Enlarge image

FOR OFFICE USE ONLY

ACCOUNT #_____________

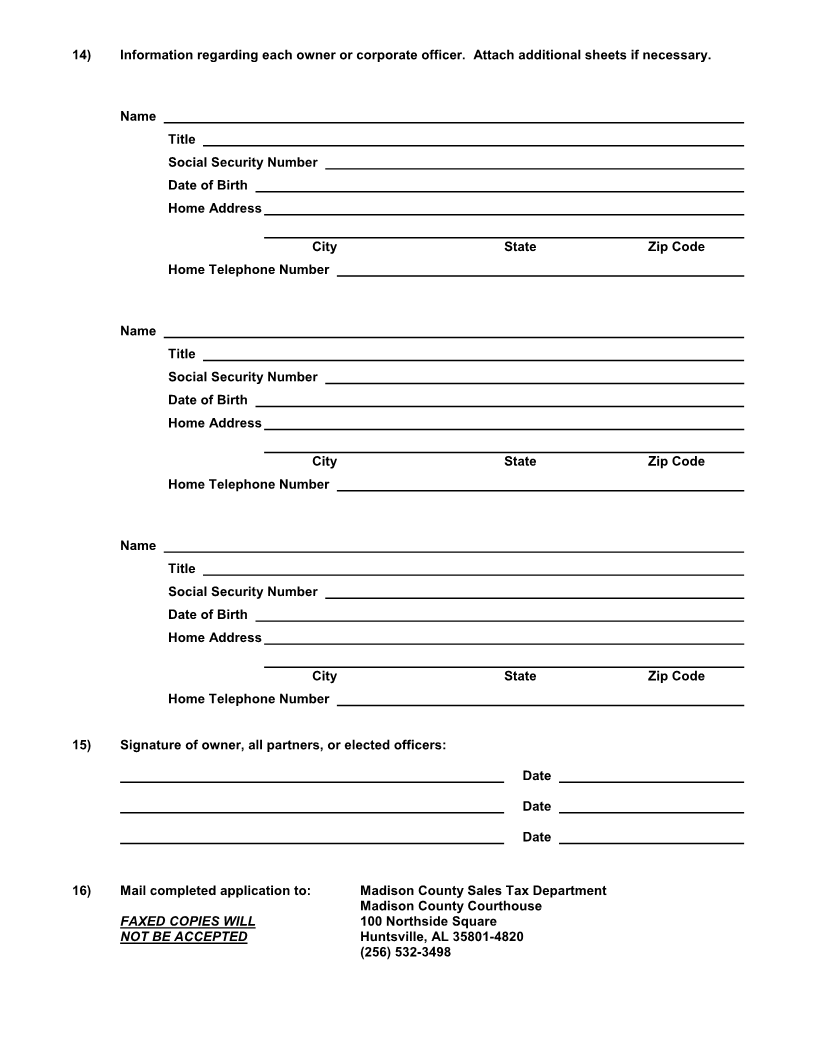

APPLICATION FOR SALES AND/OR USE TAX

MADISON COUNTY, ALABAMA

INSTRUCTIONS: COMPLETE EACH LINE. A NUMBER CANNOT BE ISSUED UNTIL THIS FORM IS

COMPLETED. TYPE OR PRINT LEGIBLY.

1) Company Name

2) Doing Business As (D/B/A)

3) Federal Employer Identification Number (FEIN)

4) Number of business locations in Madison County

5) Address(es) of business location(s) in Madison County (attach additional sheets if necessary)

City State Zip Code

6) Mailing Address

City State Zip Code

7) E-mail Address

8) Type of business (grocery, hardware, clothing sales, etc.)

Please check one:

( ) Principally Wholesale ( ) Contractors – Use

( ) Principally Retail ( ) Other

Please check one:

( ) Corporation (attach copy of Certificate of Incorporation)

( ) Partnership

( ) Sole Ownership

9) Check one: ( ) Huntsville City Limits ( ) Outside City Limits

10) Former business name and owner

11) Date retail sales and/or use tax began (begin) in Madison County

12) Person to contact if questions arise

Business # Extension Home #

13) Filing Status, Please check one:

( ) Monthly (gross taxable amount is greater than $2000/month)

( ) Quarterly (gross taxable amount is less than $2000/month)

( ) Semi-annually

( ) Annually

* We DO NOT offer an OCCASIONAL filing status. You MUST choose a status listed above.