Enlarge image

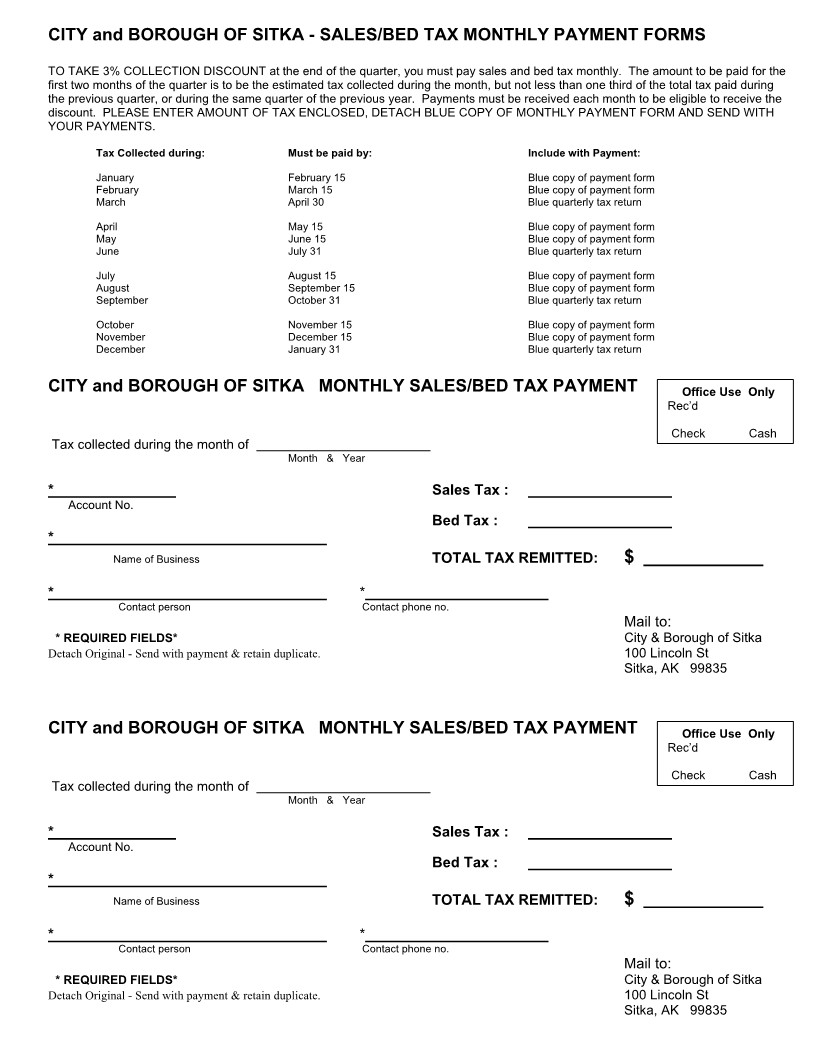

CITY and BOROUGH OF SITKA - SALES/BED TAX MONTHLY PAYMENT FORMS

TO TAKE 3% COLLECTION DISCOUNT at the end of the quarter, you must pay sales and bed tax monthly. The amount to be paid for the

first two months of the quarter is to be the estimated tax collected during the month, but not less than one third of the total tax paid during

the previous quarter, or during the same quarter of the previous year. Payments must be received each month to be eligible to receive the

discount. PLEASE ENTER AMOUNT OF TAX ENCLOSED, DETACH BLUE COPY OF MONTHLY PAYMENT FORM AND SEND WITH

YOUR PAYMENTS.

Tax Collected during: Must be paid by: Include with Payment:

January February 15 Blue copy of payment form

February March 15 Blue copy of payment form

March April 30 Blue quarterly tax return

April May 15 Blue copy of payment form

May June 15 Blue copy of payment form

June July 31 Blue quarterly tax return

July August 15 Blue copy of payment form

August September 15 Blue copy of payment form

September October 31 Blue quarterly tax return

October November 15 Blue copy of payment form

November December 15 Blue copy of payment form

December January 31 Blue quarterly tax return

CITY and BOROUGH OF SITKA MONTHLY SALES/BED TAX PAYMENT Office Use Only

Rec’d

R

Check Cash

Tax collected during the month of

Month & Year

* Sales Tax :

Account No.

Bed Tax :

*

Name of Business TOTAL TAX REMITTED: $

* *

Contact person Contact phone no.

Mail to:

* REQUIRED FIELDS* City & Borough of Sitka

Detach Original - Send with payment & retain duplicate. 100 Lincoln St

Sitka, AK 99835

CITY and BOROUGH OF SITKA MONTHLY SALES/BED TAX PAYMENT Office Use Only

Rec’d

R

Check Cash

Tax collected during the month of

Month & Year

* Sales Tax :

Account No.

Bed Tax :

*

Name of Business TOTAL TAX REMITTED: $

* *

Contact person Contact phone no.

Mail to:

* REQUIRED FIELDS* City & Borough of Sitka

Detach Original - Send with payment & retain duplicate. 100 Lincoln St

Sitka, AK 99835