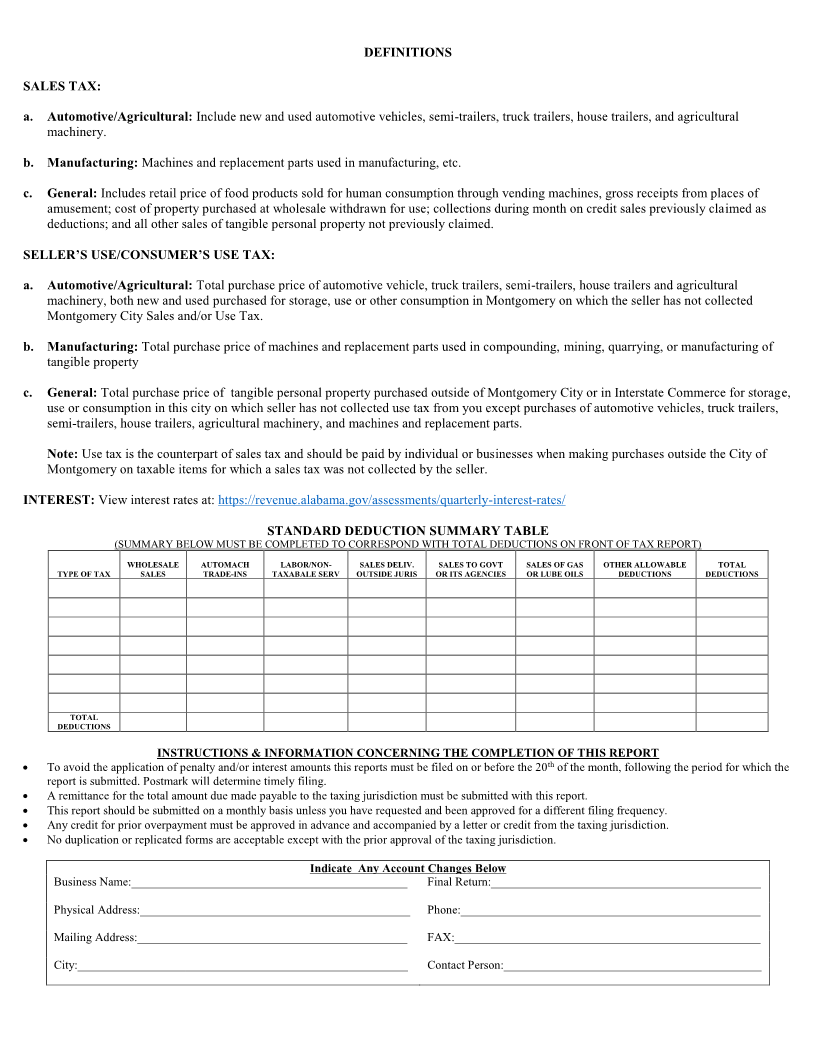

Enlarge image

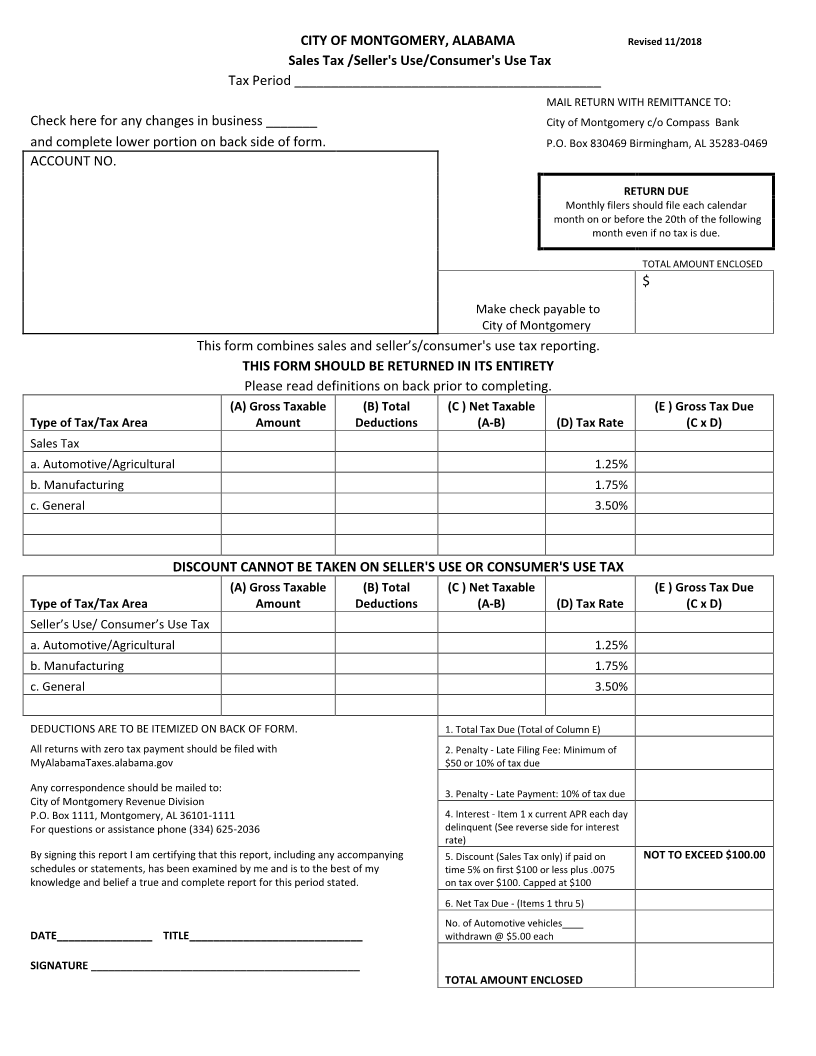

CITY OF MONTGOMERY, ALABAMA Revised 11/2018

Sales Tax /Seller's Use/Consumer's Use Tax

Tax Period __________________________________________

MAIL RETURN WITH REMITTANCE TO:

Check here for any changes in business _______ City of Montgomery c/o Compass Bank

and complete lower portion on back side of form. P.O. Box 830469 Birmingham, AL 35283-0469

ACCOUNT NO.

RETURN DUE

Monthly filers should file each calendar

month on or before the 20th of the following

month even if no tax is due.

TOTAL AMOUNT ENCLOSED

$

Make check payable to

City of Montgomery

This form combines sales and seller’s/consumer's use tax reporting.

THIS FORM SHOULD BE RETURNED IN ITS ENTIRETY

Please read definitions on back prior to completing.

(A) Gross Taxable (B) Total (C ) Net Taxable (E ) Gross Tax Due

Type of Tax/Tax Area Amount Deductions (A-B) (D) Tax Rate (C x D)

Sales Tax

a. Automotive/Agricultural 1.25%

b. Manufacturing 1.75%

c. General 3.50%

DISCOUNT CANNOT BE TAKEN ON SELLER'S USE OR CONSUMER'S USE TAX

(A) Gross Taxable (B) Total (C ) Net Taxable (E ) Gross Tax Due

Type of Tax/Tax Area Amount Deductions (A-B) (D) Tax Rate (C x D)

Seller’s Use/ Consumer’s Use Tax

a. Automotive/Agricultural 1.25%

b. Manufacturing 1.75%

c. General 3.50%

DEDUCTIONS ARE TO BE ITEMIZED ON BACK OF FORM. 1. Total Tax Due (Total of Column E)

All returns with zero tax payment should be filed with 2. Penalty - Late Filing Fee: Minimum of

MyAlabamaTaxes.alabama.gov $50 or 10% of tax due

Any correspondence should be mailed to: 3. Penalty - Late Payment: 10% of tax due

City of Montgomery Revenue Division

P.O. Box 1111, Montgomery, AL 36101-1111 4. Interest - Item 1 x current APR each day

For questions or assistance phone (334) 625-2036 delinquent (See reverse side for interest

rate)

By signing this report I am certifying that this report, including any accompanying 5. Discount (Sales Tax only) if paid on NOT TO EXCEED $100.00

schedules or statements, has been examined by me and is to the best of my time 5% on first $100 or less plus .0075

knowledge and belief a true and complete report for this period stated. on tax over $100. Capped at $100

6. Net Tax Due - (Items 1 thru 5)

No. of Automotive vehicles____

DATE________________ TITLE_____________________________ withdrawn @ $5.00 each

SIGNATURE _____________________________________________

TOTAL AMOUNT ENCLOSED