Enlarge image

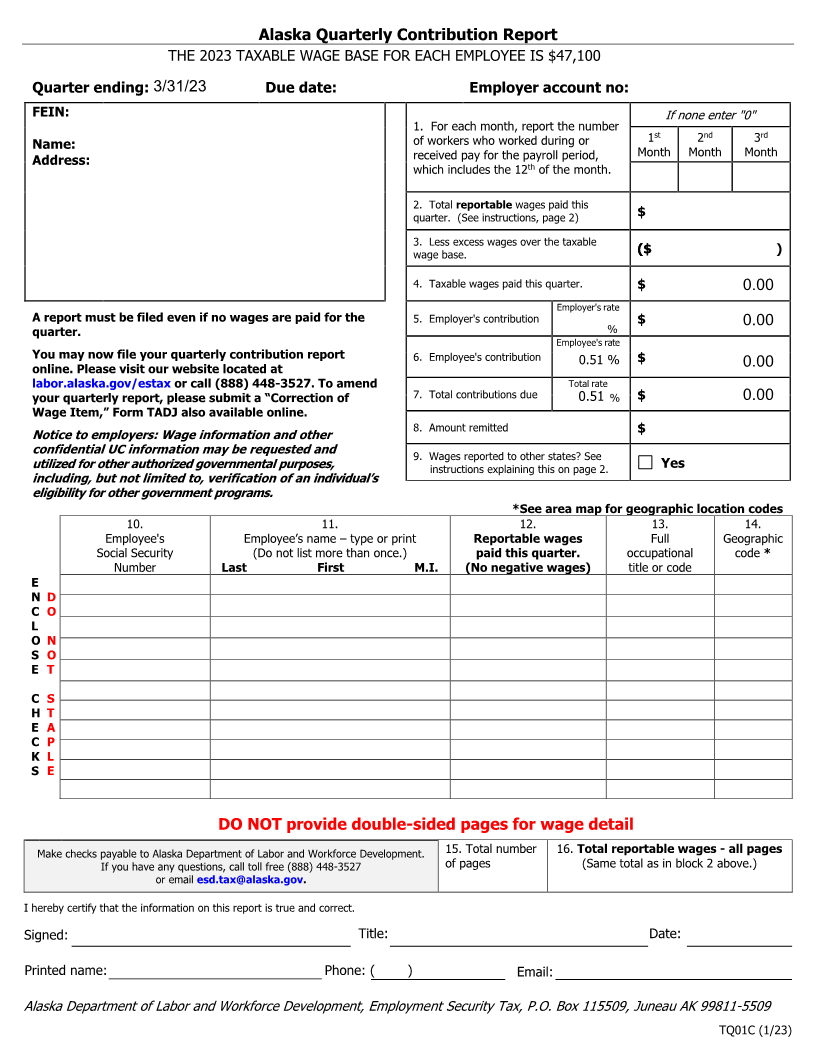

Alaska Quarterly Contribution Report

THE 202 3TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $417 , 00

Quarter ending: 3/31/23 Due date: Employer account no:

FEIN: If none enter "0"

1. For each month, report the number

Name: of workers who worked during or 1st 2nd 3rd

Address: received pay for the payroll period, Month Month Month

which includes the 12 thof the month.

2. Total reportable wages paid this

quarter. (See instructions, page 2) $

3. Less excess wages over the taxable

wage base. ( ($$ )

4. Taxable wages paid this quarter. $ 0.00

Employer's rate

A report must be filed even if no wages are paid for the 5. Employer's contribution $ 0.00

quarter. %

Employee's rate

You may now file your quarterly contribution report 6. Employee's contribution 0 1 .5 % $ 0.00

online. Please visit our website located at

labor.alaska.gov/estax or call (888) 448-3527. To amend Total rate

your quarterly report, please submit a “Correction of 7. Total contributions due 0.51 % $ 0.00

Wage Item,” Form TADJ also available online.

8. Amount remitted

Notice to employers: Wage information and other $

confidential UC information may be requested and 9. Wages reported to other states? See

utilized for other authorized governmental purposes, instructions explaining this on page 2. Yes

including, but not limited to, verification of an individual’s

eligibility for other government programs.

*See area map for geographic location codes

10. 11. 12. 13. 14.

Employee's Employee’s name – type or print Reportable wages Full Geographic

Social Security (Do not list more than once.) paid this quarter. occupational code *

Number Last First M.I. (No negative wages) title or code

E

N D

C O

L

O N

S O

E T

C S

H T

E A

C P

K L

S E

DO NOT provide double-sided pages for wage detail

Make checks payable to Alaska Department of Labor and Workforce Development. 15. Total number 16. Total reportable wages - all pages

If you have any questions, call toll free (888) 448-3527 of pages (Same total as in block 2 above.)

or email esd.tax@alaska.gov.

I hereby certify that the information on this report is true and correct.

Signed: Title: Date:

Printed name: Phone: ( ) Email:

Alaska Department of Labor and Workforce Development, Employment Security Tax, P.O. Box 115509, Juneau AK 99811-5509

TQ01C (1/23)