Enlarge image

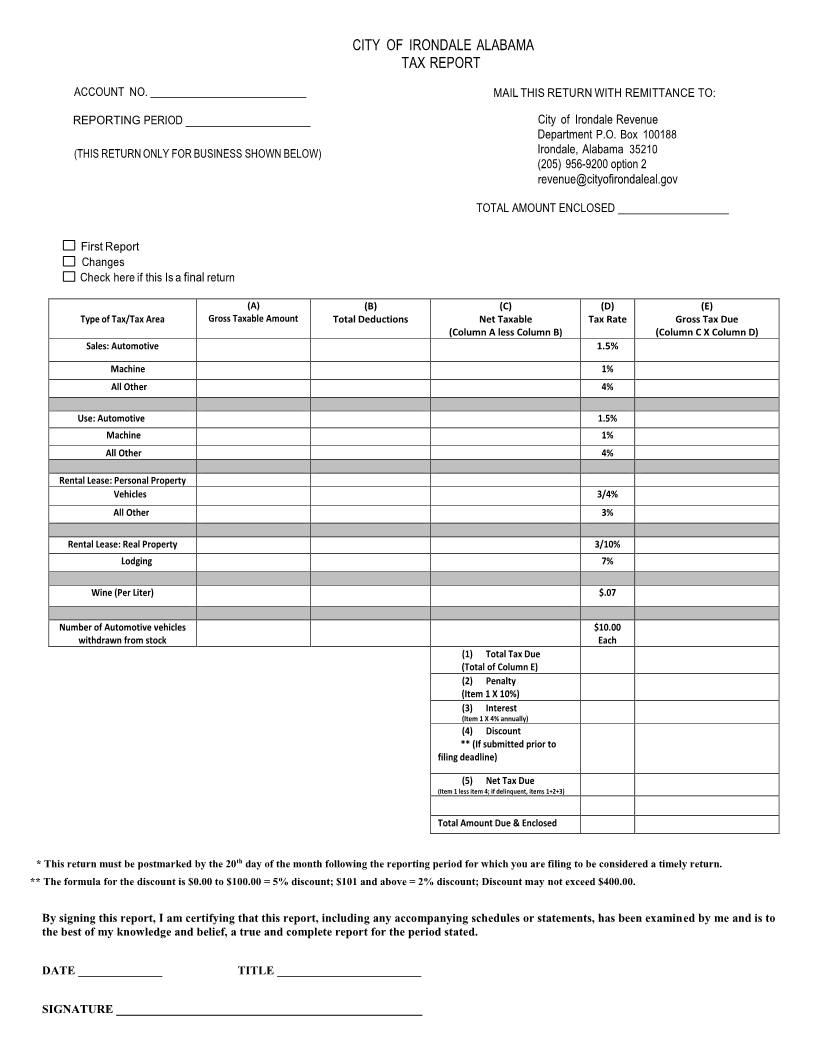

CITY OF IRONDALE ALABAMA

TAX REPORT

ACCOUNT NO. MAIL THIS RETURN WITH REMITTANCE TO:

REPORTING PERIOD ______________________ City of Irondale Revenue

Department P.O. Box 100188

(THIS RETURN ONLY FOR BUSINESS SHOWN BELOW) Irondale, Alabama 35210

(205) 956-9200 option 2

revenue@cityofirondaleal.gov

TOTAL AMOUNT ENCLOSED _________________

First Report

Changes

Check here if this Is a final return

(A) (B) (C) (D) (E)

Type of Tax/Tax Area Gross Taxable Amount Total Deductions Net Taxable Tax Rate Gross Tax Due

(Column A less Column B) (Column C X Column D)

Sales: Automotive 1.5%

Machine 1%

All Other 4%

Use: Automotive 1.5%

Machine 1%

All Other 4%

Rental Lease: Personal Property

Vehicles 3/4%

All Other 3%

Rental Lease: Real Property 3/10%

Lodging 7%

Wine (Per Liter) $.07

Number of Automotive vehicles $10.00

withdrawn from stock Each

(1) Total Tax Due

(Total of Column E)

(2) Penalty

(Item 1 X 10%)

(3) Interest

(Item 1 X 4% annually )

(4) Discount

** (If submitted prior to

filing deadline)

(5) Net Tax Due

(Item 1 less item 4; if delinquent, items 1+2+3)

Total Amount Due & Enclosed

* This return must be postmarked by the 20 thday of the month following the reporting period for which you are filing to be considered a timely return.

** The formula for the discount is $0.00 to $100.00 = 5% discount; $101 and above = 2% discount; Discount may not exceed $400.00.

By signing this report, I am certifying that this report, including any accompanying schedules or statements, has been examined by me and is to

the best of my knowledge and belief, a true and complete report for the period stated.

DATE ______________ TITLE ________________________

SIGNATURE ___________________________________________________