Enlarge image

Alaska Federal-Based Credits

Form 2020

6390

EIN Name Shown on Return

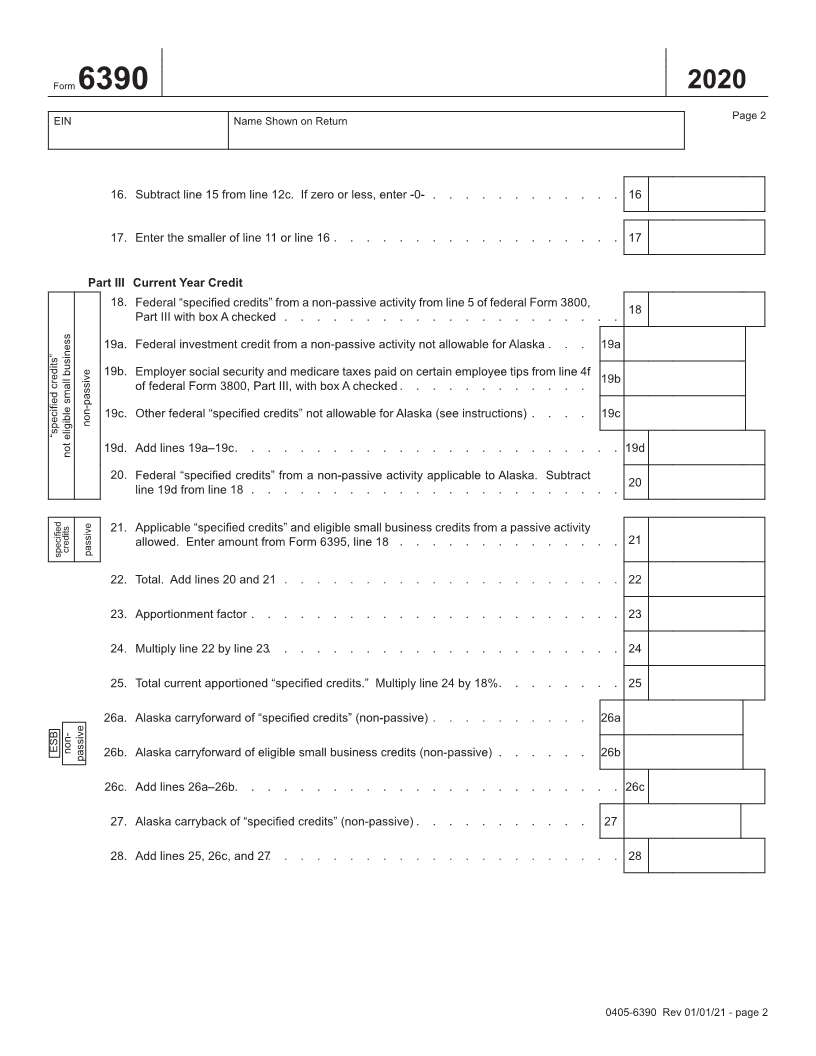

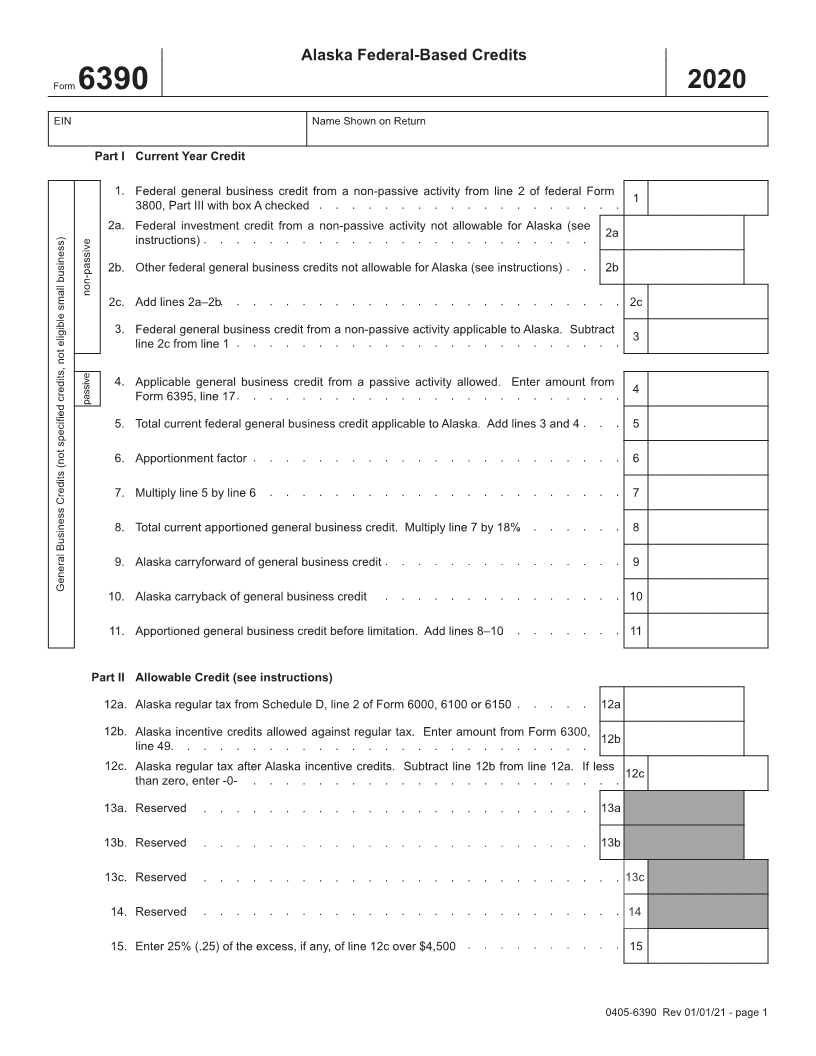

Part I Current Year Credit

1. Federal general business credit from a non-passive activity from line 2 of federal Form

1

3800, Part III with box A checked . . . . . . . . . . . . . . . . . . .

2a. Federal investment credit from a non-passive activity not allowable for Alaska (see

2a

instructions) . . . . . . . . . . . . . . . . . . . . . . . .

2b. Other federal general business credits not allowable for Alaska (see instructions) . . 2b

non-passive

2c. Add lines 2a–2b. . . . . . . . . . . . . . . . . . . . . . . . . 2c

3. Federal general business credit from a non-passive activity applicable to Alaska. Subtract

3

line 2c from line 1 . . . . . . . . . . . . . . . . . . . . . . . .

4. Applicable general business credit from a passive activity allowed. Enter amount from

4

passive Form 6395, line 17 . . . . . . . . . . . . . . . . . . . . . . . .

5. Total current federal general business credit applicable to Alaska. Add lines 3 and 4 . . . 5

6. Apportionment factor . . . . . . . . . . . . . . . . . . . . . . . 6

7. Multiply line 5 by line 6. . . . . . . . . . . . . . . . . . . . . . . 7

8. Total current apportioned general business credit. Multiply line 7 by 18%. . . . . . . 8

9. Alaska carryforward of general business credit . . . . . . . . . . . . . . . 9

General Business Credits (not specified credits, not eligible small business)

10. Alaska carryback of general business credit . . . . . . . . . . . . . . . 10

11. Apportioned general business credit before limitation. Add lines 8–10. . . . . . . . 11

Part II Allowable Credit (see instructions)

12a. Alaska regular tax from Schedule D, line 2 of Form 6000, 6100 or 6150 . . . . . 12a

12b. Alaska incentive credits allowed against regular tax. Enter amount from Form 6300,

12b

line 49. . . . . . . . . . . . . . . . . . . . . . . . . .

12c. Alaska regular tax after Alaska incentive credits. Subtract line 12b from line 12a. If less

12c

than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . .

13a. Reserved . . . . . . . . . . . . . . . . . . . . . . . . 13a

13b. Reserved . . . . . . . . . . . . . . . . . . . . . . . . 13b

13c. Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . 13c

14. Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15. Enter 25% (.25) of the excess, if any, of line 12c over $4,500 . . . . . . . . . . 15

0405-6390 Rev 01/01/21 - page 1