Enlarge image

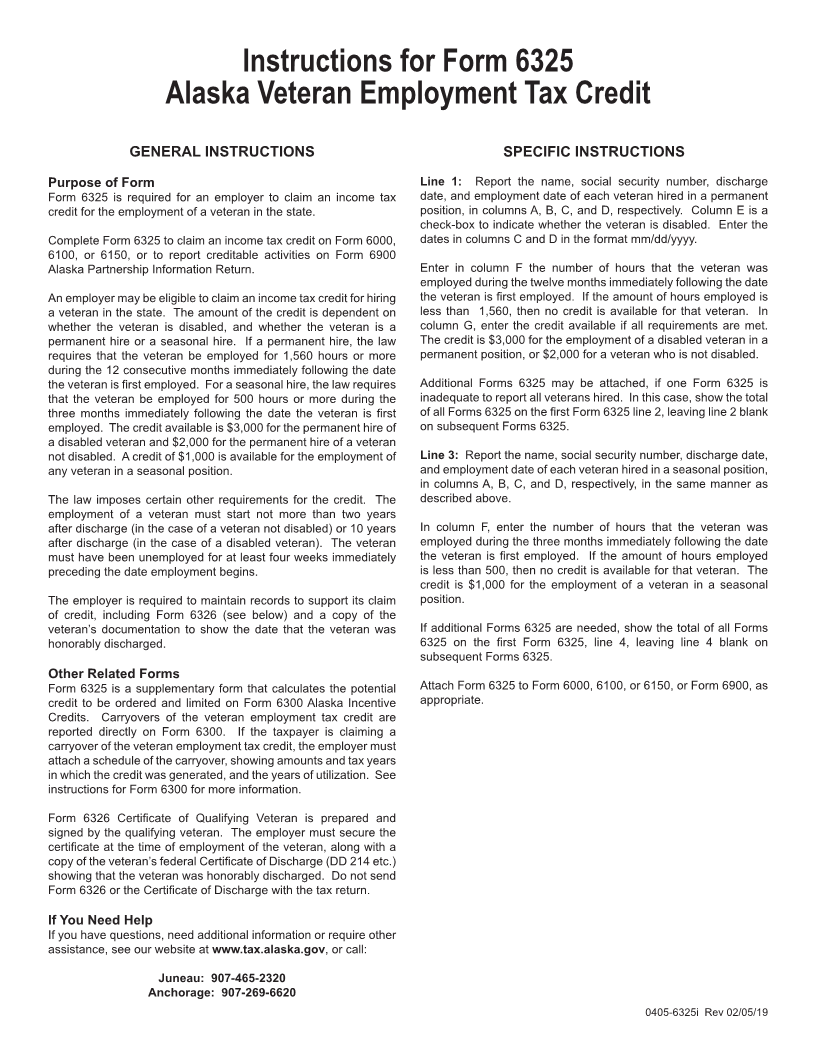

Instructions for Form 6325

Alaska Veteran Employment Tax Credit

GENERAL INSTRUCTIONS SPECIFIC INSTRUCTIONS

Purpose of Form Line 1: Report the name, social security number, discharge

Form 6325 is required for an employer to claim an income tax date, and employment date of each veteran hired in a permanent

credit for the employment of a veteran in the state. position, in columns A, B, C, and D, respectively. Column E is a

check-box to indicate whether the veteran is disabled. Enter the

Complete Form 6325 to claim an income tax credit on Form 6000, dates in columns C and D in the format mm/dd/yyyy.

6100, or 6150, or to report creditable activities on Form 6900

Alaska Partnership Information Return. Enter in column F the number of hours that the veteran was

employed during the twelve months immediately following the date

An employer may be eligible to claim an income tax credit for hiring the veteran is first employed. If the amount of hours employed is

a veteran in the state. The amount of the credit is dependent on less than 1,560, then no credit is available for that veteran. In

whether the veteran is disabled, and whether the veteran is a column G, enter the credit available if all requirements are met.

permanent hire or a seasonal hire. If a permanent hire, the law The credit is $3,000 for the employment of a disabled veteran in a

requires that the veteran be employed for 1,560 hours or more permanent position, or $2,000 for a veteran who is not disabled.

during the 12 consecutive months immediately following the date

the veteran is first employed. For a seasonal hire, the law requires Additional Forms 6325 may be attached, if one Form 6325 is

that the veteran be employed for 500 hours or more during the inadequate to report all veterans hired. In this case, show the total

three months immediately following the date the veteran is first of all Forms 6325 on the first Form 6325 line 2, leaving line 2 blank

employed. The credit available is $3,000 for the permanent hire of on subsequent Forms 6325.

a disabled veteran and $2,000 for the permanent hire of a veteran

not disabled. A credit of $1,000 is available for the employment of Line 3: Report the name, social security number, discharge date,

any veteran in a seasonal position. and employment date of each veteran hired in a seasonal position,

in columns A, B, C, and D, respectively, in the same manner as

The law imposes certain other requirements for the credit. The described above.

employment of a veteran must start not more than two years

after discharge (in the case of a veteran not disabled) or 10 years In column F, enter the number of hours that the veteran was

after discharge (in the case of a disabled veteran). The veteran employed during the three months immediately following the date

must have been unemployed for at least four weeks immediately the veteran is first employed. If the amount of hours employed

preceding the date employment begins. is less than 500, then no credit is available for that veteran. The

credit is $1,000 for the employment of a veteran in a seasonal

The employer is required to maintain records to support its claim position.

of credit, including Form 6326 (see below) and a copy of the

veteran’s documentation to show the date that the veteran was If additional Forms 6325 are needed, show the total of all Forms

honorably discharged. 6325 on the first Form 6325, line 4, leaving line 4 blank on

subsequent Forms 6325.

Other Related Forms

Form 6325 is a supplementary form that calculates the potential Attach Form 6325 to Form 6000, 6100, or 6150, or Form 6900, as

credit to be ordered and limited on Form 6300 Alaska Incentive appropriate.

Credits. Carryovers of the veteran employment tax credit are

reported directly on Form 6300. If the taxpayer is claiming a

carryover of the veteran employment tax credit, the employer must

attach a schedule of the carryover, showing amounts and tax years

in which the credit was generated, and the years of utilization. See

instructions for Form 6300 for more information.

Form 6326 Certificate of Qualifying Veteran is prepared and

signed by the qualifying veteran. The employer must secure the

certificate at the time of employment of the veteran, along with a

copy of the veteran’s federal Certificate of Discharge (DD 214 etc.)

showing that the veteran was honorably discharged. Do not send

Form 6326 or the Certificate of Discharge with the tax return.

If You Need Help

If you have questions, need additional information or require other

assistance, see our website at www.tax.alaska.gov, or call:

Juneau: 907-465-2320

Anchorage: 907-269-6620

0405-6325i Rev 02/05/19