Enlarge image

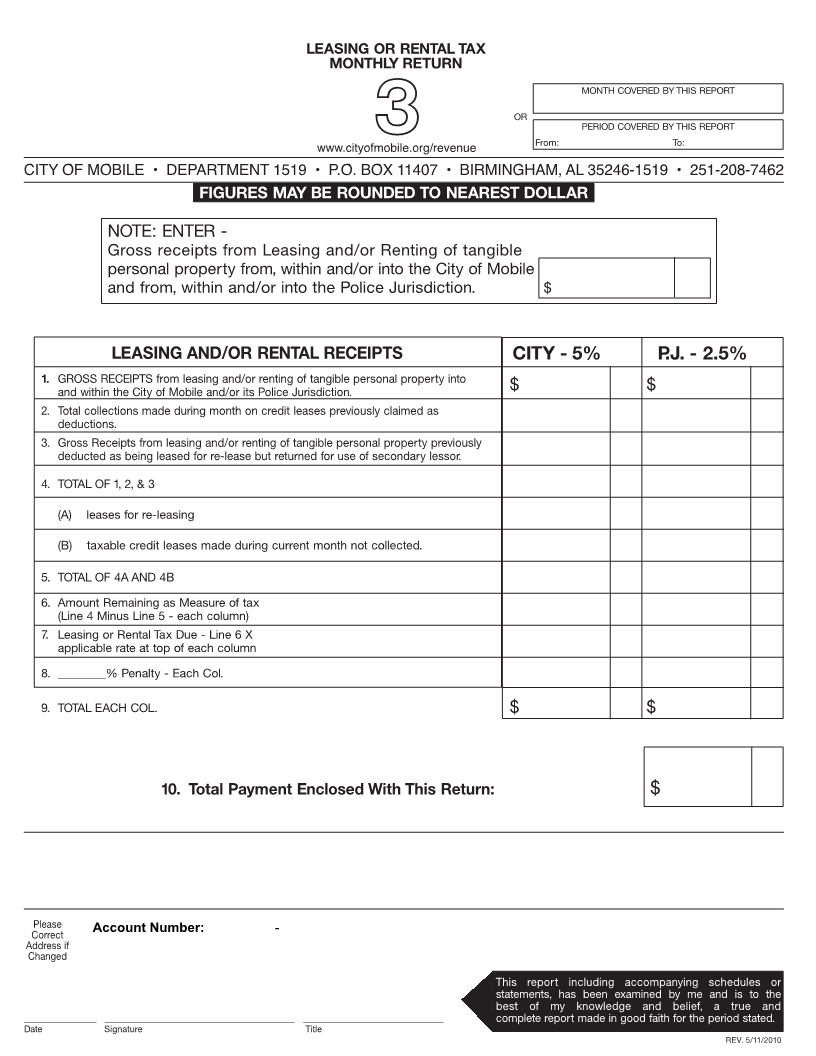

LEASING OR RENTAL TAX

MONTHLY RETURN

MONTH COVERED BY THIS REPORT

OR

PERIOD COVERED BY THIS REPORT

www.cityofmobile.org/html/departments/revenuewww.cityofmobile.org/revenue3 From: To:

CITY OF MOBILE • DEPARTMENT 1519 • P.O. BOX 11407 • BIRMINGHAM, AL 35246-1519 • 251-208-7462City of Mobile • P.O. Box 2745 • Mobile, AL 36652-2745 • Phone (251) 208-7461

FIGURES MAY BE ROUNDED TO NEAREST DOLLAR

NOTE: ENTER -

Gross receipts from Leasing and/or Renting of tangible

personal property from, within and/or into the City of Mobile

and from, within and/or into the Police Jurisdiction. $

LEASING AND/OR RENTAL RECEIPTS CITY - 5% P.J. - 2.5%

1. GROSS RECEIPTS from leasing and/or renting of tangible personal property into

and within the City of Mobile and/or its Police Jurisdiction. $ $

2. Total collections made during month on credit leases previously claimed as

deductions.

3. Gross Receipts from leasing and/or renting of tangible personal property previously

deducted as being leased for re-lease but returned for use of secondary lessor.

4. TOTAL OF 1, 2, & 3

(A) leases for re-leasing

(B) taxable credit leases made during current month not collected.

5. TOTAL OF 4A AND 4B

6. Amount Remaining as Measure of tax

(Line 4 Minus Line 5 - each column)

7. Leasing or Rental Tax Due - Line 6 X

applicable rate at top of each column

8. ________% Penalty - Each Col. (See Below*)

9. TOTAL EACH COL. $ $

10. Total Payment Enclosed With This Return: $

Please Account Number: - *PENALTY OF 5% PER MONTH WHEN

Correct

Address if PAID AFTER THE 20TH OF MONTH

Changed FOLLOWING THE PERIOD COVERED.

This report including accompanying schedules or

statements, has been examined by me and is to the

best of my knowledge and belief, a true and

________________ __________________________________________ _______________________________ complete report made in good faith for the period stated.

Date Signature Title

REV. 5/11/2010REV. 9/3/2008