Enlarge image

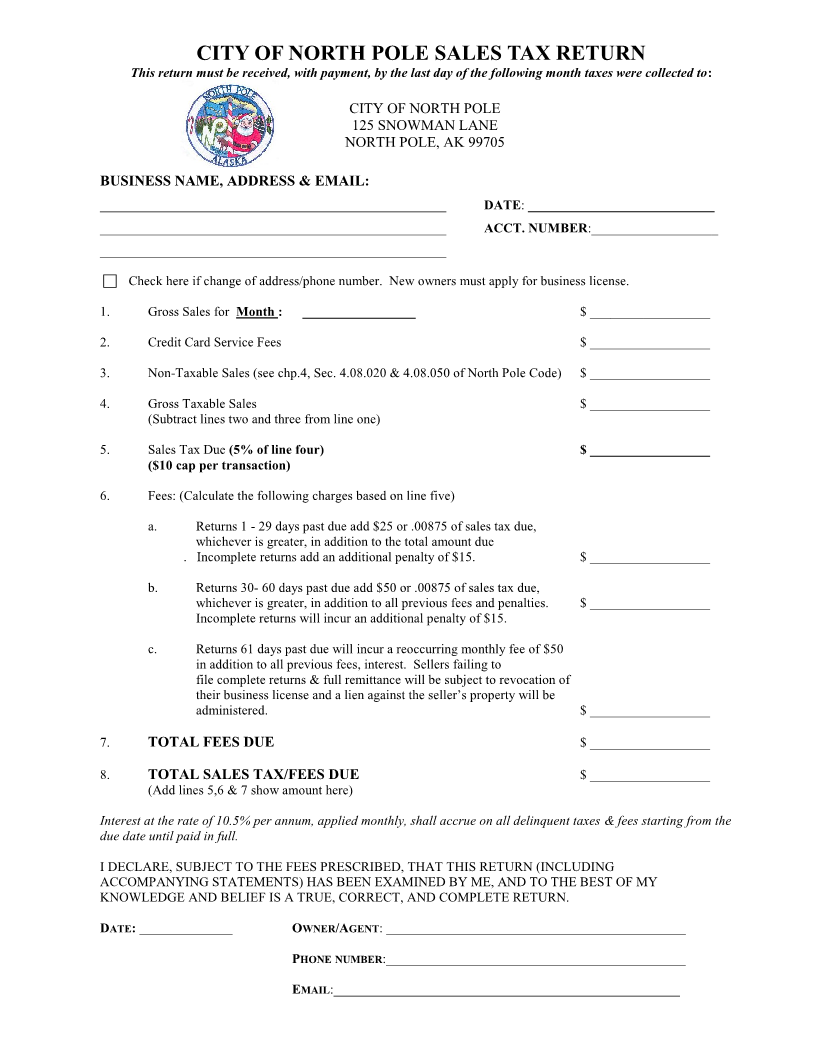

CITY OF NORTH POLE SALES TAX RETURN

This return must be received, with payment, by the last day of the following month taxes were collected to:

CITY OF NORTH POLE

125 SNOWMAN LANE

NORTH POLE, AK 99705

BUSINESS NAME, ADDRESS & EMAIL:

____________________________________________________ DATE:____________________________

____________________________________________________ ACCT. NUMBER:___________________

____________________________________________________

Check here if change of address/phone number. New owners must apply for business license.

1. Gross Sales for Month : _________________ $ __________________

2. Credit Card Service Fees $ __________________

3. Non-Taxable Sales (see chp.4, Sec. 4.08.020 & 4.08.050 of North Pole Code) $ __________________

4. Gross Taxable Sales $ __________________

(Subtract lines two and three from line one)

5. Sales Tax Due (5% of line four) $ __________________

($10 cap per transaction)

6. Fees: (Calculate the following charges based on line five)

a. Returns 1 - 29 days past due add $25 or .00875 of sales tax due,

whichever is greater, in addition to the total amount due

. Incomplete returns add an additional penalty of $15. $ __________________

b. Returns 30- 60 days past due add $50 or .00875 of sales tax due,

whichever is greater, in addition to all previous fees and penalties. $ __________________

Incomplete returns will incur an additional penalty of $15.

c. Returns 61 days past due will incur a reoccurring monthly fee of $50

in addition to all previous fees, interest. Sellers failing to

file complete returns & full remittance will be subject to revocation of

their business license and a lien against the seller’s property will be

administered. $ __________________

7. TOTAL FEES DUE $ __________________

8. TOTAL SALES TAX/FEES DUE $ __________________

(Add lines 5,6 & 7 show amount here)

Interest at the rate of 10.5% per annum, applied monthly, shall accrue on all delinquent taxes & fees starting from the

due date until paid in full.

I DECLARE, SUBJECT TO THE FEES PRESCRIBED, THAT THIS RETURN (INCLUDING

ACCOMPANYING STATEMENTS) HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IS A TRUE, CORRECT, AND COMPLETE RETURN.

DATE: ______________ OWNER/AGENT: _____________________________________________

PHONE NUMBER :_____________________________________________

EMAIL:____________________________________________________