Enlarge image

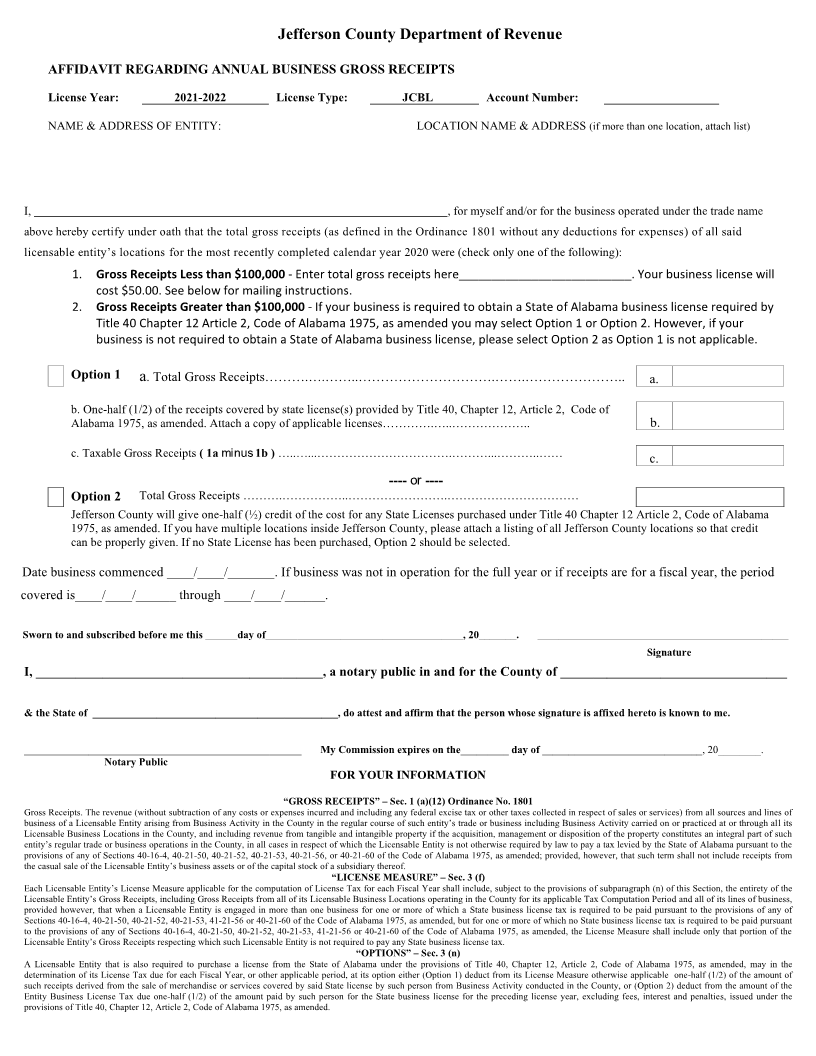

Jefferson County Department of Revenue

AFFIDAVIT REGARDING ANNUAL BUSINESS GROSS RECEIPTS

License Year: 2021-2022 License Type: JCBL Account Number:

NAME & ADDRESS OF ENTITY: LOCATION NAME & ADDRESS (if more than one location, attach list)

I, , for myself and/or for the business operated under the trade name

above hereby certify under oath that the total gross receipts (as defined in the Ordinance 1801 without any deductions for expenses) of all said

licensable entity’s locations for the most recently completed calendar year 2020 were (check only one of the following):

1. Gross Receipts Less than $100,000 - Enter total gross receipts here__________________________. Your business license will

cost $50.00. See below for mailing instructions.

2. Gross Receipts Greater than $100,000 - If your business is required to obtain a State of Alabama business license required by

Title 40 Chapter 12 Article 2, Code of Alabama 1975, as amended you may select Option 1 or Option 2. However, if your

business is not required to obtain a State of Alabama business license, please select Option 2 as Option 1 is not applicable.

Option 1 a. Total Gross Receipts……….….……..………………………….…….………………….. a.

b. One-half (1/2) of the receipts covered by state license(s) provided by Title 40, Chapter 12, Article 2, Code of

Alabama 1975, as amended. Attach a copy of applicable licenses………….…..……………….. b.

c. Taxable Gross Receipts ( 1a minus 1b ) …..…...…………………………….………...………..…… c.

---- or----

Option 2 Total Gross Receipts ……….……………..…………………….……………………………

Jefferson County will give one-half (½) credit of the cost for any State Licenses purchased under Title 40 Chapter 12 Article 2, Code of Alabama

1975, as amended. If you have multiple locations inside Jefferson County, please attach a listing of all Jefferson County locations so that credit

can be properly given. If no State License has been purchased, Option 2 should be selected.

Date business commenced ____/____/_______. If business was not in operation for the full year or if receipts are for a fiscal year, the period

covered is____/____/______ through ____/____/______.

Sworn to and subscribed before me this ______day of_____________________________________, 20_______. _______________________________________________

Signature

I, ___________________________________________, a notary public in and for the County of __________________________________

& the State of ______________________________________________, do attest and affirm that the person whose signature is affixed hereto is known to me.

____________________________________________________ My Commission expires on the_________ day of ______________________________, 20________.

Notary Public

FOR YOUR INFORMATION

“GROSS RECEIPTS” – Sec. 1 (a)(12) Ordinance No. 1801

Gross Receipts. The revenue (without subtraction of any costs or expenses incurred and including any federal excise tax or other taxes collected in respect of sales or services) from all sources and lines of

business of a Licensable Entity arising from Business Activity in the County in the regular course of such entity’s trade or business including Business Activity carried on or practiced at or through all its

Licensable Business Locations in the County, and including revenue from tangible and intangible property if the acquisition, management or disposition of the property constitutes an integral part of such

entity’s regular trade or business operations in the County, in all cases in respect of which the Licensable Entity is not otherwise required by law to pay a tax levied by the State of Alabama pursuant to the

provisions of any of Sections 40-16-4, 40-21-50, 40-21-52, 40-21-53, 40-21-56, or 40-21-60 of the Code of Alabama 1975, as amended; provided, however, that such term shall not include receipts from

the casual sale of the Licensable Entity’s business assets or of the capital stock of a subsidiary thereof.

“LICENSE MEASURE” – Sec. 3 (f)

Each Licensable Entity’s License Measure applicable for the computation of License Tax for each Fiscal Year shall include, subject to the provisions of subparagraph (n) of this Section, the entirety of the

Licensable Entity’s Gross Receipts, including Gross Receipts from all of its Licensable Business Locations operating in the County for its applicable Tax Computation Period and all of its lines of business,

provided however, that when a Licensable Entity is engaged in more than one business for one or more of which a State business license tax is required to be paid pursuant to the provisions of any of

Sections 40-16-4, 40-21-50, 40-21-52, 40-21-53, 41-21-56 or 40-21-60 of the Code of Alabama 1975, as amended, but for one or more of which no State business license tax is required to be paid pursuant

to the provisions of any of Sections 40-16-4, 40-21-50, 40-21-52, 40-21-53, 41-21-56 or 40-21-60 of the Code of Alabama 1975, as amended, the License Measure shall include only that portion of the

Licensable Entity’s Gross Receipts respecting which such Licensable Entity is not required to pay any State business license tax.

“OPTIONS” – Sec. 3 (n)

A Licensable Entity that is also required to purchase a license from the State of Alabama under the provisions of Title 40, Chapter 12, Article 2, Code of Alabama 1975, as amended, may in the

determination of its License Tax due for each Fiscal Year, or other applicable period, at its option either (Option 1) deduct from its License Measure otherwise applicable one-half (1/2) of the amount of

such receipts derived from the sale of merchandise or services covered by said State license by such person from Business Activity conducted in the County, or (Option 2) deduct from the amount of the

Entity Business License Tax due one-half (1/2) of the amount paid by such person for the State business license for the preceding license year, excluding fees, interest and penalties, issued under the

provisions of Title 40, Chapter 12, Article 2, Code of Alabama 1975, as amended.