Enlarge image

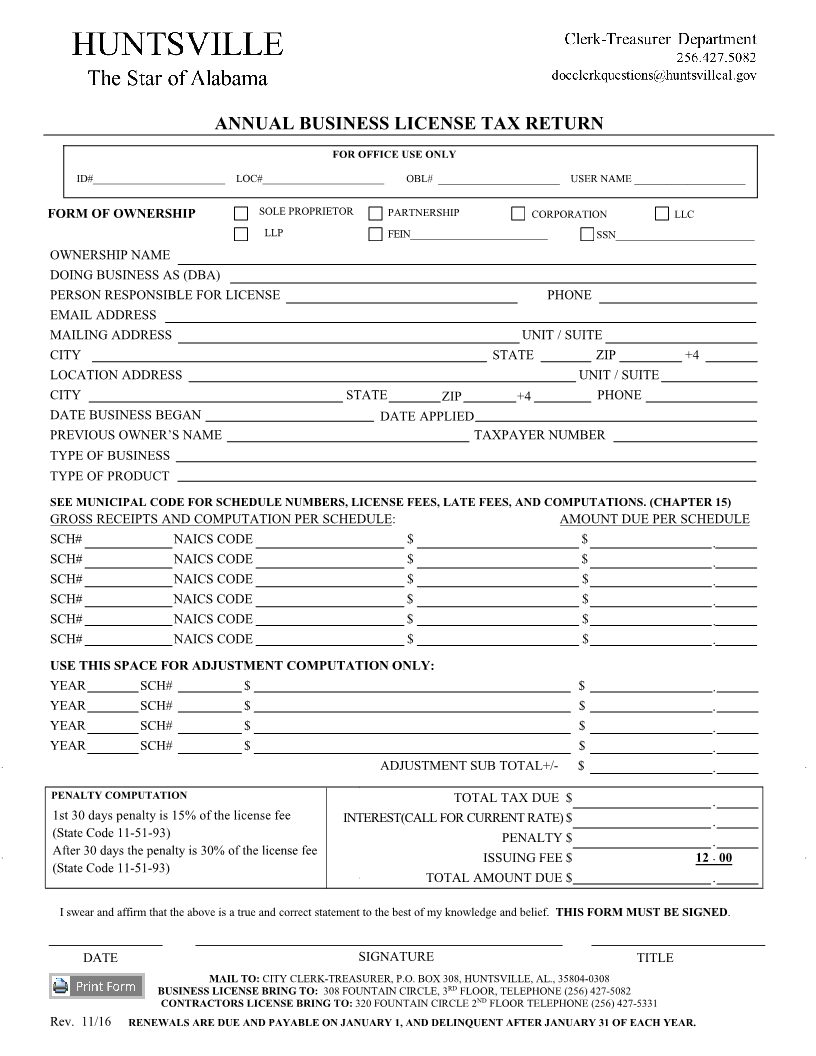

ANNUAL BUSINESS LICENSE TAX RETURN

FOR OFFICE USE ONLY

ID#_________________________ LOC#_______________________ OBL# _______________________ USER NAME _____________________

FORM OF OWNERSHIP SOLE PROPRIETOR PARTNERSHIP CORPORATION LLC

LLP FEIN__________________________ SSN__________________________

OWNERSHIP NAME

DOING BUSINESS AS (DBA)

PERSON RESPONSIBLE FOR LICENSE PHONE

EMAIL ADDRESS

MAILING ADDRESS UNIT / SUITE

CITY STATE ZIP +4

LOCATION ADDRESS UNIT / SUITE

CITY STATE ZIP +4 PHONE

DATE BUSINESS BEGAN DATE APPLIED

PREVIOUS OWNER’S NAME TAXPAYER NUMBER

TYPE OF BUSINESS

TYPE OF PRODUCT

SEE MUNICIPAL CODE FOR SCHEDULE NUMBERS, LICENSE FEES, LATE FEES, AND COMPUTATIONS. (CHAPTER 15)

GROSS RECEIPTS AND COMPUTATION PER SCHEDULE: AMOUNT DUE PER SCHEDULE

SCH# NAICS CODE $ $ .

SCH# NAICS CODE $ $ .

SCH# NAICS CODE $ $ .

SCH# NAICS CODE $ $ .

SCH# NAICS CODE $ $ .

SCH# NAICS CODE $ $ .

USE THIS SPACE FOR ADJUSTMENT COMPUTATION ONLY:

YEAR SCH# $ $ .

YEAR SCH# $ $ .

YEAR SCH# $ $ .

YEAR SCH# $ $ .

ADJUSTMENT SUB TOTAL+/- $ .

PENALTY COMPUTATION TOTAL TAX DUE $ .

1st 30 days penalty is 15% of the license fee INTEREST(CALL FOR CURRENT RATE) $ .

(State Code 11-51-93) PENALTY $ .

After 30 days the penalty is 30% of the license fee 12 .00

ISSUING FEE $

(State Code 11-51-93)

TOTAL AMOUNT DUE $ .

I swear and affirm that the above is a true and correct statement to the best of my knowledge and belief. THIS FORM MUST BE SIGNED.

DATE SIGNATURE TITLE

MAIL TO: CITY CLERK-TREASURER, P.O. BOX 308, HUNTSVILLE, AL., 35804-0308

BUSINESS LICENSE BRING TO: 308 FOUNTAIN CIRCLE, 3 RDFLOOR, TELEPHONE (256) 427-5082

CONTRACTORS LICENSE BRING TO:320 FOUNTAIN CIRCLE 2 NDFLOOR TELEPHONE (256) 427-5331

Rev. 1 / 1 16 RENEWALS ARE DUE AND PAYABLE ON JANUARY 1, AND DELINQUENT AFTER JANUARY 31 OF EACH YEAR.