Enlarge image

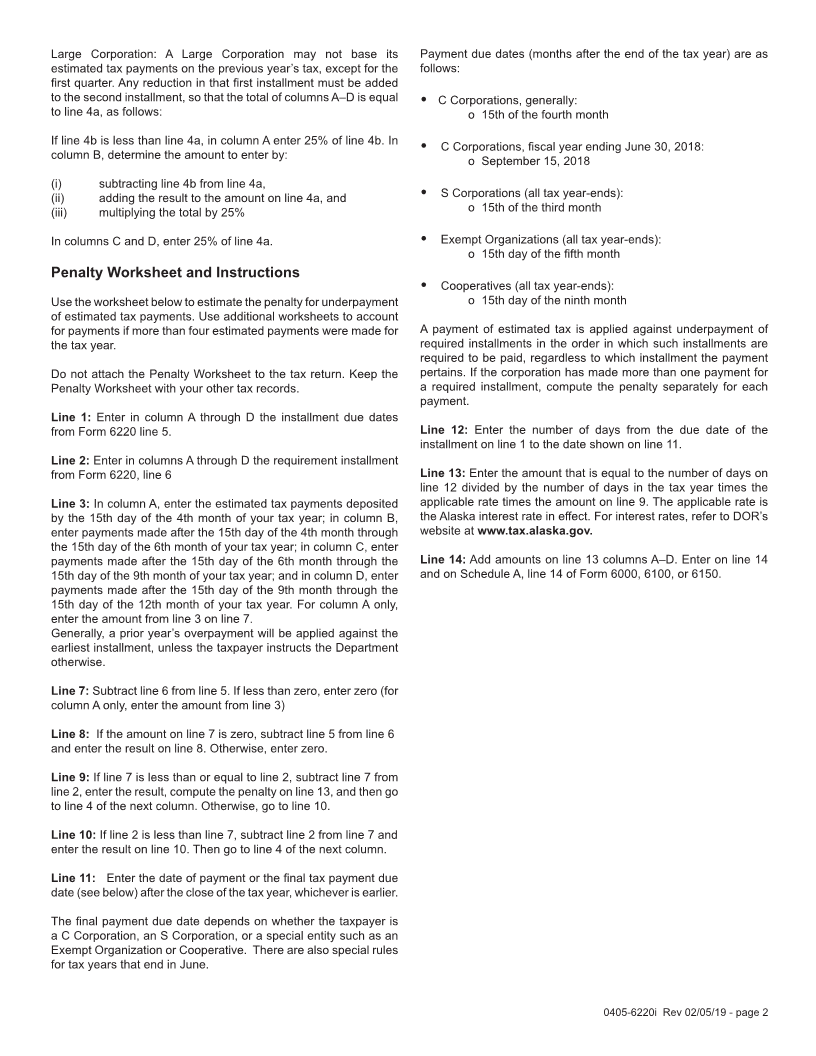

Instructions for Form 6220 Alaska

Underpayment of Estimated Tax by Corporations

Purpose of the Form considered the original return if the amended return is filed by the

filing due date (including extension) of the original return.

A corporation uses Form 6220 to report the use of the annualized

income installment method or the adjusted seasonal installment Specific Instructions

method of calculating any estimated tax penalty.

Attach Form 6220 to the income tax return (Form 6000, 6100,

Due Date Alert or 6150) if the annualized income installment method or adjusted

seasonal installment method is used.

Because of recent federal law changes, the payment due date for

Alaska corporate income tax has also changed, in most cases. Line 1: Enter on line 1 the net income tax from Form 6000, 6100,

This will impact the calculation of the underpayment of estimated or 6150, Schedule A, line 9 less refundable credits on Schedule A,

tax. See Specific Instructions for line 11 below. line 11 and line 12. Do not enter an amount less than zero.

Who Must File Line 3: Subtract line 2d from line 1. If the result is less than $500,

do not complete the rest of this form.

A corporation is required to complete and attach Form 6220 to

its return, only if the corporation pays its estimated tax based Line 4b: Compute your previous year’s tax in the same way that

on the annualized income installment method or the adjusted the amount on line 3 of this form was determined, using the taxes

seasonal installment method. If neither of these methods apply, and credits from your previous year’s tax return. If you did not file

a corporation is not required to use the form, because the DOR an Alaska return showing a tax liability for the previous tax year, or

will calculate the amount of any penalty and notify the corporation if that tax year was for less than 12 months, do not complete this

of any amount due. line. Instead, enter the amount from line 4a on line 4c.

Who Must Pay the Underpayment Penalty Line 4c: Enter the lesser of line 4a or line 4b.

If the corporation did not pay sufficient estimated tax by any due Line 5: Enter in columns A through D the installment due dates

date for paying estimated tax, it may be charged a penalty. This (the 15th day of the 4th, 6th, 9th and 12th months of the tax year).

is true even if the corporation is due a refund when its return is

filed. The penalty is computed separately for each installment due Line 6: Annualized income installment method or adjusted

date. Therefore, the corporation may owe a penalty for an earlier seasonal installment method: If the corporation’s income varied

installment due date, even if it paid enough tax later to make up during the year because, for example, it operated its business

the underpayment. on a seasonal basis, it may be able to lower the amount of

one or more required installments by using the annualized

Generally, a corporation is subject to the penalty if its tax liability, income installment method or the adjusted seasonal installment

net of all credits, is $500 or more and it did not pay on time the method. The annualized income installment or adjusted seasonal

lesser of: 100% of its tax liability for this tax year, or 100% of its tax installment may be less than the required installment under the

liability for the previous tax year, if a return was filed showing a tax regular method for one or more due dates, thereby reducing or

liability, and it covered a full 12 months. (A “large corporation” may eliminating the penalty for those due dates.

base only its first required installment on 100% of the prior year’s

tax liability.) A corporation may be able to reduce or eliminate the To use one or both of these methods to compute one or more

penalty by using the annualized income or adjusted seasonal required installments, use the worksheet for federal Form 2220,

installment method. using Alaska figures, rates, and computations. Taxpayers must

calculate a cumulative quarterly Alaska apportionment factor for

Check the applicable box, if the corporation uses the annualized each required installment payment. The taxpayer calculates the

income installment method or the adjusted seasonal installment estimated Alaska taxable income by multiplying the cumulative

method, or if the corporation is a “large corporation.” A “large quarterly consolidated taxable income by the cumulative quarterly

corporation” is a corporation (or its predecessor) that reported Alaska apportionment factor. If you use the worksheet for any

$1 million or more of Alaska taxable income for any of the three payment date, you must use it for all payment due dates. Do not

tax years immediately preceding the tax year involved. For this enter an amount less than zero in each column.

purpose, taxable income does not include a net operating loss or

capital loss carryback. Members of a controlled group, as defined If you are not using the annualized income installment method or

in IRS Section 1563, must divide the $1 million among themselves adjusted seasonal installment method, and are completing Form

in accordance with IRC Section 1561. 6220 to estimate the penalty for underpayment of estimated tax,

then follow the instructions below to compute the amount to enter

Amended Returns on line 6, and complete the Penalty Worksheet below.

A penalty for underpayment of estimated tax is based on the If the corporation is not a Large Corporation, enter 25% of line 4c

tax liability of the original return. The amendment of the return in columns A through D.

does not change the penalty. However, an amended return is

0405-6220i Rev 02/05/19 - page 1