Enlarge image

SALSALESCONSUMERES& USE TAX & USE TAX

MOMONTHLYUSE TAXTAXRETURNNTHLYRETURN TAX RETURN

MONTH COVERED BY THIS REPORTONTH COVERED BY THIS REPORTM MONTH COVERED BY THIS REPORT

OR R O OR

PERIOD COVERED BY THIS REPORTERIOD COVERED BY THIS REPORTP PERIOD COVERED BY THIS REPORT

www.cityofmobile.org/html/departments/revenuewww.cityofmobile.org/html/departments/revenuewww.cityofmobile.org/html/departments/revenuewww.cityofmobile.org/revenuewww.cityofmobile.org/revenue121214 From: F From: To:rom: To: To:

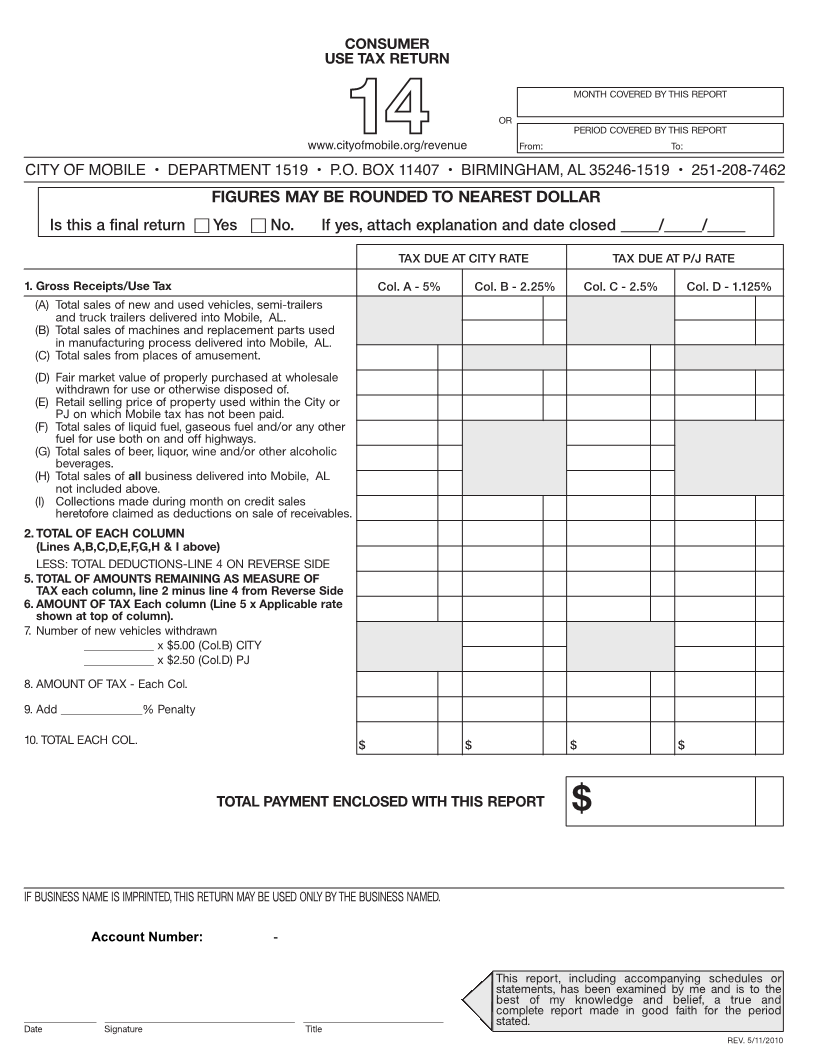

CITY OF MOBILE • DEPARTMENT 1519 • P.O. BOX 11407 • BIRMINGHAM, AL 35246-1519 • 251-208-7462CITY OF MOBILE • DEPARTMENT 1519 • P.O. BOX 11407 • BIRMINGHAM, AL 35246-1519 • 251-208-7462CITY OF MOBILE • P.O. BOX 2745 • MOBILE, AL 36652-2745 • PHONE (251) 208-7461ITY OF MOBILE • P.O. BOX 2745 • MOBILE, AL 36652-2745 • PHONE (251) 208-7461C CITY OF MOBILE • P.O. BOX 2745 • MOBILE, AL 36652-2745 • PHONE (251) 208-7461

FIGURES MAY BE ROUNDED TO NEAREST DOLLARIGURES MAY BE ROUNDED TO NEAREST DOLLARF FIGURES MAY BE ROUNDED TO NEAREST DOLLAR

IsIsIs thisthis aa finalfinal return return � � thisYYes Yes a final� �es NoNo.No..return IfI Ifyes,yes,attachattachexplanationexplanationandanddatedateclosedclosed_____/_____/_____f_____/_____/_____ yes, attach explanation and date closed _____/_____/_____

TAX DUE AT CITY RATE TAX DUE AT P/J RATEAX DUE AT CITY RATE TAX DUE AT P/J RATET TAX DUE AT CITY RATE TAX DUE AT P/J RATE

1. 1. 1. GGrossGrossReceipts/UseSales/Use TaxTaxross Sales/Use Tax Col.Col.ColCol.AAA---5%4% 4% Col.Col.Col.BB-2% B-2% - 2.25% Col.Col.Col.CC-2% C-2% - 2.5% Col.Col.Col.D-1%.D-1%D - 1.125%A - 4% Col. B-2% Col. C-2% Col. D-1%

(A) Total sales of new and used vehicles, semi-trailers(A) Gross sales of new and used vehicles, semi-trailers(A) Gross sales of new and used vehicles, semi-trailers

andandandtrucktrucktrucktrailerstrailers.trailers.delivered into Mobile, AL.

(B)(B)(B)TotalGrossGrosssalessalessalesofofofmachinesmachinesmachinesandandandreplacementreplacementreplacementpartspartspartsusedduseused

inininmanufacturingmanufacturingmanufacturingprocessprocess.process.delivered into Mobile, AL.

(C)(C)(C)TotalGrossGrosssalessalessalesfromfromfromplacesplacesplacesofofofamusement.t.amusemenamusement.

(D) Fair market value of properly purchased at wholesale(D) Fair market value of properly purchased at wholesale(D) Fair market value of properly purchased at wholesale

withdrawn for use or otherwise disposed of.withdrawn for use or otherwise disposed of.withdrawn for use or otherwise disposed of.

(E) Retail selling price of property used within the City or(E) Retail selling price of property used within the City or(E) Retail selling price of property used within the City or

PJ on which Mobile tax has not been paid.PJ on which Mobile tax has not been paid.PJ on which Mobile tax has not been paid.

(F) Total sales of liquid fuel, gaseous fuel and/or any other(F) Gross sales of liquid fuel, gaseous fuel and/or any other(F) Gross sales of liquid fuel, gaseous fuel and/or any other

fuel for use both on and off highways.fuel for use both on and off highways.fuel for use both on and off highways.

(G) Total sales of beer, liquor, wine and/or other alcoholic(G) Gross sales of beer, liquor, wine and/or other alcoholic(G) Gross sales of beer, liquor, wine and/or other alcoholic

beverages.beverages.beverages.

(H)(H)TotalGrosssalessalesoffromallbusinessall businessdeliverednot includedinto Mobile,aboveAL

(H) Gross sales from not included above.all business not included above. .

(I) Collections made during month on credit sales(I) Collections made during month on credit sales(I) Collections made during month on credit sales

heretofore claimed as deductions on sale of receivables.heretofore claimed as deductions on sale of receivables.heretofore claimed as deductions on sale of receivables.

2. TOTAL2. TOTAL OF EACH COLUMN2. TOTAL OF EACH COLUMNOF EACH COLUMN

(Lines A,B,C,D,E,F,G,H & I above)(Lines A,B,C,D,E,F,G,H & I above)(Lines A,B,C,D,E,F,G,H & I above)

LESS: TOTAL DEDUCTIONS-LINE 4 ON REVERSE SIDELESS: TOTAL DEDUCTIONS-LINE 4 ON REVERSE SIDELESS: TOTAL DEDUCTIONS-LINE 4 ON REVERSE SIDE

5. TOTAL OF AMOUNTS REMAINING AS MEASURE OF5. TOTAL OF AMOUNTS REMAINING AS MEASURE OF5. TOTAL OF AMOUNTS REMAINING AS MEASURE OF

TATATAX each column, line 2 minus line 4 from Reverse SideX each column, line 2 minus line 4 from Reverse SideX each column, line 2 minus line 4 from Reverse Side

6. 6. 6. AMOUNT OF TAAMOUNT OF TAAMOUNT OF TAX Each column (Line 5 x Applicable rateX Each column (Line 5 x Applicable rateX Each column (Line 5 x Applicable rate

shown at top of column).shown at top of column).shown at top of column).

7. Number of new vehicles withdrawn7. Number of new vehicles withdrawn7. Number of new vehicles withdrawn

____________ x $5.00 (Col.B) CITY____________ x $5.00 (Col.B) CITY____________ x $5.00 (Col.B) CITY

____________ x $2.50 (Col.D) PJ____________ x $2.50 (Col.D) PJ____________ x $2.50 (Col.D) PJ

8. AMOUNT OF TAX - Each Col.8. AMOUNT OF TAX - Each Col.8. AMOUNT OF TAX - Each Col.

9. Add ______________% Penalty - (SEE BELOW*)9. Add ______________% Penalty - (SEE BELOW*)9. Add ______________% Penalty - (SEE BELOW*)

10. TOTAL EACH COL.10. TOTAL EACH COL.10. TOTAL EACH COL. $ $ $ $ $ $ $ $ $ $$ $

TOTAL PAYMENT ENCLOSEOTAL PAYMENT ENCLOSET TOTAL PAYMENT ENCLOSED WWD D WITH THIS REPORTTH THIS REPORTI ITH THIS REPORT

$ $ $

IF BUSINESS NAME IS IMPRINTED,THIS RETURN MAY BE USED ONLY BYTHE BUSINESS NAMED.F BUSINESS NAME IS IMPRINTED,THIS RETURN MAY BE USED ONLY BYTHE BUSINESS NAMED.I IF BUSINESS NAME IS IMPRINTED,THIS RETURN MAY BE USED ONLY BYTHE BUSINESS NAMED.

*PENALT*PENALTY*PENALT Y YOF OF OF 5% 5% 5% PER PER PER MONTHMONTHMONTH

WHENWHENWHEN PAIDPAIDPAID AFTERAFTERAFTER 20TH20TH20TH OFOFOF

Account Number: - MONTH FOLLOWING THE PERIODMONTH FOLLOWING THE PERIODMONTH FOLLOWING THE PERIOD

COVERED.COVERED.COVERED.

This T This report,report,including including accompanying accompanying schedules schedulesorhis report, including accompanying schedules or or

statements, has been examined by me and is to thetatements, has been examined by me and is to thes statements, has been examined by me and is to the

best of my knowledge and belief, a true and est of my knowledge and belief, a true and b best of my knowledge and belief, a true and

com

________________________________ ________________ __________________________________________ __________________________________________ ______________________________________________________________ __________________________________________ complete complete report report made made in in good good _______________________________faith faith for for the the periodperiodplete report made in good faith for the period

Date D Date ate Signature Signature Sig TitleTitlenature Titlesstated.tated.stated.

REV. 5/11/2010REV. 9/3/2008REV. 9/3/2008