Enlarge image

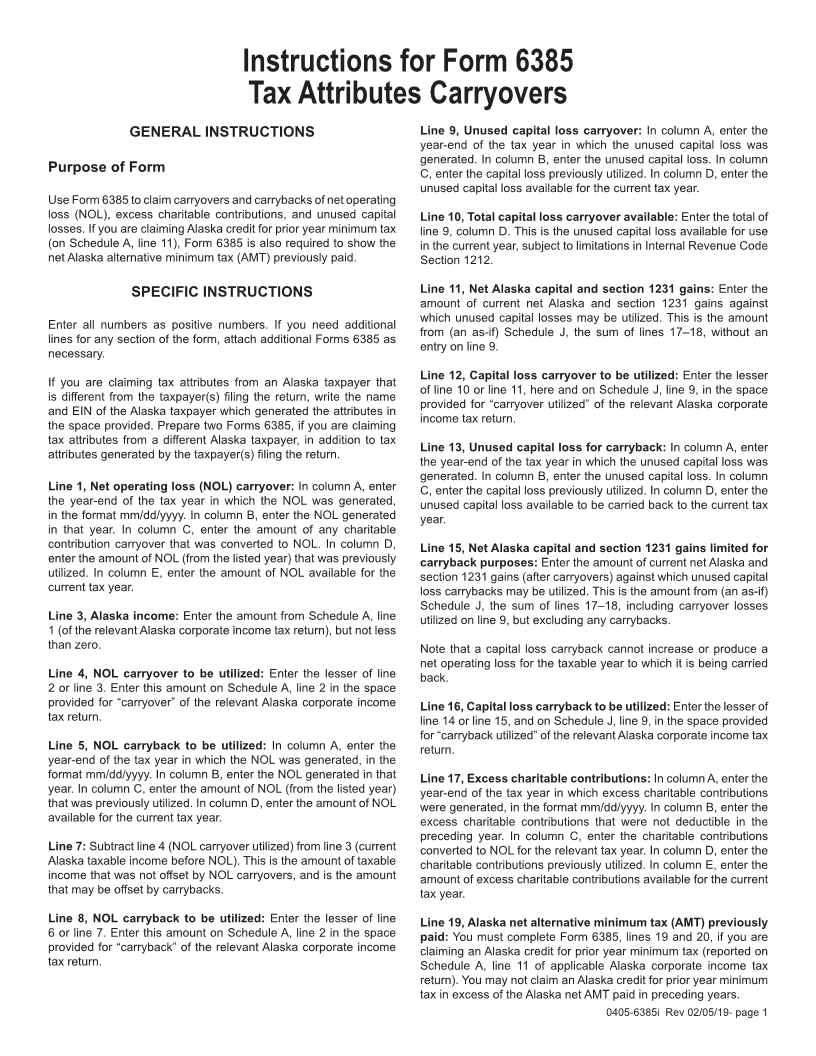

Instructions for Form 6385

Tax Attributes Carryovers

GENERAL INSTRUCTIONS Line 9, Unused capital loss carryover: In column A, enter the

year-end of the tax year in which the unused capital loss was

generated. In column B, enter the unused capital loss. In column

Purpose of Form C, enter the capital loss previously utilized. In column D, enter the

unused capital loss available for the current tax year.

Use Form 6385 to claim carryovers and carrybacks of net operating

loss (NOL), excess charitable contributions, and unused capital Line 10, Total capital loss carryover available: Enter the total of

losses. If you are claiming Alaska credit for prior year minimum tax line 9, column D. This is the unused capital loss available for use

(on Schedule A, line 11), Form 6385 is also required to show the in the current year, subject to limitations in Internal Revenue Code

net Alaska alternative minimum tax (AMT) previously paid. Section 1212.

SPECIFIC INSTRUCTIONS Line 11, Net Alaska capital and section 1231 gains: Enter the

amount of current net Alaska and section 1231 gains against

which unused capital losses may be utilized. This is the amount

Enter all numbers as positive numbers. If you need additional

from (an as-if) Schedule J, the sum of lines 17–18, without an

lines for any section of the form, attach additional Forms 6385 as

entry on line 9.

necessary.

If you are claiming tax attributes from an Alaska taxpayer that Line 12, Capital loss carryover to be utilized: Enter the lesser

of line 10 or line 11, here and on Schedule J, line 9, in the space

is different from the taxpayer(s) filing the return, write the name

provided for “carryover utilized” of the relevant Alaska corporate

and EIN of the Alaska taxpayer which generated the attributes in

income tax return.

the space provided. Prepare two Forms 6385, if you are claiming

tax attributes from a different Alaska taxpayer, in addition to tax

attributes generated by the taxpayer(s) filing the return. Line 13, Unused capital loss for carryback: In column A, enter

the year-end of the tax year in which the unused capital loss was

generated. In column B, enter the unused capital loss. In column

Line 1, Net operating loss (NOL) carryover: In column A, enter C, enter the capital loss previously utilized. In column D, enter the

the year-end of the tax year in which the NOL was generated, unused capital loss available to be carried back to the current tax

in the format mm/dd/yyyy. In column B, enter the NOL generated year.

in that year. In column C, enter the amount of any charitable

contribution carryover that was converted to NOL. In column D, Line 15, Net Alaska capital and section 1231 gains limited for

enter the amount of NOL (from the listed year) that was previously carryback purposes: Enter the amount of current net Alaska and

utilized. In column E, enter the amount of NOL available for the section 1231 gains (after carryovers) against which unused capital

current tax year. loss carrybacks may be utilized. This is the amount from (an as-if)

Schedule J, the sum of lines 17–18, including carryover losses

Line 3, Alaska income: Enter the amount from Schedule A, line utilized on line 9, but excluding any carrybacks.

1 (of the relevant Alaska corporate income tax return), but not less

than zero. Note that a capital loss carryback cannot increase or produce a

net operating loss for the taxable year to which it is being carried

Line 4, NOL carryover to be utilized: Enter the lesser of line back.

2 or line 3. Enter this amount on Schedule A, line 2 in the space

provided for “carryover” of the relevant Alaska corporate income Line 16, Capital loss carryback to be utilized: Enter the lesser of

tax return. line 14 or line 15, and on Schedule J, line 9, in the space provided

for “carryback utilized” of the relevant Alaska corporate income tax

Line 5, NOL carryback to be utilized: In column A, enter the return.

year-end of the tax year in which the NOL was generated, in the

format mm/dd/yyyy. In column B, enter the NOL generated in that Line 17, Excess charitable contributions: In column A, enter the

year. In column C, enter the amount of NOL (from the listed year) year-end of the tax year in which excess charitable contributions

that was previously utilized. In column D, enter the amount of NOL were generated, in the format mm/dd/yyyy. In column B, enter the

available for the current tax year. excess charitable contributions that were not deductible in the

preceding year. In column C, enter the charitable contributions

Line 7: Subtract line 4 (NOL carryover utilized) from line 3 (current converted to NOL for the relevant tax year. In column D, enter the

Alaska taxable income before NOL). This is the amount of taxable charitable contributions previously utilized. In column E, enter the

income that was not offset by NOL carryovers, and is the amount amount of excess charitable contributions available for the current

that may be offset by carrybacks. tax year.

Line 8, NOL carryback to be utilized: Enter the lesser of line Line 19, Alaska net alternative minimum tax (AMT) previously

6 or line 7. Enter this amount on Schedule A, line 2 in the space paid: You must complete Form 6385, lines 19 and 20, if you are

provided for “carryback” of the relevant Alaska corporate income claiming an Alaska credit for prior year minimum tax (reported on

tax return. Schedule A, line 11 of applicable Alaska corporate income tax

return). You may not claim an Alaska credit for prior year minimum

tax in excess of the Alaska net AMT paid in preceding years.

0405-6385i Rev 02/05/19- page 1