Enlarge image

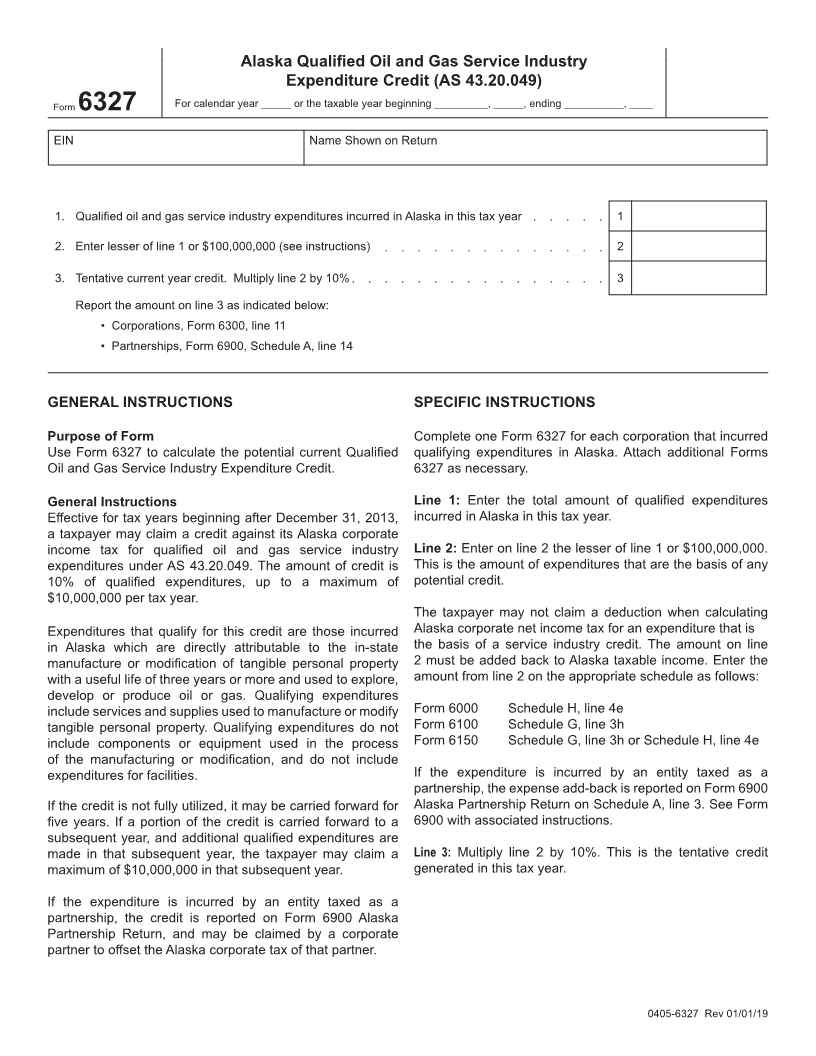

Alaska Qualified Oil and Gas Service Industry

Expenditure Credit (AS 43.20.049)

Form For calendar year _____ or the taxable year beginning _________, _____, ending __________, ____

6327

EIN Name Shown on Return

1. Qualified oil and gas service industry expenditures incurred in Alaska in this tax year . . . . . 1

2. Enter lesser of line 1 or $100,000,000 (see instructions) . . . . . . . . . . . . . . 2

3. Tentative current year credit. Multiply line 2 by 10% . . . . . . . . . . . . . . . . 3

Report the amount on line 3 as indicated below:

• Corporations, Form 6300, line 11

• Partnerships, Form 6900, Schedule A, line 14

GENERAL INSTRUCTIONS SPECIFIC INSTRUCTIONS

Purpose of Form Complete one Form 6327 for each corporation that incurred

Use Form 6327 to calculate the potential current Qualified qualifying expenditures in Alaska. Attach additional Forms

Oil and Gas Service Industry Expenditure Credit. 6327 as necessary.

General Instructions Line 1: Enter the total amount of qualified expenditures

Effective for tax years beginning after December 31, 2013, incurred in Alaska in this tax year.

a taxpayer may claim a credit against its Alaska corporate

income tax for qualified oil and gas service industry Line 2: Enter on line 2 the lesser of line 1 or $100,000,000.

expenditures under AS 43.20.049. The amount of credit is This is the amount of expenditures that are the basis of any

10% of qualified expenditures, up to a maximum of potential credit.

$10,000,000 per tax year.

The taxpayer may not claim a deduction when calculating

Expenditures that qualify for this credit are those incurred Alaska corporate net income tax for an expenditure that is

in Alaska which are directly attributable to the in-state the basis of a service industry credit. The amount on line

manufacture or modification of tangible personal property 2 must be added back to Alaska taxable income. Enter the

with a useful life of three years or more and used to explore, amount from line 2 on the appropriate schedule as follows:

develop or produce oil or gas. Qualifying expenditures

include services and supplies used to manufacture or modify Form 6000 Schedule H, line 4e

tangible personal property. Qualifying expenditures do not Form 6100 Schedule G, line 3h

include components or equipment used in the process Form 6150 Schedule G, line 3h or Schedule H, line 4e

of the manufacturing or modification, and do not include

expenditures for facilities. If the expenditure is incurred by an entity taxed as a

partnership, the expense add-back is reported on Form 6900

If the credit is not fully utilized, it may be carried forward for Alaska Partnership Return on Schedule A, line 3. See Form

five years. If a portion of the credit is carried forward to a 6900 with associated instructions.

subsequent year, and additional qualified expenditures are

made in that subsequent year, the taxpayer may claim a Line 3: Multiply line 2 by 10%. This is the tentative credit

maximum of $10,000,000 in that subsequent year. generated in this tax year.

If the expenditure is incurred by an entity taxed as a

partnership, the credit is reported on Form 6900 Alaska

Partnership Return, and may be claimed by a corporate

partner to offset the Alaska corporate tax of that partner.

0405-6327 Rev 01/01/19