Enlarge image

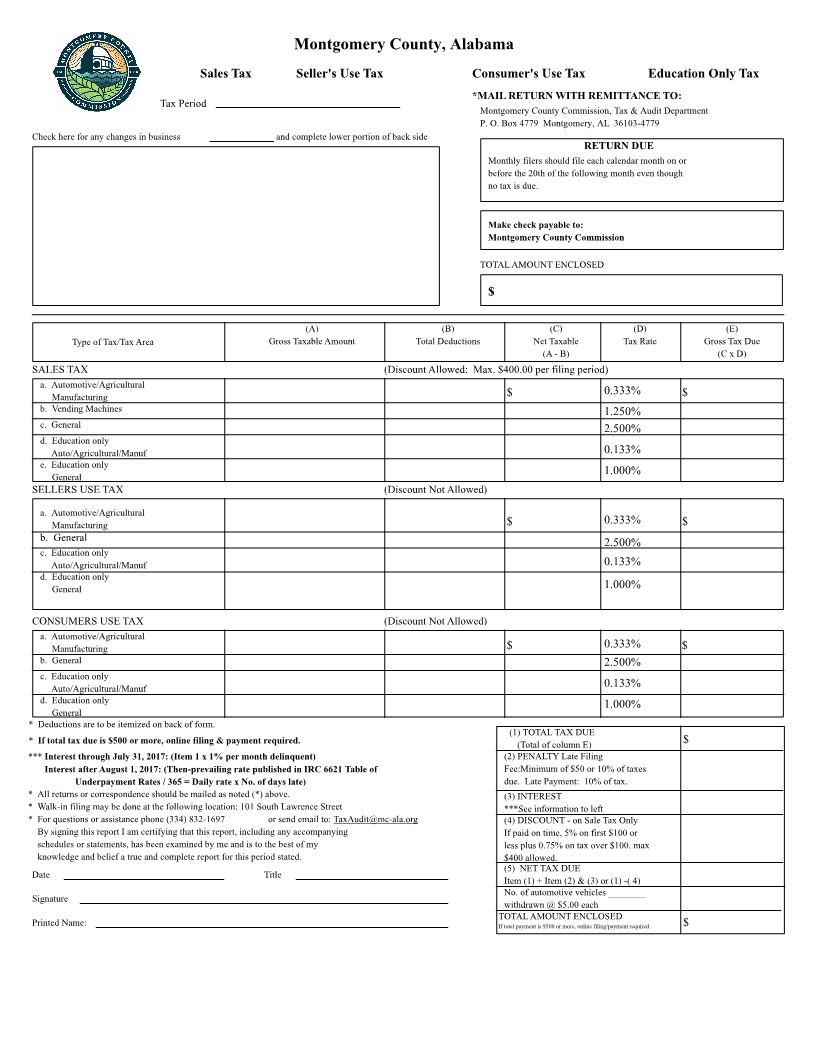

Montgomery County, Alabama

Sales Tax Seller's Use Tax Consumer's Use Tax Education Only Tax

*MAIL RETURN WITH REMITTANCE TO:

Tax Period Montgomery County Commission, Tax & Audit Department

P. O. Box 4779 Montgomery, AL 36103-4779

Check here for any changes in business and complete lower portion of back side

RETURN DUE

Monthly filers should file each calendar month on or

before the 20th of the following month even though

no tax is due.

Make check payable to:

Montgomery County Commission

TOTAL AMOUNT ENCLOSED

$

(A) (B) (C) (D) (E)

Type of Tax/Tax Area Gross Taxable Amount Total Deductions Net Taxable Tax Rate Gross Tax Due

(A - B) (C x D)

SALES TAX (Discount Allowed: Max. $400.00 per filing period)

a. Automotive/Agricultural

Manufacturing $ 0.333% $

b. Vending Machines 1.250%

c. General 2.500%

d. Education only

Auto/Agricultural/Manuf 0.133%

e. Education only

General 1.000%

SELLERS USE TAX (Discount Not Allowed)

a. Automotive/Agricultural

Manufacturing $ 0.333% $

b. General 2.500%

c. Education only

Auto/Agricultural/Manuf 0.133%

d. Education only

General 1.000%

CONSUMERS USE TAX (Discount Not Allowed)

a. Automotive/Agricultural

Manufacturing $ 0.333% $

b. General 2.500%

c. Education only

Auto/Agricultural/Manuf 0.133%

d. Education only 1.000%

General

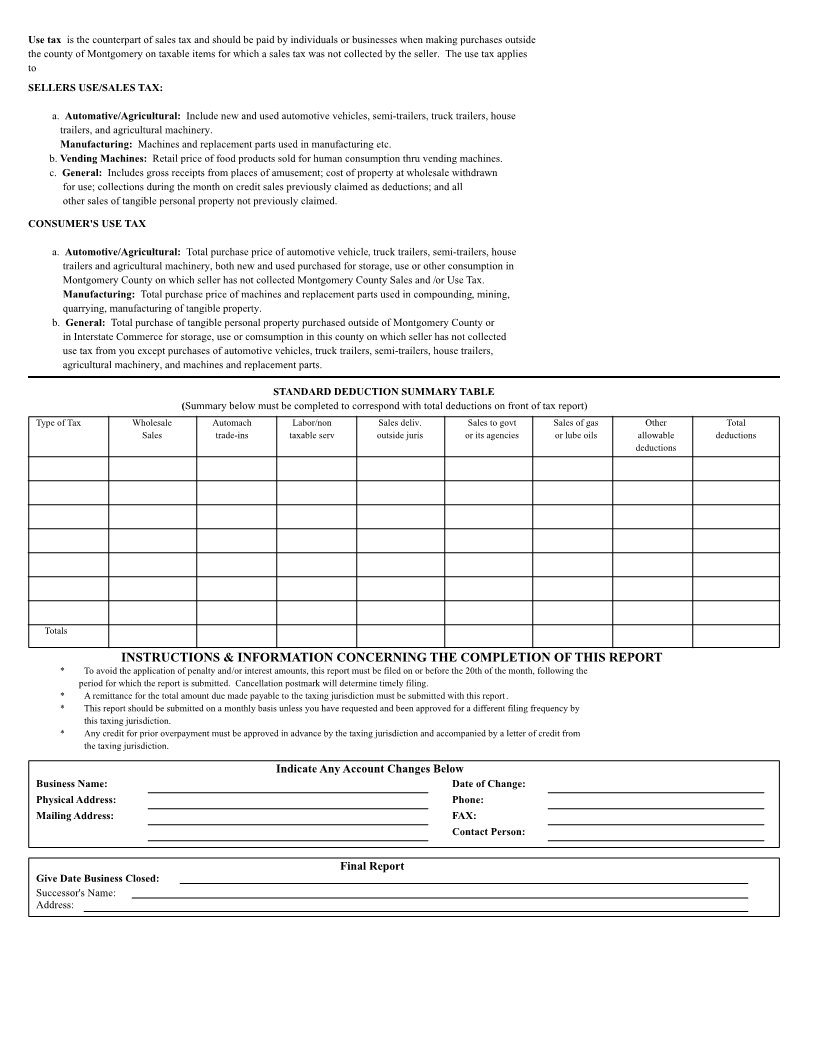

* Deductions are to be itemized on back of form.

(1) TOTAL TAX DUE

* If total tax due is $500 or more, online filing & payment required. (Total of column E) $

*** Interest through July 31, 2017: (Item 1 x 1% per month delinquent) (2) PENALTY Late Filing

Interest after August 1, 2017: (Then-prevailing rate published in IRC 6621 Table of Fee:Minimum of $50 or 10% of taxes

Underpayment Rates / 365 = Daily rate x No. of days late) due. Late Payment: 10% of tax.

* All returns or correspondence should be mailed as noted (*) above. (3) INTEREST

* Walk-in filing may be done at the following location: 101 South Lawrence Street ***See information to left

* For questions or assistance phone (334) 832-1697 or send email to: TaxAudit@mc-ala.org (4) DISCOUNT - on Sale Tax Only

By signing this report I am certifying that this report, including any accompanying If paid on time, 5% on first $100 or

schedules or statements, has been examined by me and is to the best of my less plus 0.75% on tax over $100. max

knowledge and belief a true and complete report for this period stated. $400 allowed.

Date Title (5) NET TAX DUE

Item (1) + Item (2) & (3) or (1) -( 4)

Signature No. of automotive vehicles ________

withdrawn @ $5.00 each

Printed Name: TOTAL AMOUNT ENCLOSED $

If total payment is $500 or more, online filing/payment required.