Enlarge image

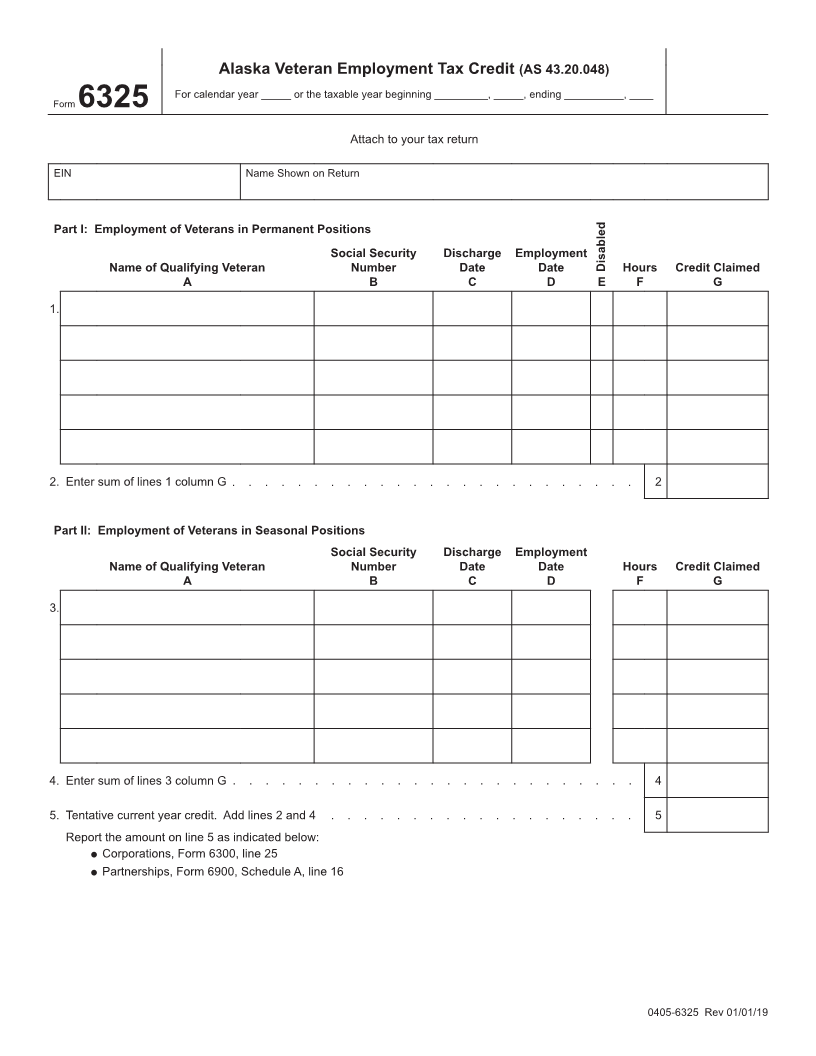

Alaska Veteran Employment Tax Credit (AS 43.20.048)

For calendar year _____ or the taxable year beginning _________, _____, ending __________, ____

Form

6325

Attach to your tax return

EIN Name Shown on Return

Part I: Employment of Veterans in Permanent Positions

Social Security Discharge Employment

Name of Qualifying Veteran Number Date Date Disabled Hours Credit Claimed

A B C D E F G

1.

2. Enter sum of lines 1 column G . . . . . . . . . . . . . . . . . . . . . . . . . 2

Part II: Employment of Veterans in Seasonal Positions

Social Security Discharge Employment

Name of Qualifying Veteran Number Date Date Hours Credit Claimed

A B C D F G

3.

4. Enter sum of lines 3 column G . . . . . . . . . . . . . . . . . . . . . . . . . 4

5. Tentative current year credit. Add lines 2 and 4 . . . . . . . . . . . . . . . . . . . 5

Report the amount on line 5 as indicated below:

Corporations, Form 6300, line 25

Partnerships, Form 6900, Schedule A, line 16

0405-6325 Rev 01/01/19