Enlarge image

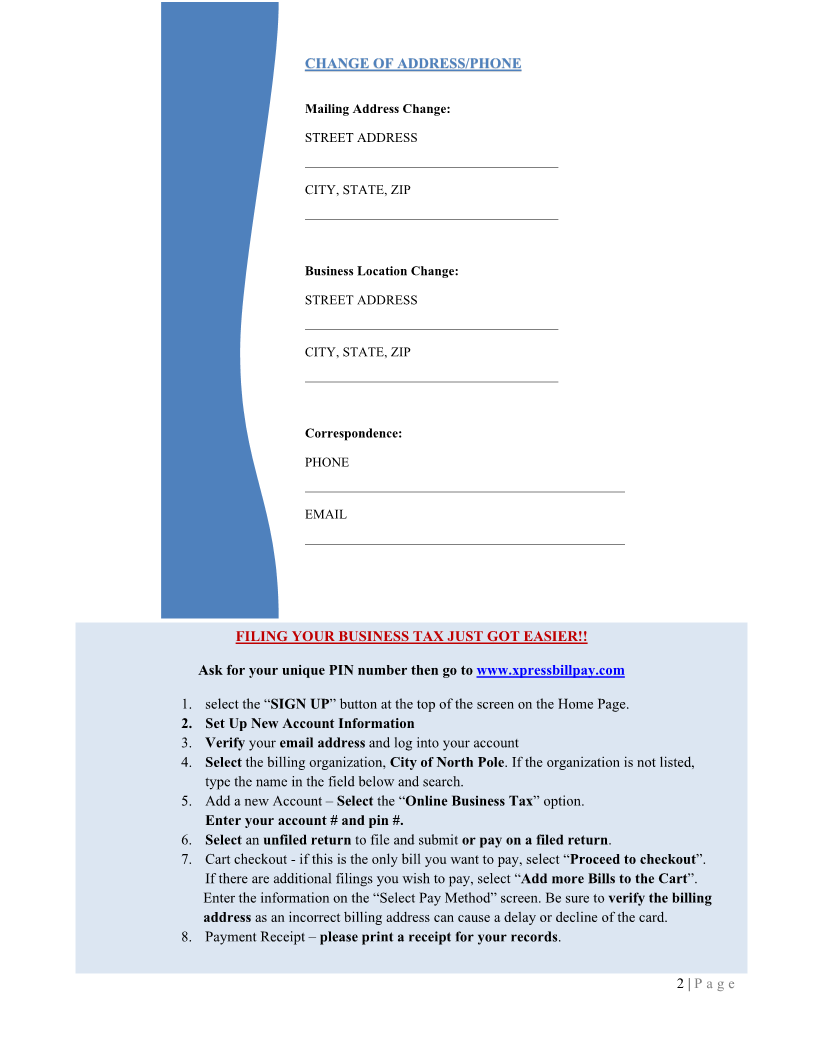

City of North Pole SALES TAX Remittance Form

Payments must accompany tax submission for a complete filing. Tax submissions are for the previous sales

month and are due by the last day of the following month by 5 pm (i.e., June sales are filed and paid by July 31).

Zero sales months still require a filing to be completed.

Mail To: THE CITY OF NORTH POLE DATE: __________

125 SNOWMAN LANE

BUSINESS LICENSE NUMBER: _______________

NORTH POLE, AK 99705

Phone: 907-488-8536 BUSINESS NAME: ___________________________

Online Filing: www.xpressbillpay.com

Check here if your physical address or phone number has changed, or if the business is closing.

Note changes on the back of this form. New owners must apply for a business license.

1. Gross Sales for Month Ending: $

2. Credit Card Service Fees $

3. Non-Taxable Sales (see chp.4, Sec. 4.08.020 & 4.08.050 of North Pole Code) $

4. Gross Taxable Sales $

(Subtract lines two and three from line one)

5. Sales Tax Due (5.5% of line four ) ($11 cap per transaction) $

6. Fees: (Calculate the following charges based on line five)

a. Returns 1 - 29 days past due add $25 or .00875 of sales tax

due, whichever is greater, in addition to the total amount due

. Incomplete returns add a penalty of $15. $

b. Returns 30- 60 days past due add $50 or .00875 of sales tax due,

whichever is greater, in addition to all previous fees and penalties. $

Incomplete returns will incur an additional penalty of $15.

c. Returns 61 days past due will incur a reoccurring monthly fee of

$50 in addition to all previous fees, and interest. Sellers failing to

file complete returns & full remittance will be subject to revocation of

their business license and a lien against the seller’s property will be

administered. $

7. TOTAL FEES DUE $

8. TOTAL SALES TAX/FEES DUE $

(Add lines 5,6 & 7 to show the amount here)

Interest at the rate of 10.5% per annum, applied monthly, shall accrue on all delinquent taxes & fees

starting from the due date until paid in full.

I DECLARE, SUBJECT TO THE FEES PRESCRIBED, THAT THIS RETURN (INCLUDING ACCOMPANYING STATEMENTS)

HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT, AND

COMPLETE RETURN.

DATE: OWNER/AGENT:

PHONE: _________________ EMAIL: ____________________________________________________________

1 | Pa g e