Enlarge image

Instructions For Form 6300

2019 Alaska Incentive Credits

GENERAL INSTRUCTIONS as certain other taxes imposed through Alaska’s adoption of the

Internal Revenue Code.

Purpose of Form

Form 6300 orders and limits Alaska incentive credits, based on tax Credits Originating from a Partnership

liability. This form is required if such credits are to be claimed on A corporation may claim Alaska incentive credits generated by a

Form 6000, 6100, or 6150. partnership in which the corporation is a partner. The partnership

is required to report the partner’s share of any credits on Form

Form 6300 is not required to be filed when creditable activities are 6900, Schedule K-1. In order to claim the credit and offset Alaska

reported by a partnership filing Form 6900. income tax, the taxpayer will include the creditable amounts shown

on the Schedule K-1 on the applicable line of Form 6300. For

Other Related Forms example, a corporation will include on Form 6300, line 8 (income

Alaska Incentive Credits tax education credit) its share of the credit shown on Form 6900,

To claim Alaska incentive credits on Form 6300, you must also Schedule K-1, lines 18–19.

attach specified supplementary credit forms as follows:

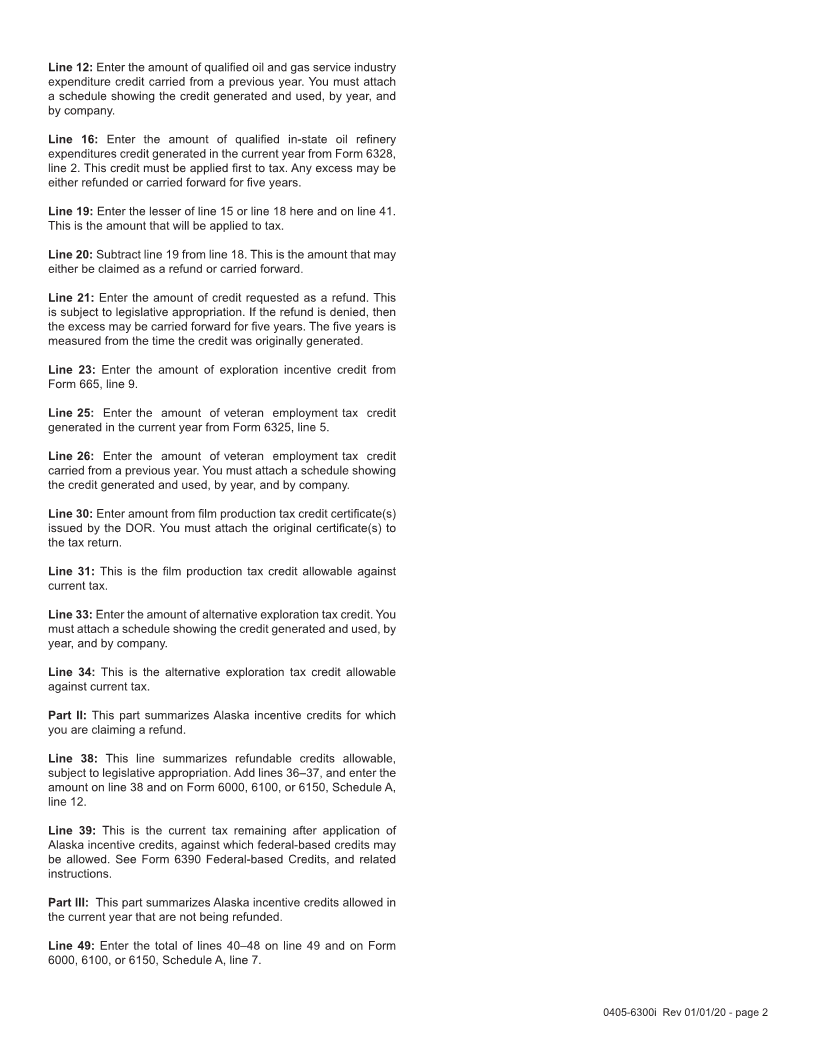

Carryforward of Unused Credit

• Income tax education credit (AS 43.20.014) .......... Form 6310 Certain credits may be carried forward if the credits cannot be

• Exploration incentive credit (AS 43.20.044) ............. Form 665 used because of the tax liability limitation, as shown below.

• Veteran employment tax credit (AS 43.20.048) ..... Form 6325

• LNG storage facility credit (AS 43.20.047)............. Form 6323 Credit Alaska Carryforward

• Qualified oil and gas service industry Statute Period

expenditure credit (AS 43.20.049)........................... Form 6327

• Qualified in-state oil refinery infrastructure In-state manufacture of urea, AS 43.20.052 None

expenditures tax credit (AS 43.20.053)................... Form 6328 ammonia or gas-to-liquids credit

Qualified oil and gas service

To claim the veteran employment tax credit, you must maintain industry expenditure credit AS 43.20.049 5 years

certain records, including properly completed Form(s) 6326 Qualified in-state refinery AS 43.20.053 5 years

Certificate of Qualifying Veteran. Do not send in Form 6326 with expenditures credit

your tax return. Exploration incentive credit AS 43.20.044 15 years

Veteran employment tax credit AS 43.20.048

To claim the film production tax credit, you must attach the original No limit

tax credit certificate issued by the Department of Revenue (DOR). Film production tax credit AS 43.98.030 See Inst.

Alt. oil and gas exploration credit AS 43.55.025 No Limit

Federal-based Credits

You may be eligible to claim certain federal-based credits, based Form 6300 is required to be filed to claim credits generated in an

on Alaska’s adoption of the Internal Revenue Code under AS earlier year. Form 6300 must be accompanied by a schedule for

43.20.021. These credits are claimed on Alaska Form 6390 each credit, showing the amount of credit generated and used, by

Federal-based Credits. See Form 6390 and related instructions. year.

Passive activity credit limitations are calculated on an as-if Alaska

basis, using Alaska Form 6395 Passive Activity Limitation. Refundable Credits

The LNG storage facility credit (AS 43.20.047) and the in-state

If You Need Help oil refinery credit (AS 43.20.053) are refundable under certain

If you have questions, need additional information or require other conditions. If the credit exceeds the taxpayer’s tax liability,

assistance, see our website at www.tax.alaska.gov, or call: the DOR may refund the excess credit, subject to legislative

appropriation.

Juneau: 907-465-2320

Anchorage: 907-269-6620 SPECIFIC INSTRUCTIONS

Complete Form 6300 to claim any Alaska incentive credit on the Line 2a: Enter the amount of gas exploration and development tax

corporation’s net income tax return (Form 6000, 6100, or 6150). credit carried from a previous year. You must attach a schedule

showing the credit generated and used, by year, and by company.

Form 6300 accounts for all Alaska incentive credits, including the

income tax education credit, the film production tax credit, and Line 5: Enter the tentative in-state manufacture of urea, ammonia

various other credits. The form also accounts for any refundable or gas-to-liquids products credit from your attached schedule.

credits. The credits are grouped on Form 6300 and then carried

to, and claimed on, lines 7 or 12 of the corporation net income tax Line 8: Enter the tentative income tax education credit from Form

return (Form 6000, 6100, or 6150). 6310 line 9.

In general, Alaska incentive credits may be used to offset the Line 11: Enter the amount of the qualified oil and gas service

general Alaska income tax imposed under AS 43.20.011, as well industry expenditure credit from Form 6327, line 3.

0405-6300i Rev 01/01/20 - page 1