Enlarge image

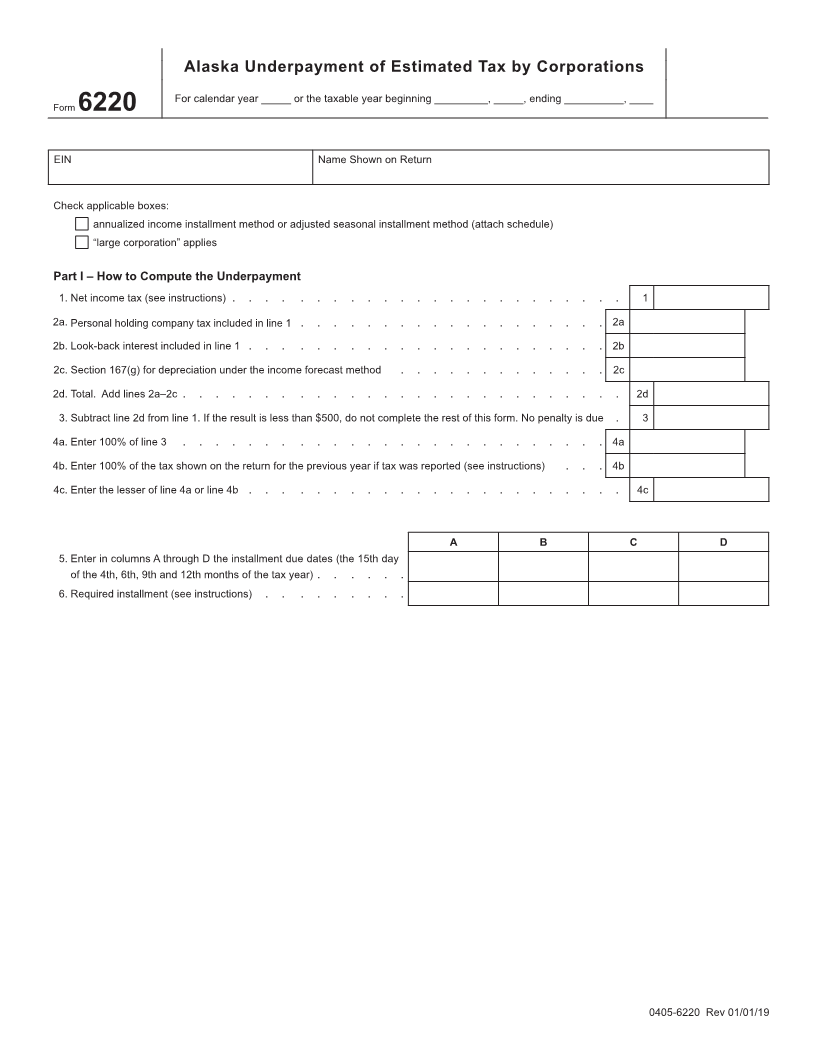

Alaska Underpayment of Estimated Tax by Corporations

For calendar year _____ or the taxable year beginning _________, _____, ending __________, ____

Form

6220

EIN Name Shown on Return

Check applicable boxes:

annualized income installment method or adjusted seasonal installment method (attach schedule)

“large corporation” applies

Part I – How to Compute the Underpayment

1.Net income tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . 1

2a. Personal holding company tax included in line 1 . . . . . . . . . . . . . . . . . . . 2a

2b.Look-back interest included in line 1 . . . . . . . . . . . . . . . . . . . . . . 2b

2c.Section 167(g) for depreciation under the income forecast method . . . . . . . . . . . . . 2c

2d.Total. Add lines 2a–2c . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

3.Subtract line 2d from line 1. If the result is less than $500, do not complete the rest of this form. No penalty is due . 3

4a.Enter 100% of line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

4b.Enter 100% of the tax shown on the return for the previous year if tax was reported (see instructions) . . . 4b

4c.Enter the lesser of line 4a or line 4b . . . . . . . . . . . . . . . . . . . . . . . 4c

A B C D

5.Enter in columns A through D the installment due dates (the 15th day

of the 4th, 6th, 9th and 12th months of the tax year) . . . . . .

6.Required installment (see instructions) . . . . . . . . .

0405-6220 Rev 01/01/19