Enlarge image

ORDINANCE NUMBER 11052014-300

COUNCIL MEMBER GOLDSMITH

INTRODUCED THE FOLLOWING ORDINANCE

COUNCIL MEMBER GILBERT

SECONDED THE ORDINANCE

An Ordinance Amending the Montevallo Code of Ordinances,

Chapter 8 – Sections 8-1 through 8-26 and Ordinances 07S, 091409-305,

09082014-305 and 09222014-303

Whereas, the State of Alabama did enact the Municipal Business License Reform

Act of 2006 (Act No. 2006-586)

Be It Ordained by the City Council of the City of Montevallo all other ordinances

or parts of ordinances in conflict or inconsistent with this ordinance, and all

amendments thereto, are hereby repealed to the extent necessary to give this

ordinance full force and effect.

E IT ORDAINED BY THE MAYOR AND COUNCIL OF THE CITY OF

B MONTEVALLO, ALABAMA, AS FOLLOWS:

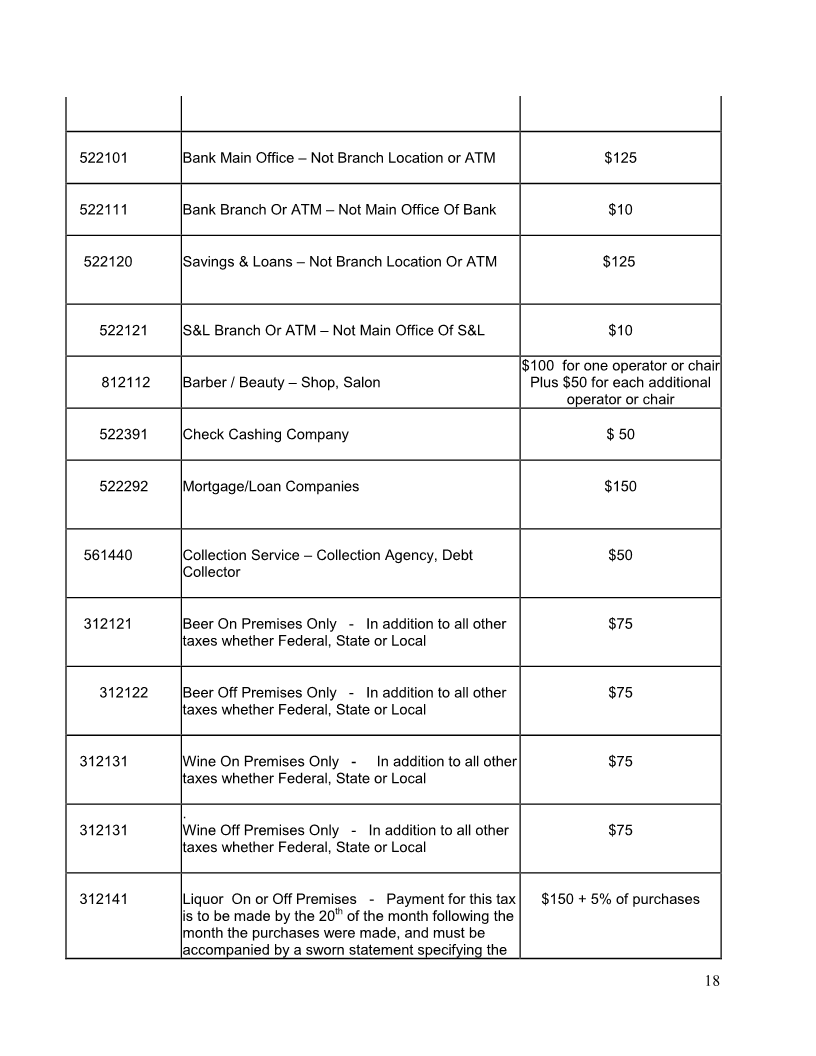

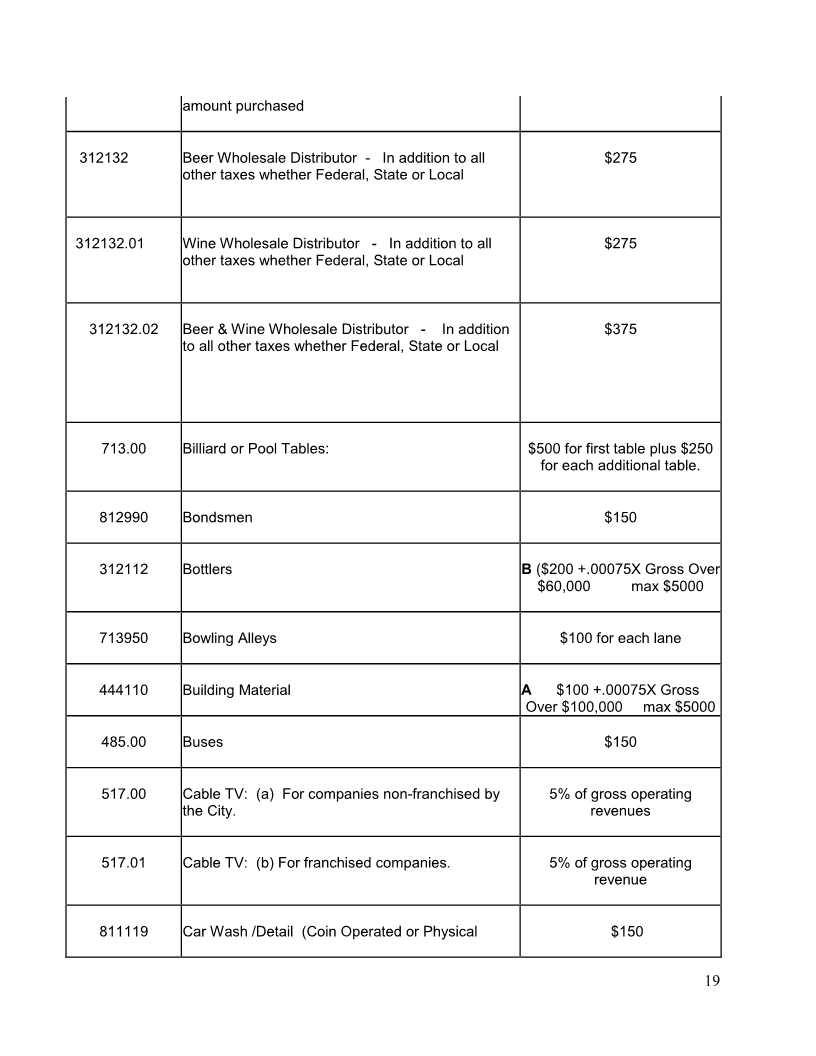

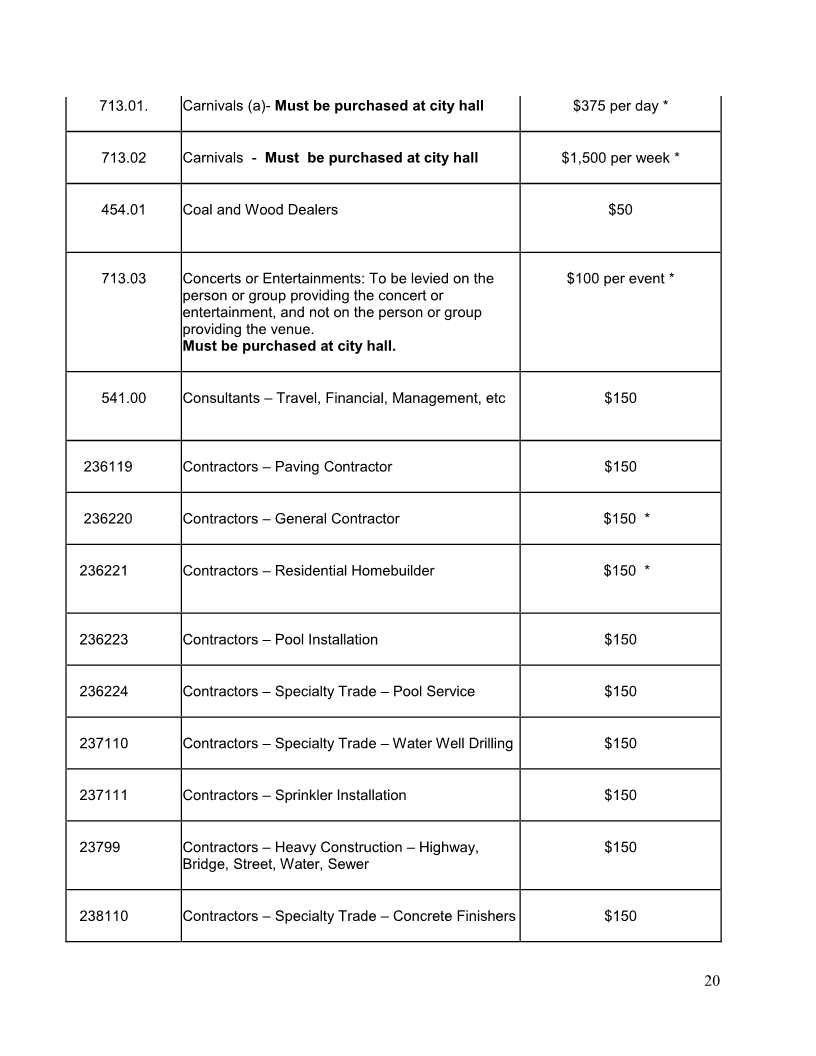

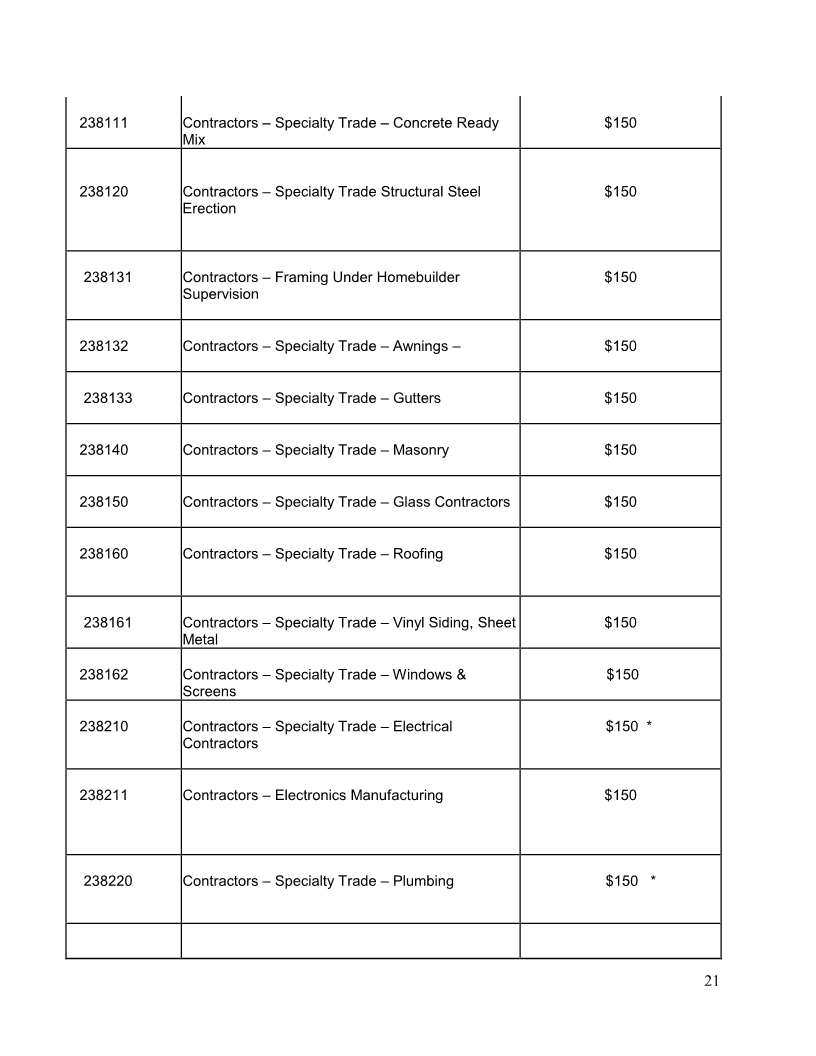

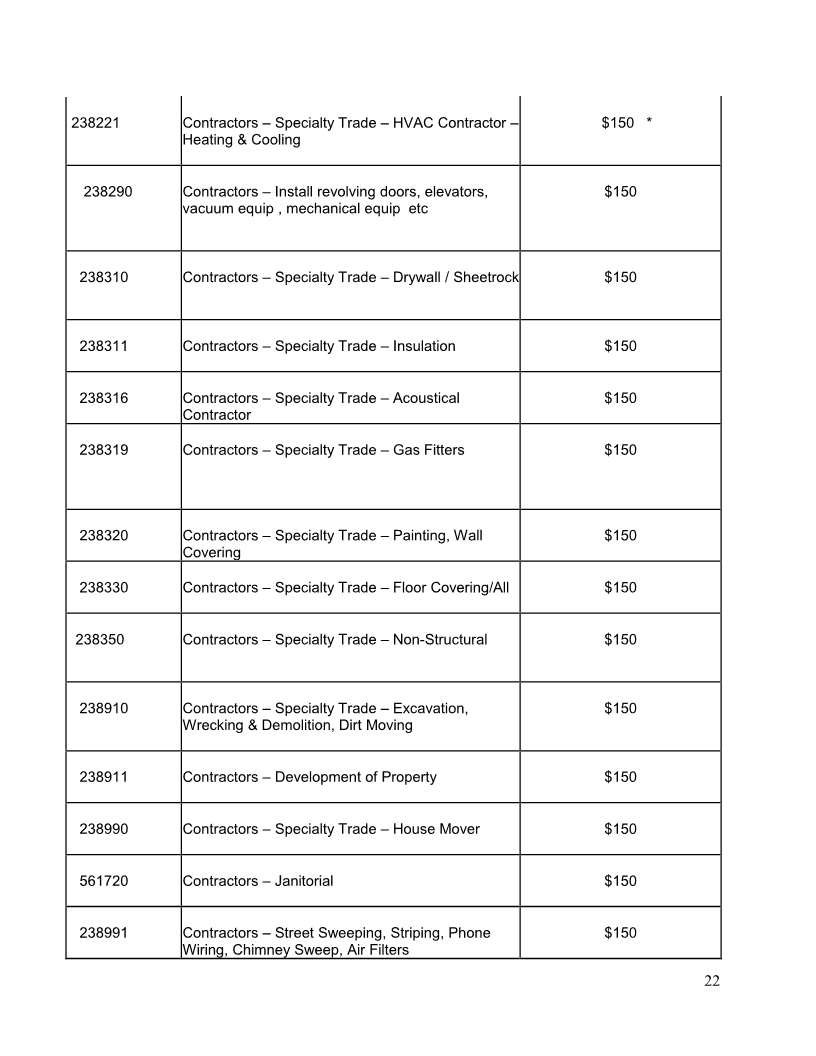

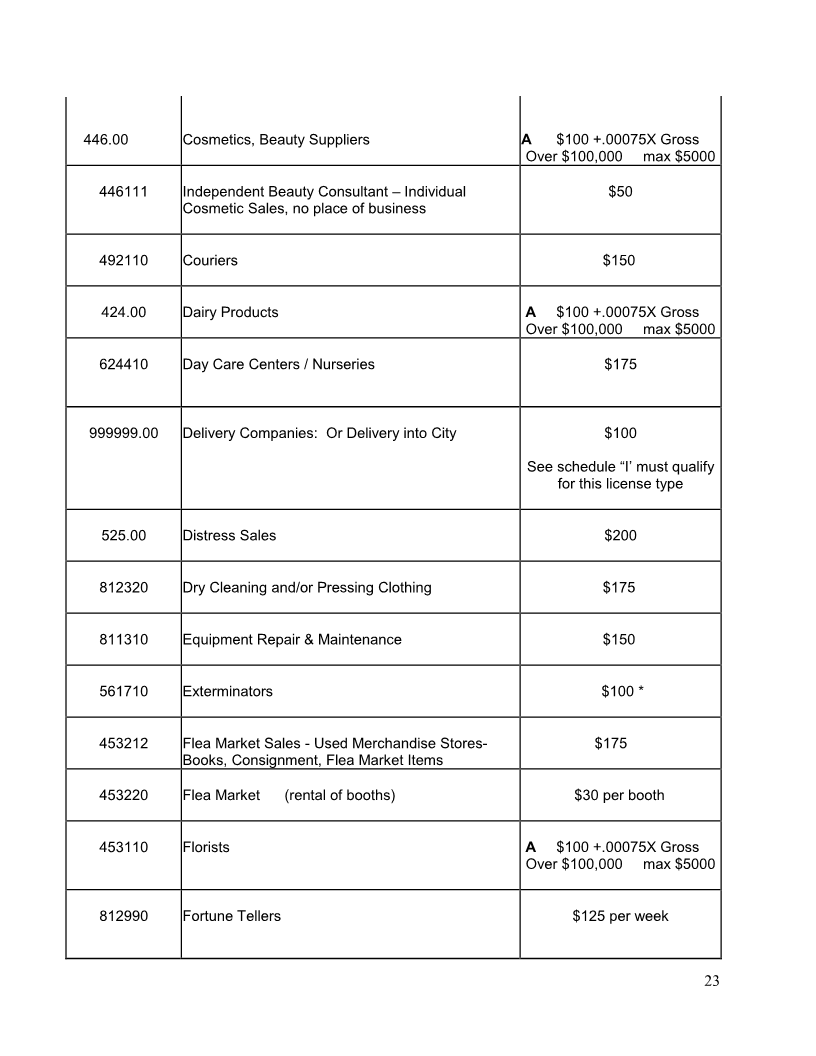

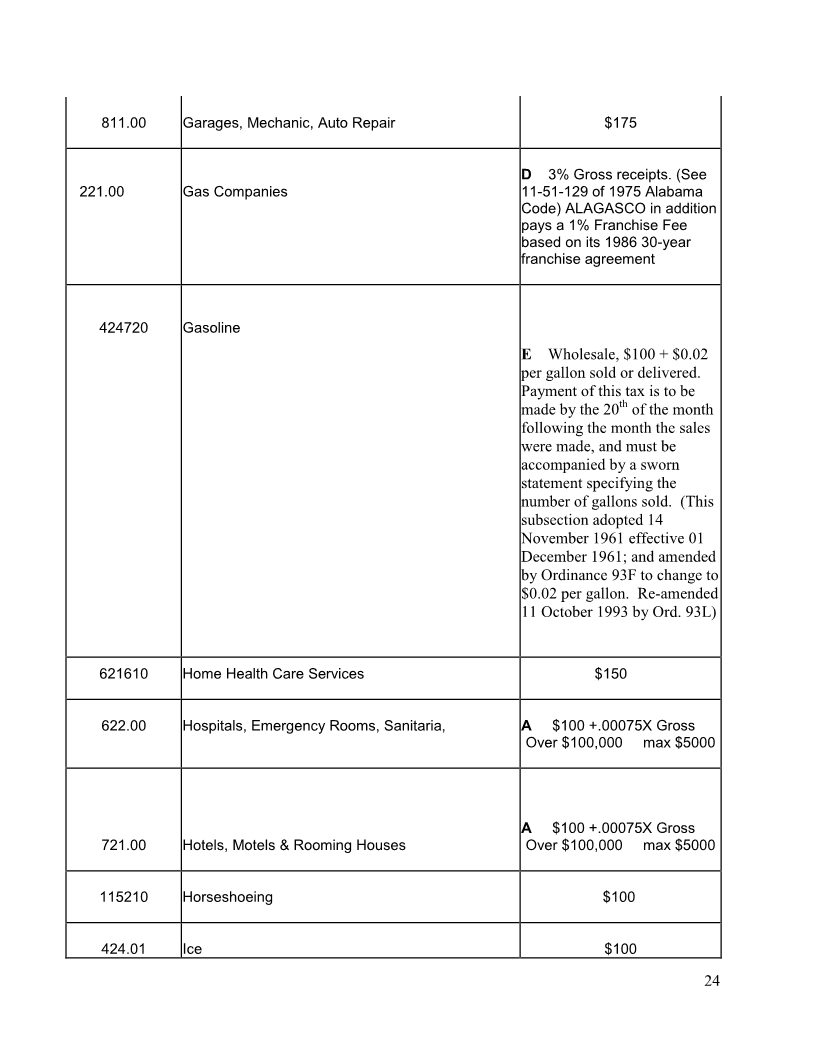

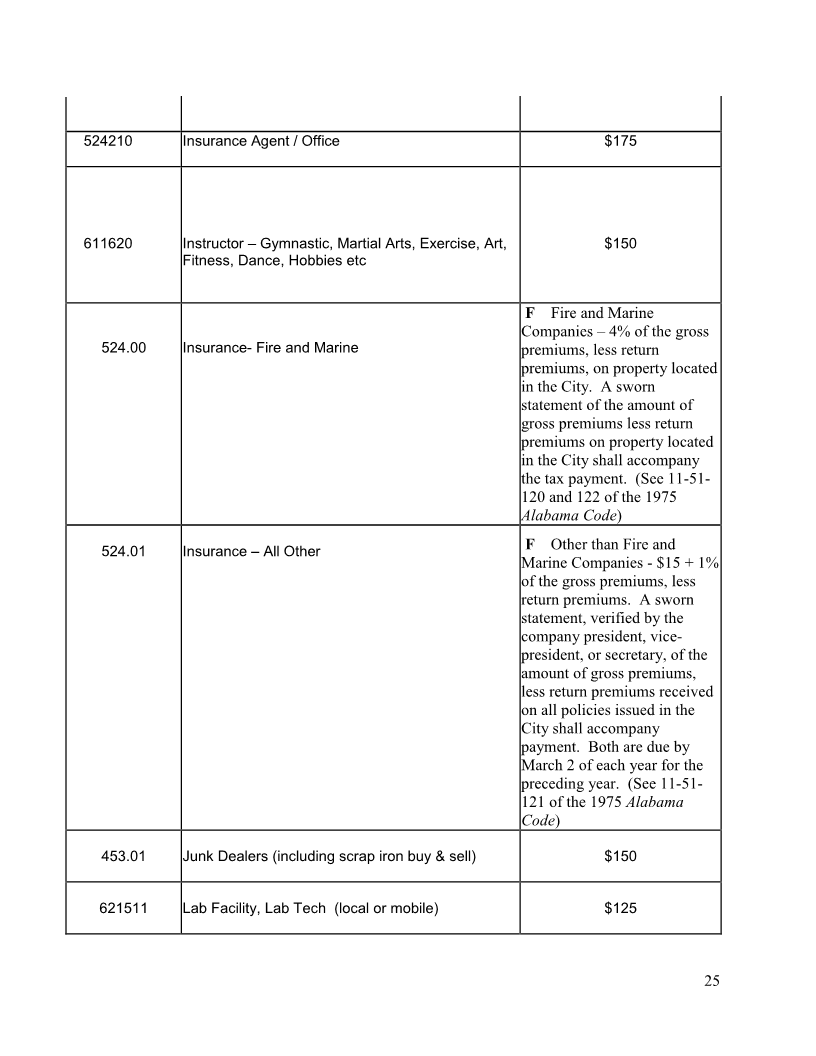

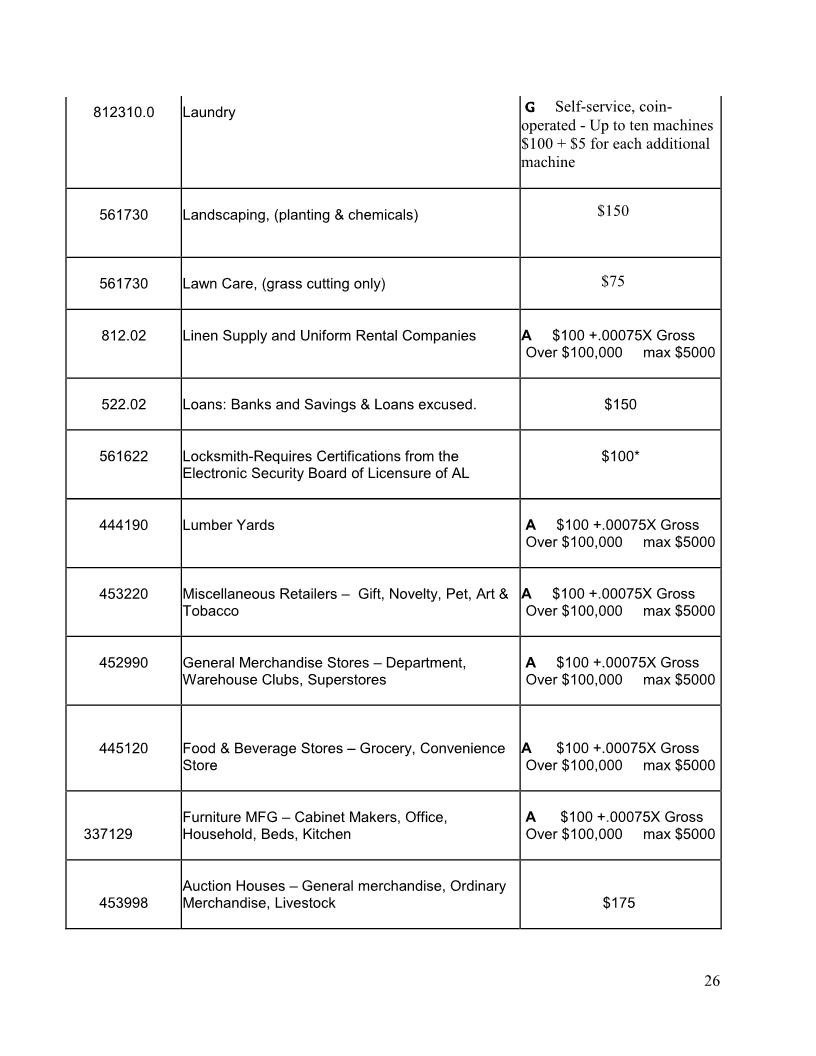

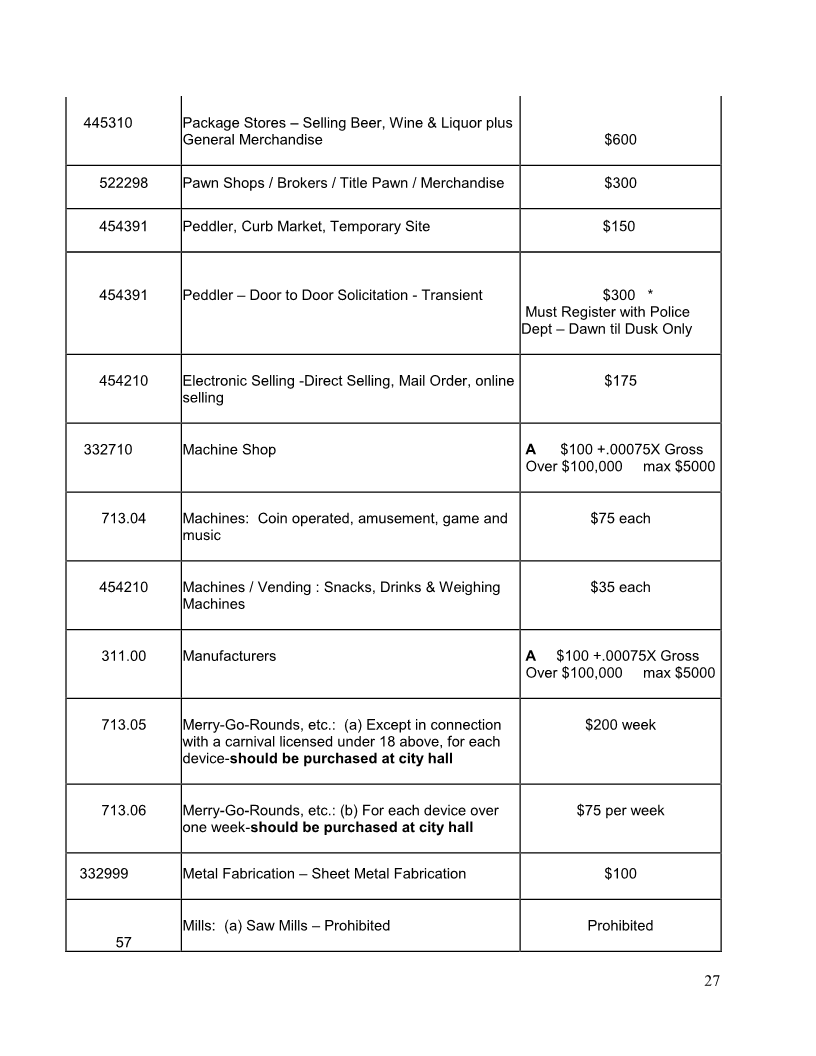

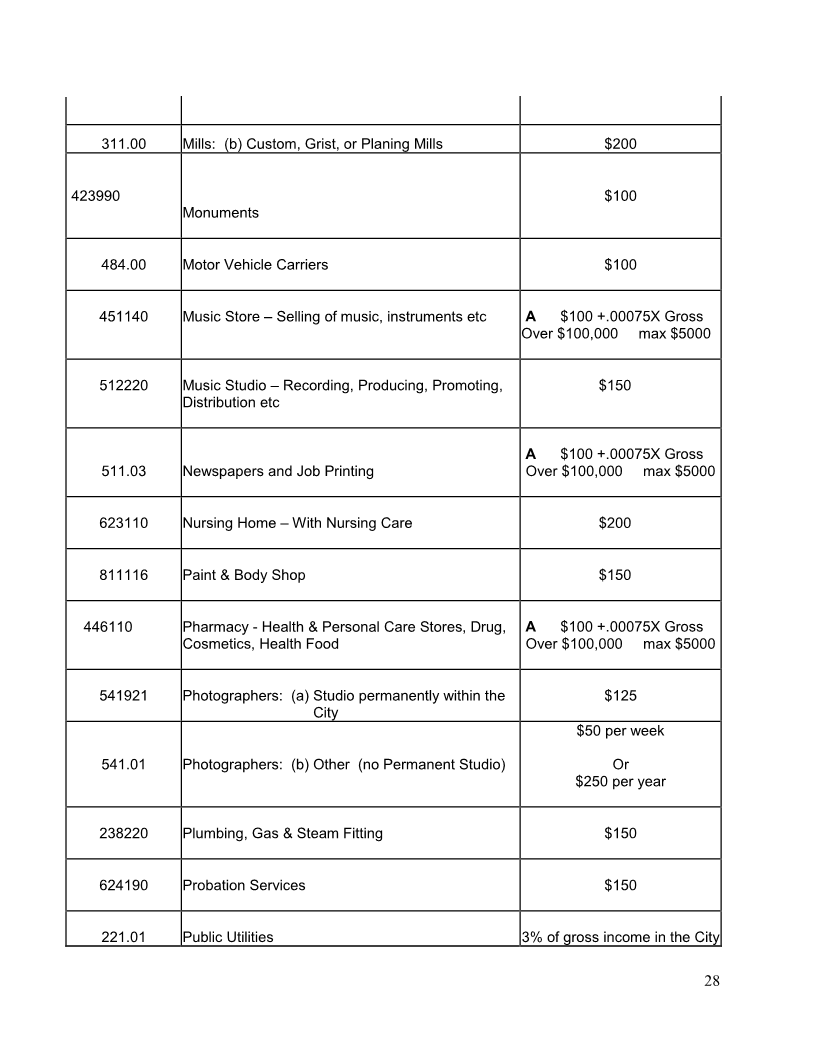

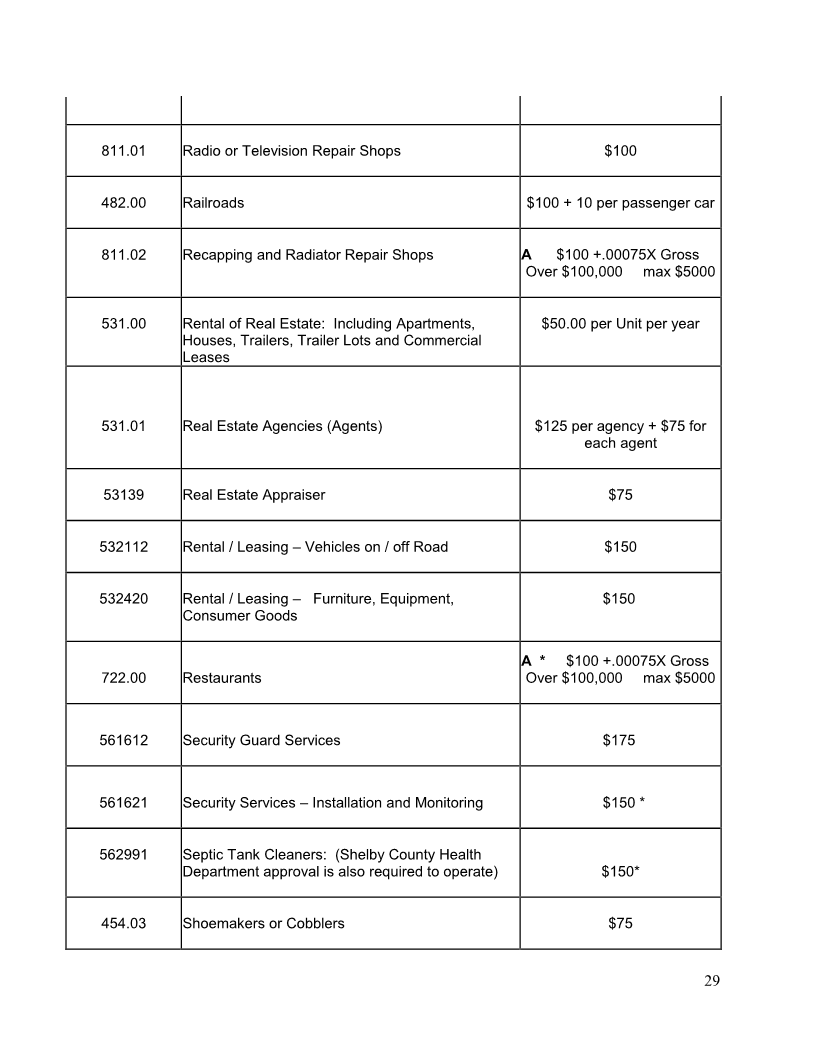

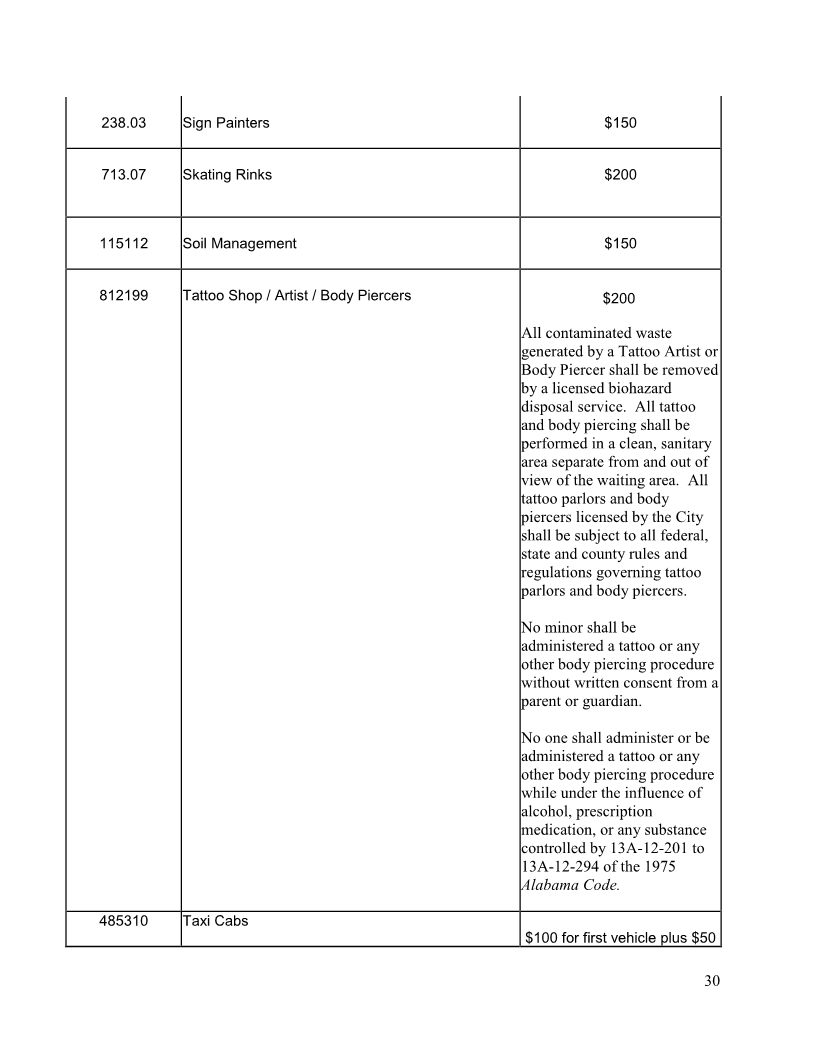

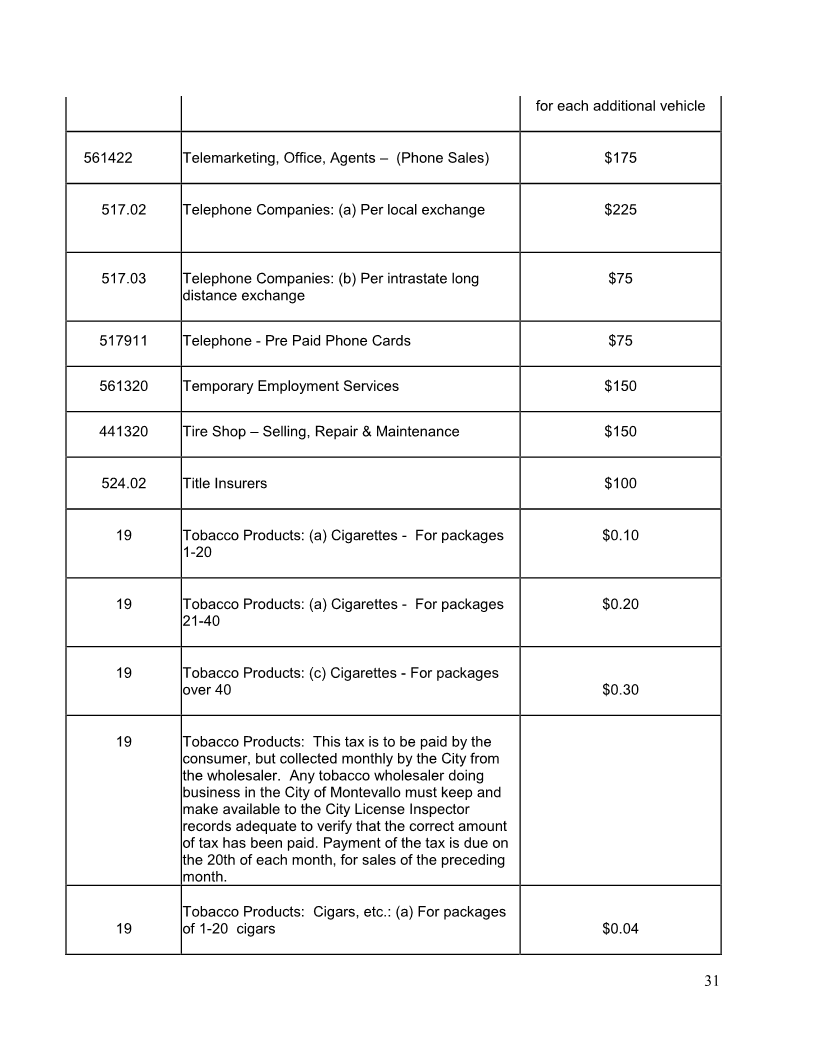

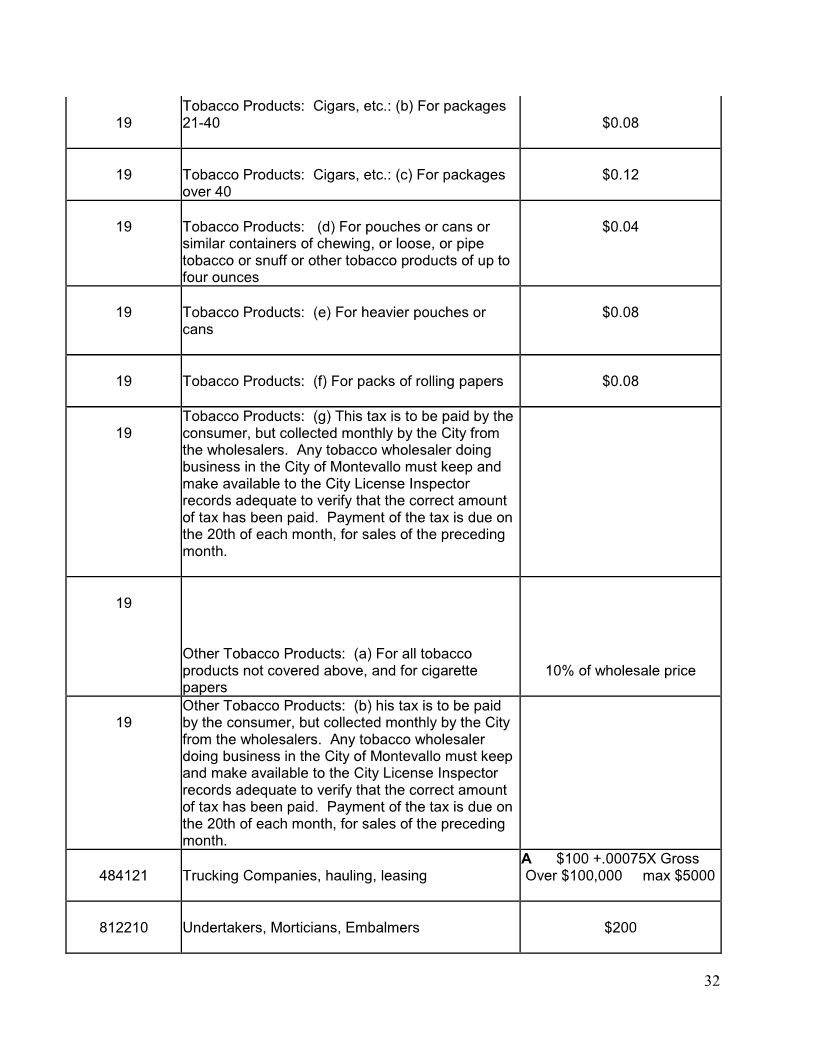

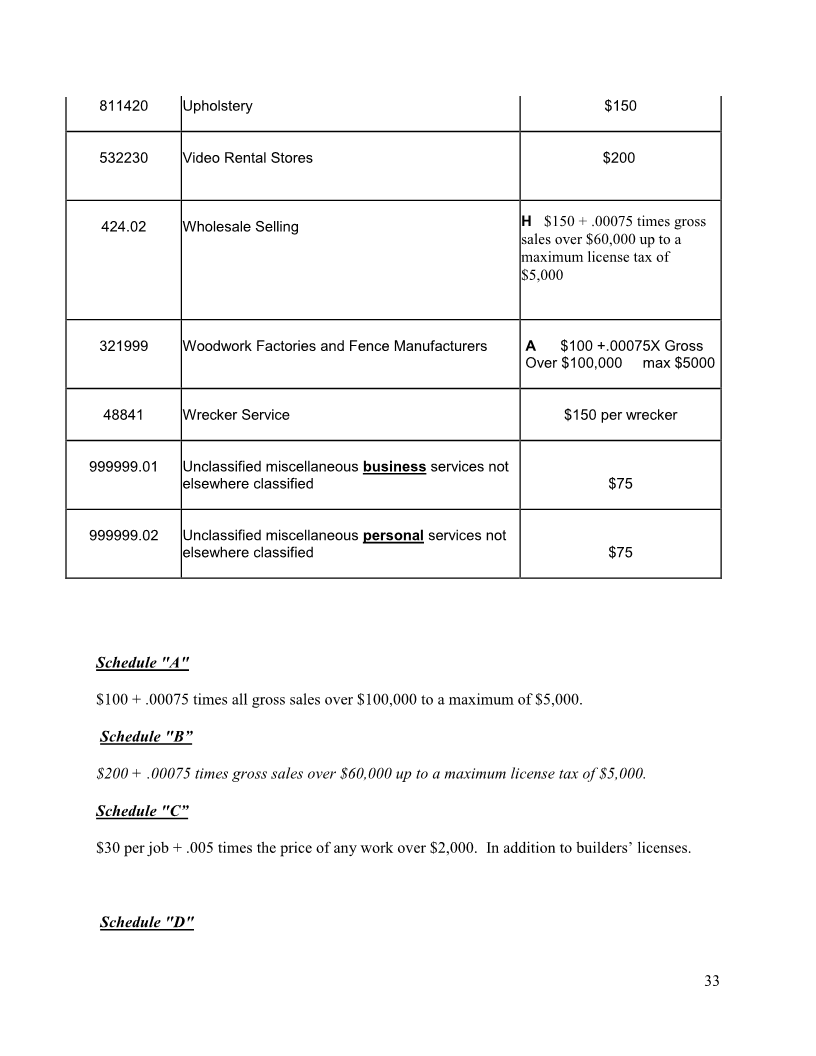

Section 1 – Levy of License Tax

Pursuant to the Code of Alabama and in accordance with the Municipal Business

License Reform Act of 2006(Act No. 2006-586) ,the following is hereby declared

to be and is adopted as the business license code and schedule of licenses for the

City of Montevallo for the year beginning January 1, 2015, and for each

subsequent year thereafter. There is hereby levied and assessed a business license

fee for the privilege of doing any kind of business, trade, profession or other

activity in the municipality, by whatever name called.

Section 2 - Definitions.

Unless the context clearly requires otherwise, the following terms shall have the

following meaning as set forth below:

BUSINESS. Any commercial or industrial activity or any Montevallo, trade,

profession, occupation, or livelihood, including the lease or rental of residential or

1