Enlarge image

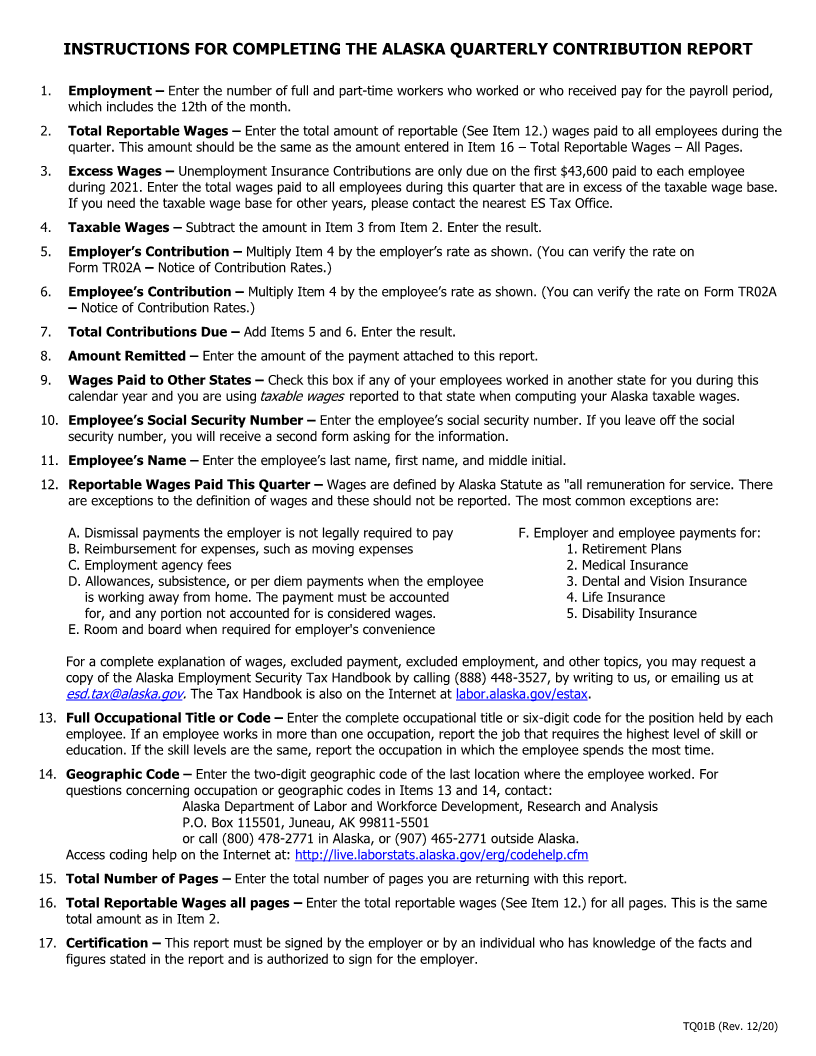

INSTRUCTIONS FOR COMPLETING THE ALASKA QUARTERLY CONTRIBUTION REPORT

1. Employment – Enter the number of full and part-time workers who worked or who received pay for the payroll period,

which includes the 12th of the month.

2. Total Reportable Wages – Enter the total amount of reportable (See Item 12.) wages paid to all employees during the

quarter. This amount should be the same as the amount entered in Item 16 – Total Reportable Wages – All Pages.

3. Excess Wages – Unemployment Insurance Contributions are only due on the first $4 , 00 paid3 6to each employee

during 202 . Enter1 the total wages paid to all employees during this quarter that are in excess of the taxable wage base.

If you need the taxable wage base for other years, please contact the nearest ES Tax Office.

4. Taxable Wages – Subtract the amount in Item 3 from Item 2. Enter the result.

5. Employer’s Contribution – Multiply Item 4 by the employer’s rate as shown. (You can verify the rate on

Form TR02A Notice of–Contribution Rates.)

6. Employee’s Contribution – Multiply Item 4 by the employee’s rate as shown. (You can verify the rate on Form TR02A

– Notice of Contribution Rates.)

7. Total Contributions Due – Add Items 5 and 6. Enter the result.

8. Amount Remitted – Enter the amount of the payment attached to this report.

9. Wages Paid to Other States – Check this box if any of your employees worked in another state for you during this

calendar year and you are using taxable wages reported to that state when computing your Alaska taxable wages.

10. Employee’s Social Security Number – Enter the employee’s social security number. If you leave off the social

security number, you will receive a second form asking for the information.

11. Employee’s Name – Enter the employee’s last name, first name, and middle initial.

12. Reportable Wages Paid This Quarter – Wages are defined by Alaska Statute as "all remuneration for service. There

are exceptions to the definition of wages and these should not be reported. The most common exceptions are:

A. Dismissal payments the employer is not legally required to pay F. Employer and employee payments for:

B. Reimbursement for expenses, such as moving expenses 1. Retirement Plans

C. Employment agency fees 2. Medical Insurance

D. Allowances, subsistence, or per diem payments when the employee 3. Dental and Vision Insurance

is working away from home. The payment must be accounted 4. Life Insurance

for, and any portion not accounted for is considered wages. 5. Disability Insurance

E. Room and board when required for employer's convenience

For a complete explanation of wages, excluded payment, excluded employment, and other topics, you may request a

copy of the Alaska Employment Security Tax Handbook by calling (888) 448-3527, by writing to us, or emailing us at

esd.tax@alaska.gov . The Tax Handbook is also on the Internet at labor.alaska.gov/estax.

13. Full Occupational Title or Code – Enter the complete occupational title or six-digit code for the position held by each

employee. If an employee works in more than one occupation, report the job that requires the highest level of skill or

education. If the skill levels are the same, report the occupation in which the employee spends the most time.

14. Geographic Code – Enter the two-digit geographic code of the last location where the employee worked. For

questions concerning occupation or geographic codes in Items 13 and 14, contact:

Alaska Department of Labor and Workforce Development, Research and Analysis

P.O. Box 115501, Juneau, AK 99811-5501

or call (800) 478-2771 in Alaska, or (907) 465-2771 outside Alaska.

Access coding help on the Internet at: http://live.laborstats.alaska.gov/erg/codehelp.cfm

15. Total Number of Pages – Enter the total number of pages you are returning with this report.

16. Total Reportable Wages all pages – Enter the total reportable wages (See Item 12.) for all pages. This is the same

total amount as in Item 2.

17. Certification – This report must be signed by the employer or by an individual who has knowledge of the facts and

figures stated in the report and is authorized to sign for the employer.

TQ01B (Rev. 12/20)