Enlarge image

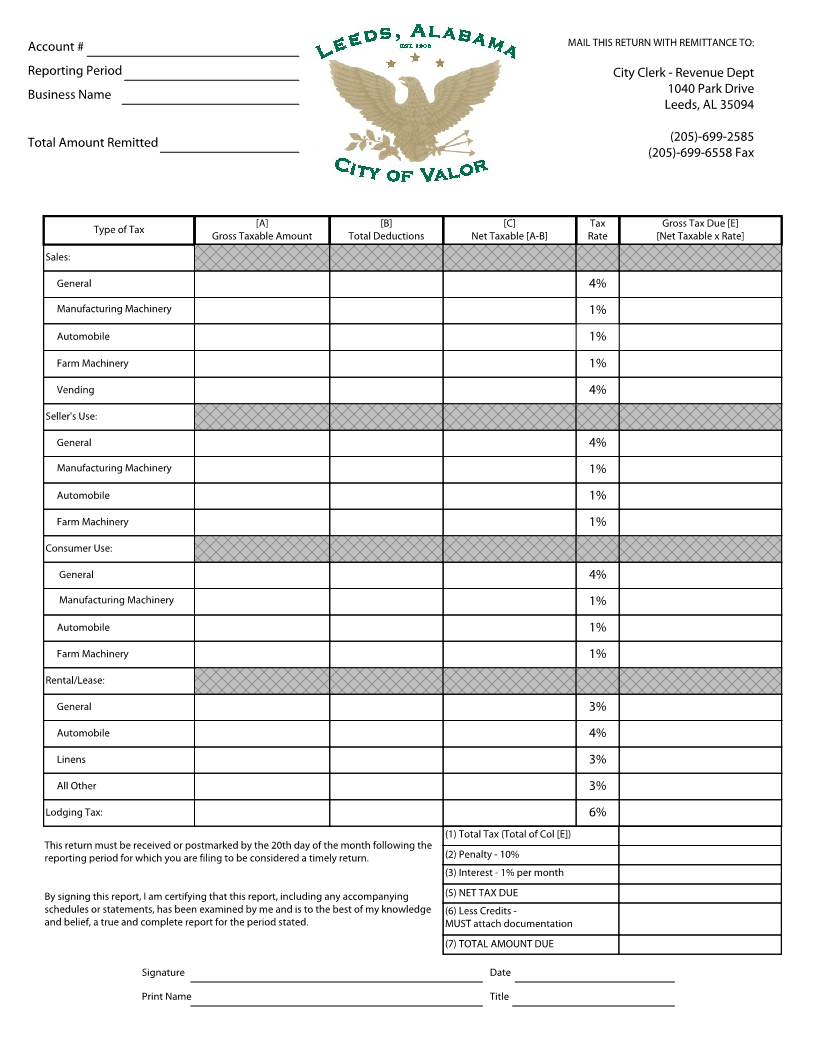

Account # MAIL THIS RETURN WITH REMITTANCE TO:

Reporting Period City Clerk - Revenue Dept

Business Name 1040 Park Drive

Leeds, AL 35094

Total Amount Remitted (205)-699-2585

(205)-699-6558 Fax

Type of Tax [A] [B] [C] Tax Gross Tax Due [E]

Gross Taxable Amount Total Deductions Net Taxable [A-B] Rate [Net Taxable x Rate]

Sales:

General 4%

Manufacturing Machinery 1%

Automobile 1%

Farm Machinery 1%

Vending 4%

Seller's Use:

General 4%

Manufacturing Machinery 1%

Automobile 1%

Farm Machinery 1%

Consumer Use:

General 4%

Manufacturing Machinery 1%

Automobile 1%

Farm Machinery 1%

Rental/Lease:

General 3%

Automobile 4%

Linens 3%

All Other 3%

Lodging Tax: 6%

(1) Total Tax (Total of Col [E])

This return must be received or postmarked by the 20th day of the month following the

reporting period for which you are filing to be considered a timely return. (2) Penalty - 10%

(3) Interest - 1% per month

By signing this report, I am certifying that this report, including any accompanying (5) NET TAX DUE

schedules or statements, has been examined by me and is to the best of my knowledge (6) Less Credits -

and belief, a true and complete report for the period stated. MUST attach documentation

(7) TOTAL AMOUNT DUE

Signature Date

Print Name Title