Enlarge image

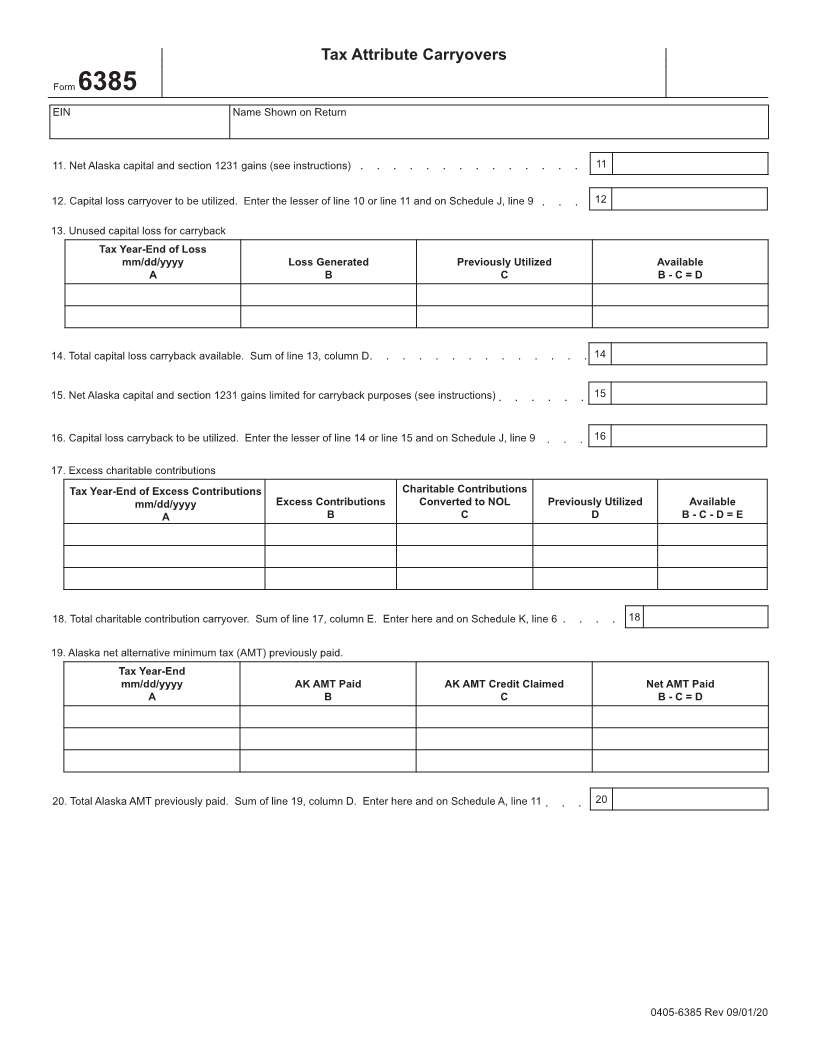

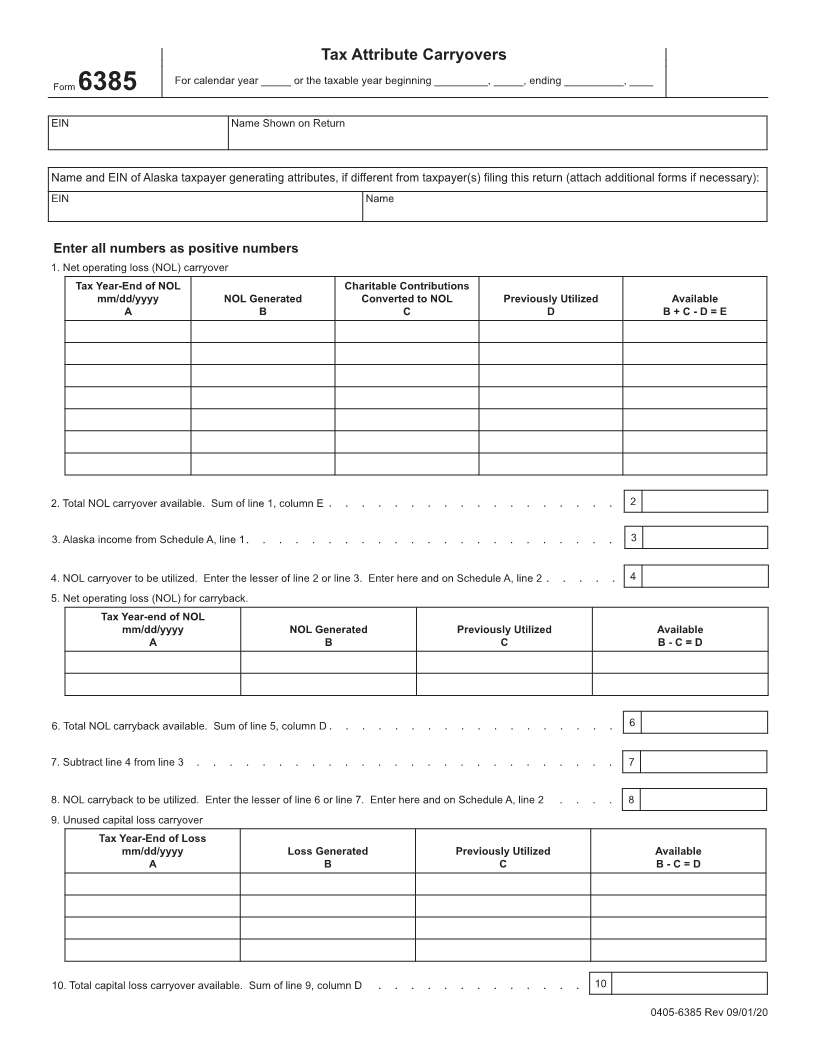

Tax Attribute Carryovers

Form For calendar year _____ or the taxable year beginning _________, _____, ending __________, ____

6385

EIN Name Shown on Return

Name and EIN of Alaska taxpayer generating attributes, if different from taxpayer(s) filing this return (attach additional forms if necessary):

EIN Name

Enter all numbers as positive numbers

1. Net operating loss (NOL) carryover

Tax Year-End of NOL Charitable Contributions

mm/dd/yyyy NOL Generated Converted to NOL Previously Utilized Available

A B C D B + C - D = E

2. Total NOL carryover available. Sum of line 1, column E . . . . . . . . . . . . . . . . . . 2

3. Alaska income from Schedule A, line 1. . . . . . . . . . . . . . . . . . . . . . . 3

4. NOL carryover to be utilized. Enter the lesser of line 2 or line 3. Enter here and on Schedule A, line 2 . . . . . 4

5. Net operating loss (NOL) for carryback.

Tax Year-end of NOL

mm/dd/yyyy NOL Generated Previously Utilized Available

A B C B - C = D

6. Total NOL carryback available. Sum of line 5, column D . . . . . . . . . . . . . . . . . . 6

7. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8. NOL carryback to be utilized. Enter the lesser of line 6 or line 7. Enter here and on Schedule A, line 2 . . . . 8

9. Unused capital loss carryover

Tax Year-End of Loss

mm/dd/yyyy Loss Generated Previously Utilized Available

A B C B - C = D

10. Total capital loss carryover available. Sum of line 9, column D . . . . . . . . . . . . . 10

0405-6385 Rev 09/01/20