Enlarge image

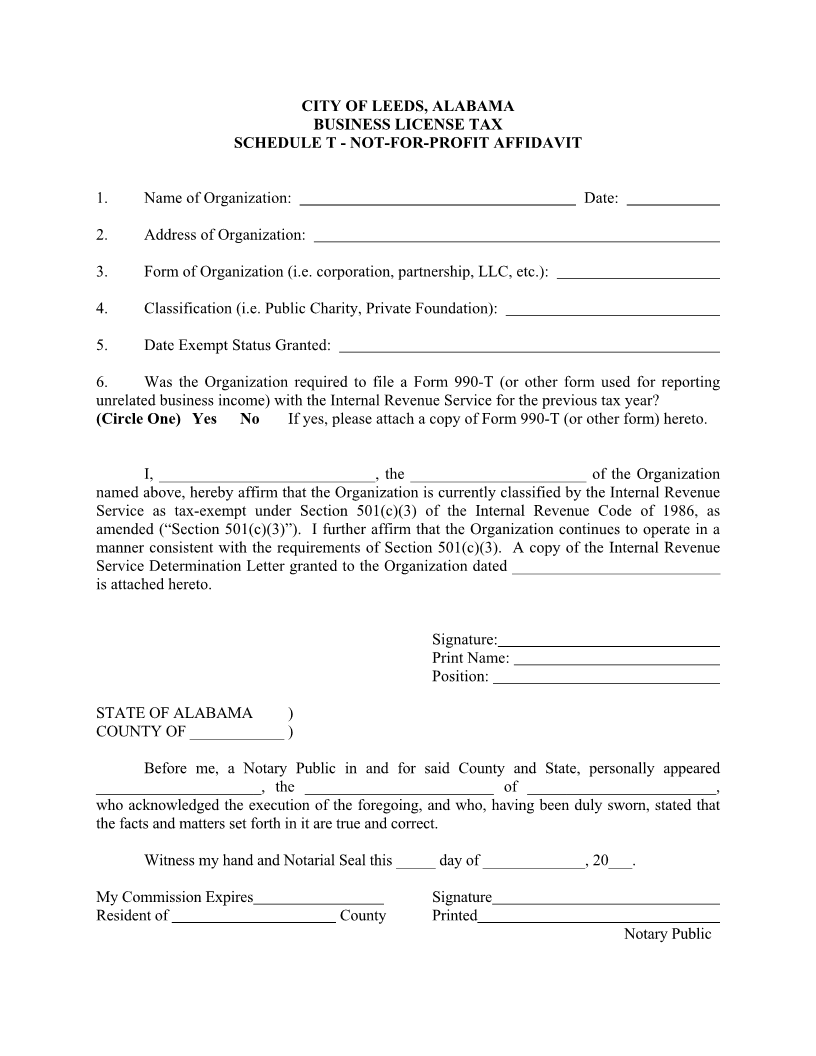

CITY OF LEEDS, ALABAMA

BUSINESS LICENSE TAX

SCHEDULE T - NOT-FOR-PROFIT AFFIDAVIT

1. Name of Organization: Date:

2. Address of Organization:

3. Form of Organization (i.e. corporation, partnership, LLC, etc.):

4. Classification (i.e. Public Charity, Private Foundation):

5. Date Exempt Status Granted:

6. Was the Organization required to file a Form 990-T (or other form used for reporting

unrelated business income) with the Internal Revenue Service for the previous tax year?

(Circle One) Yes No If yes, please attach a copy of Form 990-T (or other form) hereto.

I, ___________________________, the ______________________ of the Organization

named above, hereby affirm that the Organization is currently classified by the Internal Revenue

Service as tax-exempt under Section 501(c)(3) of the Internal Revenue Code of 1986, as

amended (“Section 501(c)(3)”). I further affirm that the Organization continues to operate in a

manner consistent with the requirements of Section 501(c)(3). A copy of the Internal Revenue

Service Determination Letter granted to the Organization dated __________________________

is attached hereto.

Signature:

Print Name:

Position:

STATE OF ALABAMA )

COUNTY OF ____________ )

Before me, a Notary Public in and for said County and State, personally appeared

_____________________, the ________________________ of ________________________,

who acknowledged the execution of the foregoing, and who, having been duly sworn, stated that

the facts and matters set forth in it are true and correct.

Witness my hand and Notarial Seal this _____ day of _____________, 20___.

My Commission Expires Signature

Resident of County Printed

Notary Public