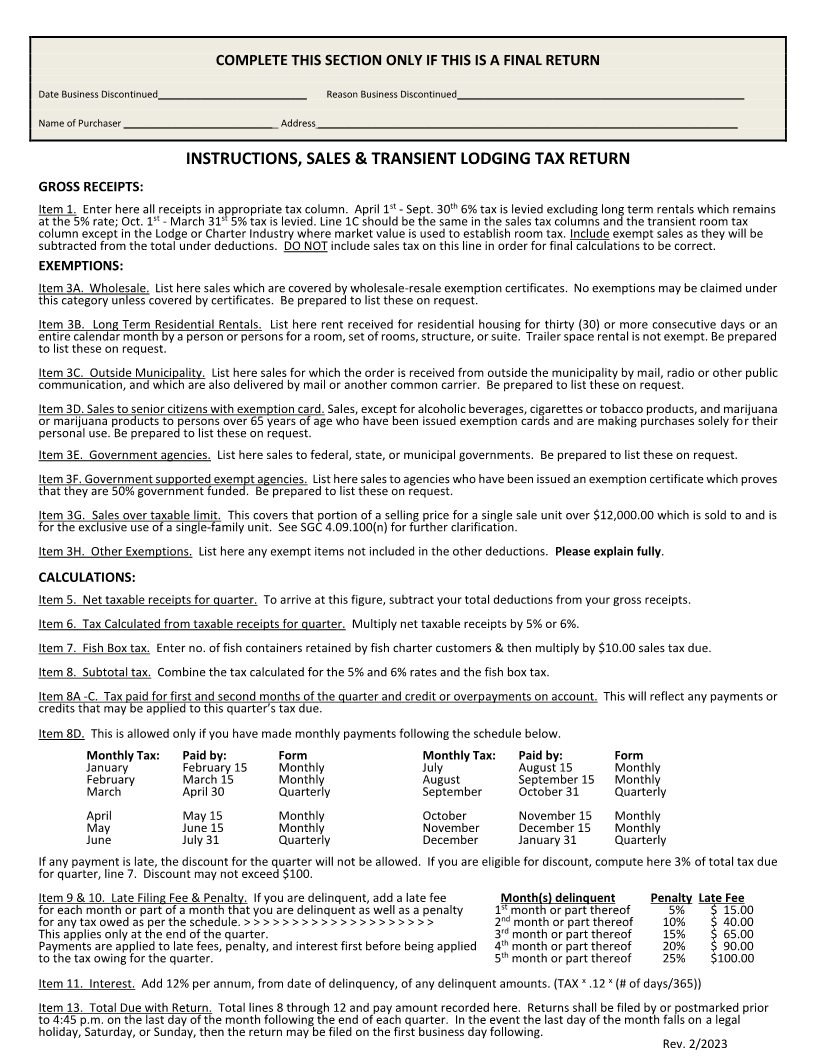

Enlarge image

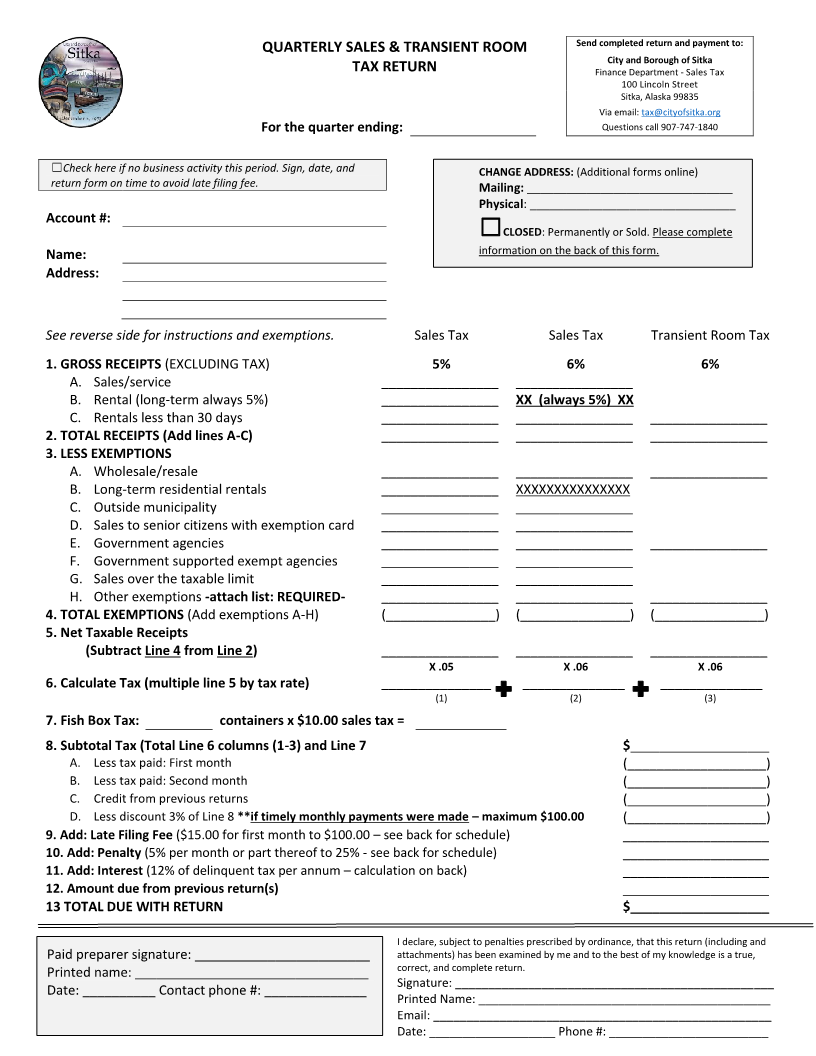

Send completed return and payment to:

QUARTERLY SALES & TRANSIENT ROOM

City and Borough of Sitka

TAX RETURN Finance Department - Sales Tax

100 Lincoln Street

Sitka, Alaska 99835

Via email: tax@cityofsitka.org

For the quarter ending: Questions call 907-747-1840

☐Check here if no business activity this period. Sign, date, and CHANGE ADDRESS: (Additional forms online)

return form on time to avoid late filing fee. Mailing: _______________________________

Physical: _______________________________

Account #:

☐CLOSED: Permanently or Sold. Please complete

Name: information on the back of this form.

Address:

See reverse side for instructions and exemptions. Sales Tax Sales Tax Transient Room Tax

1. GROSS RECEIPTS (EXCLUDING TAX) 5% 6% 6%

A. Sales/service ________________ ________________

B. Rental (long-term always 5%) ________________ XX (always 5%) XX

C. Rentals less than 30 days ________________ ________________ ________________

2. TOTAL RECEIPTS (Add lines A-C) ________________ ________________ ________________

3. LESS EXEMPTIONS

A. Wholesale/resale ________________ ________________ ________________

B. Long-term residential rentals ________________ XXXXXXXXXXXXXXX

C. Outside municipality ________________ ________________

D. Sales to senior citizens with exemption card ________________ ________________

E. Government agencies ________________ ________________ ________________

F. Government supported exempt agencies ________________ ________________

G. Sales over the taxable limit ________________ ________________

H. Other exemptions -attach list: REQUIRED- ________________ ________________ ________________

4. TOTAL EXEMPTIONS (Add exemptions A-H) (_______________) (_______________) (_______________)

5. Net Taxable Receipts

(Subtract Line 4 from Line 2) ________________ ________________ ________________

X .05 X .06 X .06

6. Calculate Tax (multiple line 5 by tax rate) _______________ ______________ ______________

(1) (2) (3)

7. Fish Box Tax: containers x $10.00 sales tax =

8. Subtotal Tax (Total Line 6 columns (1-3) and Line 7 $___________________

A. Less tax paid: First month (___________________)

B. Less tax paid: Second month (___________________)

C. Credit from previous returns (___________________)

D. Less discount 3% of Line 8 **if timely monthly payments were made – maximum $100.00 (___________________)

9. Add: Late Filing Fee($15.00 for first month to $100.00 –see back for schedule) ____________________

10. Add: Penalty (5% per month or part thereof to 25% - see back for schedule) ____________________

11. Add: Interest(12% of delinquent tax per annum –calculation on back) ____________________

12. Amount due from previous return(s) ____________________

13 TOTAL DUE WITH RETURN $___________________

I declare, subject to penalties prescribed by ordinance, that this return (including and

Paid preparer signature: ________________________ attachments) has been examined by me and to the best of my knowledge is a true,

correct, and complete return.

Printed name: ________________________________

Signature: ________________________________________________

Date: __________ Contact phone #: ______________

Printed Name: ____________________________________________

Email: ___________________________________________________

Date: ___________________ Phone #: ________________________