Enlarge image

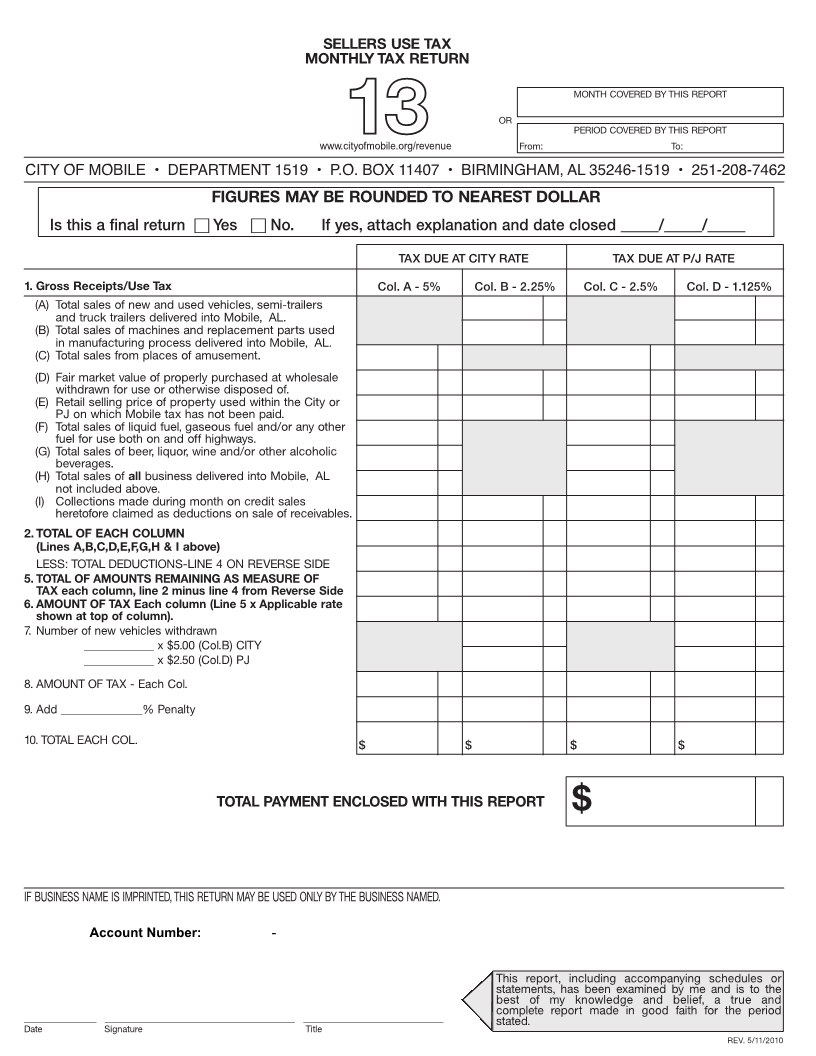

SELLERS USE TAXSELLERS USE TAXSALES & USE TAX

MONTHLY TAX RETURNMONTHLY TAX RETURNMONTHLY TAX RETURN

MONTHM COVERED BY THIS REPORTMONTH COVERED BY THIS REPORTONTH COVERED BY THIS REPORT

ORO R OR

PERIODP COVEREDPERIOD COVEREDBY THIS REPORTERIODBY THIS REPORTCOVERED BY THIS REPORT

www.cityofmobile.org/revenuewww.cityofmobile.org/revenuewww.cityofmobile.org/html/departments/revenuewww.cityofmobile.org/revenue131312 From: FFrom: To:rom: To: To:

CITY OF MOBILE • DEPARTMENT 1519 • P.O. BOX 11407 • BIRMINGHAM, AL 35246-1519 • 251-208-7462CITY OF MOBILE • P.O. BOX 2745 • MOBILE, AL 36652-2745 • PHONE (251) 208-7461CITY OF MOBILE • DEPT# 1519 • P.O.BOX 11407 • BIRMINGHAM, AL 35246-1519 • PHONE (251) 208-7462CITY OF MOBILE • DEPT# 1519 • P.O.BOX 11407 • BIRMINGHAM, AL 35246-1519 • PHONE (251) 208-7462

FIGURESFMAY BE ROUNDED TO NEAREST DOLLARFIGURES MAY BE ROUNDED TO NEAREST DOLLARIGURES MAY BE ROUNDED TO NEAREST DOLLAR

IsIs this a final return � IsYes Ythis a� Yes finalNo..No return es NoIIf yes,thisIfattachyes,a finalattachexplanationreturn explanationand dateandcloseddate closed_____/_____/_____.f_____/_____/_____attachyes, explanation and date closed _____/_____/_____

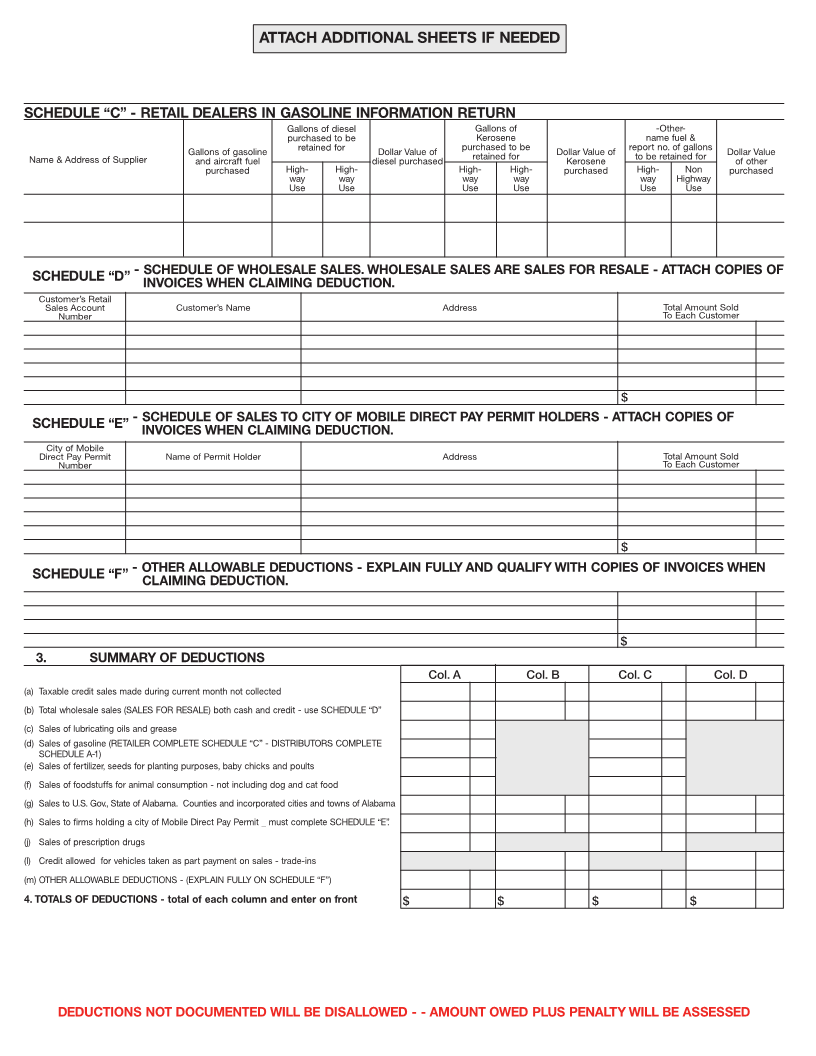

TAXTDUE AT CITY RATE TAX DUE AT P/J RATETAX DUE AT CITY RATE TAX DUE AT P/J RATEAX DUE AT CITY RATE TAX DUE AT P/J RATE

1.1. Gross Receipts/Use Tax1. Gross Receipts/Use TaxGross Sales/UseCol.ColCol.AA--5%4% Tax Col.Col.BB-2% - 2.25% Col.Col.CC-2% - 2.5% Col.Col.D-1%Col.D - 1.125%A - 4% Col. B-2% Col. C-2% Col. D-1%. A - 4% Col. B-2% Col. C-2% Col. D-1%

(A) Total sales of new and used vehicles, semi-trailersi-trailers(A) Gross sales of new and used vehicles,(A) Total sales of new and used vehicles, semsemi-trailers

andandtrucktruckandtrailerstruckdeliveredtrailers deliveredinto Mobile,intoAL.Mobile, AL.trailers.

(B)(B)TotalGross(B)salesTotalofsalesmachinesof machinesand replacementand replacementparts useddparts usedsales of machines and replacement parts use

ininmanufacturingmanufin manufacturingprocessprocessdelivereddeliveredinto Mobile,intoAL.Mobile, AL.acturing process.

(C)(C)TotalGross(C)salesTotalfromsalesplacesfromofplacesamusement.t.of amusement.sales from places of amusemen

(D) Fair market value of properly purchased at wholesaleholesale(D) Fair market value of properly purchased at wholesale(D) Fair market value of properly purchased at w

withdrawnwithdrawwithdrawnfor use orforotherwiseuse or otherwisedisposeddisposedof. of.n for use or otherwise disposed of.

(E)(E)RetailReta(E)sellingRetailpricesellingof propertyprice of propertyused withinusedthewithinCitytheor City oril selling price of property used within the City or

PJPJononwhichwhPJ onMobilewhichtaxMobilehas nottaxbeenhas notpaid.been paid.ich Mobile tax has not been paid.

(F) Total sales of liquid fuel, gaseous fuel and/or any otherny other(F) Gross sales of liquid fuel,(F) Total sales of liquid fuel, gaseous fuel and/or agaseous fuel and/or any other

fuel for usefuelbothfor useonbothand offonhighways.ighways.fueland off h for use both on and off highways.

(G)(G)TotalGross(G)salesTotalofsalesbeer,ofliquor,beer,wineliquor,and/orwineotherand/oralcoholicother alcoholicsales of beer, liquor, wine and/or other alcoholic

beverages.verages.beverages.be

(H) Total(H)salesTotalof salesallbusinessofallbusinessdelivereddeliveredinto Mobile,intoALMobile, AL

(H) Gross sales from not included above.not included above.all business not included above.

(I)(I)CollectionsCollections(I) Collectionsmademadeduringduringmademonthmonthduringononmonthcreditcreditonsalesditsalescre sales

heretofore claimed as deductions on sale of receivables.heretofore claimed as deductions on sale of receivables.heretofore claimed as deductions on sale of receivables.

2.2. TOTALTOTAL2.OFOFTOTALEACHEACHOFCOLUMNCOLUMNOLUMNEACH C

(Lines(Lines A,B,C,D,E,F,G,H & I above)A,B,C,D,E,F,G,H(Lines A,B,C,D,E,F,G,H& I above)I& above)

LESS: TOTAL DEDUCTIONS-LINE 4 ON REVERSE SIDELESS: TOTAL DEDUCTIONS-LINE 4 ON REVERSE SIDELESS: TOTAL DEDUCTIONS-LINE 4 ON REVERSE SIDE

5.5. TOTALTOTAL OFOF AMOUNTSAMOUNTS REMAININGREMAINING ASAS MEASUREMEASURE OF5.OF TOTAL OF AMOUNTS REMAINING AS MEASURE OF

TATAXX each column, line 2 minus line 4 from Reverse Sideeach column, line 2 minus line 4 from Reverse SideTAX each column, line 2 minus line 4 from Reverse Side

6.6. AMOUNTAMOUNTOFOFTATAXX Each column (Line 5 x Applicable rateEach column (Line 5 x Applicable rate6. AMOUNT OF TAX Each column (Line 5 x Applicable rate

shownshown at top of column).at top of column).shown at top of column).

7.7. NumberNumber7. Numberofof newnew vehiclesvehiclesof new vehicleswithdrawnithdrawnwithdrawnw

____________________________________xx $5.00$5.00 (Col.B)(Col.B)x $5.00CITYl.B)CITY(Co CITY

____________ x $2.50 (Col.D) PJ____________ x $2.50 (Col.D) PJ____________ x $2.50 (Col.D) PJ

8. AMOUNT OF TAX - Each Col.8. AMOUNT OF TAX - Each Col.8. AMOUNT OF TAX - Each Col.

9. Add ______________% Penalty - (SEE BELOW*)9. Add ______________% Penalty - (SEE BELOW*)9. Add ______________% Penalty - (SEE BELOW*)

10. TOTAL EACH COL.10. TOTAL EACH COL.10. TOTAL EACH COL. $ $ $ $ $ $ $ $ $ $ $ $

TOTALTOTAL PAYMENT ENCLOSE PAYMENT ENCLOSEDITH THIS REPORTWITH THIS REPORTTOTAL PAYMENT ENCLOSED WITH THIS REPORTD W

$$ $

IFI BUSINESS NAME IS IMPRINTED,THIS RETURN MAY BE USED ONLY BYTHE BUSINESS NAMED.IF BUSINESS NAME IS IMPRINTED,THIS RETURN MAY BE USED ONLY BYTHE BUSINESS NAMED.F BUSINESS NAME IS IMPRINTED,THIS RETURN MAY BE USED ONLY BYTHE BUSINESS NAMED.

*PENALTY*PENALTY*PENALTOF 5% OF OF PER 5% 5% MONTHYPER PER MONTHMONTH

ACCOUNT #ACCOUNT # WHENWHENWHENPAIPAIDDPAID AFAFTERTERAFTER20TH20TH 20THOFOF OF

AccountNAME Number:NAME - MONTH MONTH FOLLOWING FOLLOWING THE THE PERIODPERIODMONTH FOLLOWING THE PERIOD

COVERED.COVERED.COVERED.

ADDRESS ADDRESS

This Treport, including accompanying schedules orThis report, including accompanying schedules orhis report, including accompanying schedules or

statements,shas been examined by me and is to thestatements, has been examined by me and is to thetatements, has been examined by me and is to the

bbest of my knowledge and belief, a true and best of my knowledge and belief, a true and est of my knowledge and belief, a true and

________________________________ __________________________________________ _______________________________________________ comcomplete __________________________________________ report made in good faith for the _______________________________ periodcomplete report made __________________________________________ in good faith for the periodplete _______________________________report made in good faith for the period

Date D Date SigSignature ate TitleSignature sstated.Titlenature stated.tated. Title

REV. 5/11/2010REV. 9/3/2008